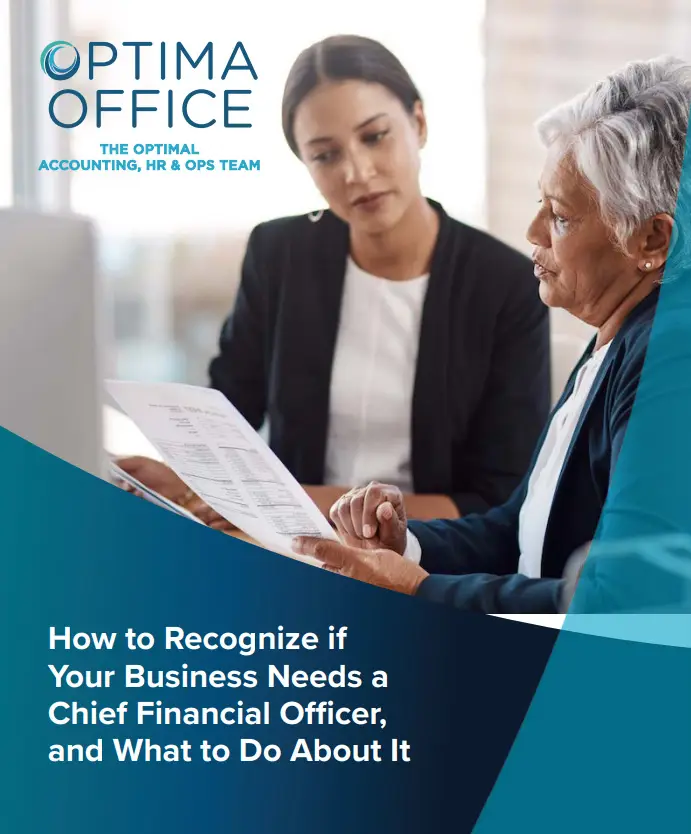

As businesses grow, their financial complexities increase, often surpassing the capabilities of basic accounting or internal financial management. For small and medium-sized enterprises between $1M-$10M in revenue, this can signal the need for a Chief Financial Officer.

A CFO brings strategic financial oversight, helping manage growth, optimize cash flow, and prepare for fundraising or investor relations. However, many small and midsized enterprises may not require a full-time CFO and can benefit from the cost-effective, flexible solution of hiring a fractional CFO.

Our fractional CFOs not only focus on driving enterprise value but are also adept at minimizing risks. Their expertise extends to providing forward-thinking strategies and helping your company reach its goals. They ensure:

Here’s our simple process to get started with our Fractional CFO Services:

We’ll discuss your financial challenges and goals.

Your CFO will craft and implement a plan based on your specific needs.

Receive ongoing financial oversight, reporting, and strategic advice.