Why San Diego Businesses Are Turning to QuickBooks Bookkeeping Specialists

QuickBooks bookkeeping San Diego services connect local business owners with certified experts who can set up, clean up, and maintain accurate financial records – so you can stop worrying about your books and focus on growing your business.

Looking for a certified QuickBooks specialist in San Diego? Here’s where to start:

- Search the QuickBooks ProAdvisor directory – Filter by location, industry, and services offered

- Look for certified bookkeepers – QuickBooks Certified ProAdvisors have passed a proficiency exam and meet professional standards

- Consider fractional bookkeeping firms – Companies like Optima Office offer dedicated teams without the cost of a full-time hire

- Check for relevant experience – Find someone familiar with San Diego tax regulations and your specific industry

- Ask about ongoing support – The best providers offer setup, training, cleanup, and monthly maintenance

If your business has outgrown its current bookkeeper – or has no real accounting leadership at all – you’re not alone. Many San Diego small businesses between $3M and $15M in revenue hit a wall where messy books start costing real money: delayed invoices, missed tax deadlines, and zero visibility into cash flow.

QuickBooks is the top-rated accounting software for small businesses, but the software alone won’t fix the problem. Without a skilled specialist behind it, even the best tools can leave your financials in chaos.

That’s exactly why finding the right QuickBooks bookkeeping professional in San Diego matters so much.

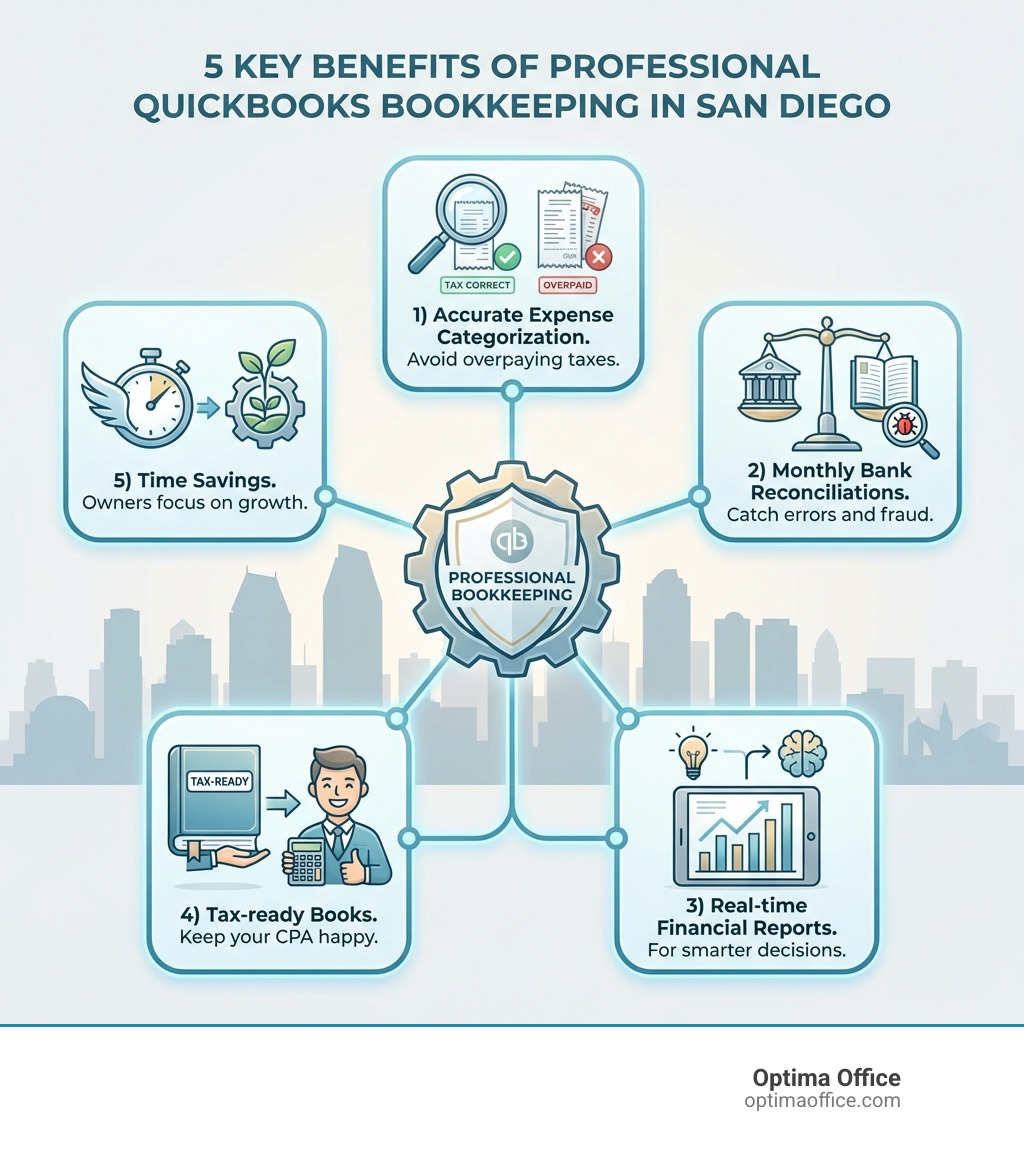

Top Benefits of Professional QuickBooks Bookkeeping San Diego Services

When we talk to business owners across Mission Valley, La Jolla, and Downtown San Diego, a common theme emerges: they love their business, but they tolerate their books. Using QuickBooks bookkeeping San Diego specialists transforms that relationship from a source of stress into a competitive advantage.

One of the most immediate perks is cash flow management. QuickBooks allows us to see exactly where your money is at any given second. Are your clients paying on time? Are your vendor bills stacking up? A specialist ensures your “Money In” and “Money Out” are tracked with surgical precision.

Then there is the magic of expense categorization. We’ve seen too many business owners dump everything into “Miscellaneous” or “Office Supplies.” A pro ensures every dollar is in the right “bucket.” This isn’t just about being tidy; it’s about tax savings. If your income is coded incorrectly, you might end up paying taxes on money that isn’t actually profit. Proper coding ensures you take every deduction you’re entitled to.

By utilizing outsourced accounting services, you also gain:

- Real-time reporting: No more waiting until the end of the year to see if you made a profit.

- Mobile accessibility: Check your Profit & Loss statement from your phone while grabbing a coffee in Little Italy.

- Business scalability: As you grow, your bookkeeping system grows with you, rather than breaking under the pressure.

- Financial transparency: Clean books make your business more valuable if you ever decide to sell or seek a loan.

Why Certification Matters for QuickBooks Bookkeeping San Diego

You wouldn’t hire a personal trainer who isn’t certified, so why trust your life’s work to an unverified bookkeeper? A QuickBooks ProAdvisor is an independent accounting professional who has passed a rigorous proficiency certification exam designed by Intuit.

Certification means the professional understands the “guts” of the software. They know how to fix a broken bank feed, how to handle complex journal entries, and how to utilize the latest automation features. At Optima Office, we believe that high-quality bookkeeping services require this baseline of technical excellence to ensure your financial data is 100% accurate.

Essential Skills for QuickBooks Bookkeeping San Diego Professionals

A true specialist brings more to the table than just data entry skills. They are financial detectives and architects. Key skills include:

- Bank Reconciliation: Matching your QuickBooks records to your actual bank and credit card statements every single month. This catches bank errors, duplicate entries, and—most importantly—fraud.

- Accounts Payable (AP): It’s not just about paying bills; it’s about timing those payments to keep your cash flow healthy.

- General Ledger Maintenance: Ensuring the “Chart of Accounts” is set up correctly from day one.

- Payroll Coordination: Integrating your payroll provider with QuickBooks so your labor costs are automatically reflected in your financial statements.

Understanding how outsourcing bookkeeping saves time and cost is vital. Instead of spending 10 hours a week struggling with an accounting checklist, you can spend that time on strategy and sales.

Finding Certified QuickBooks ProAdvisors and Experts in San Diego

Finding the right partner in America’s Finest City doesn’t have to be a chore. The first stop for most should be the QuickBooks ProAdvisor directory. You can enter your San Diego zip code and filter by industry—whether you’re in biotech, tourism, or professional services.

When vetting a local expert, look for:

- Industry Specialization: Do they understand the specific nuances of San Diego’s business landscape?

- Remote vs. On-site Support: Do you want someone who can pop into your office in Sorrento Valley, or are you comfortable with 100% remote support?

- Software Troubleshooting: Ask them how they handled a major software transfer or a “messy books” cleanup in the past.

We often find that fractional bookkeeping services are the “Goldilocks” solution for San Diego companies. You get the expertise of a high-level controller and the daily diligence of a bookkeeper without the $150k+ price tag of a full-time executive.

Local Training and Career Outlook for San Diego Bookkeepers

If you’re a business owner looking to train an internal staff member, or a professional looking to enter the field, San Diego offers world-class resources. SDSU Global Campus offers a comprehensive Professional Bookkeeping with QuickBooks Online course. This 100-hour program is 100% online and even includes a voucher for the certification exam.

The job outlook for those with these skills is incredibly bright. Nationally, over 170,000 new jobs are projected annually for bookkeeping and accounting clerks through 2030. In San Diego, the average salary for a bookkeeper is around $45,750, with top earners making over $60,000.

To help you understand where a bookkeeper fits into your organization, here is a comparison of financial roles:

| Feature | Bookkeeper | Controller | CFO |

|---|---|---|---|

| Primary Focus | Daily transactions & reconciliations | Financial reporting & internal controls | Strategy, forecasting & capital |

| Experience | 0-5 years | 5-10+ years (CPA often preferred) | 15+ years executive experience |

| Key Deliverable | Accurate General Ledger | Accurate Financial Statements | Multi-year Financial Roadmap |

Understanding the bookkeeper vs. controller difference is essential for hiring the right level of talent. For a deeper dive into these hierarchies, check out our guide on the role of bookkeepers, controllers, and CFOs.

Maximizing Efficiency with QuickBooks Online and Desktop Integrations

QuickBooks isn’t just a digital checkbook; it’s the hub of your entire business operation. One of our favorite features for San Diego businesses is mobile receipt capture. You simply snap a photo of a lunch receipt at a business meeting, and the software automatically matches it to the transaction on your credit card. No more shoe-boxes full of paper!

When we implement outsourced accounting, we focus on these powerful integrations:

- Payroll Automation: Tools like QuickBooks Payroll or ADP sync directly, ensuring your tax liabilities are always accounted for.

- Merchant Services: Accept credit cards and ACH payments directly through your invoices, which automatically marks them as “Paid.”

- Third-Party Apps: Whether you use Shopify for e-commerce or Bill.com for complex accounts payable, these tools “talk” to QuickBooks to eliminate manual data entry.

Frequently Asked Questions about San Diego Bookkeeping

How much does professional QuickBooks bookkeeping cost in San Diego?

Pricing varies based on the complexity of your business and the volume of transactions. Some independent bookkeepers charge hourly rates ranging from $50 to $100 per hour. Many firms, including the “Live” services offered by Intuit, use tiered pricing based on monthly expenses. For example, a business with $10,000 to $50,000 in monthly expenses might pay around $500 per month for basic maintenance. Fractional firms often provide a customized quote based on the specific mix of staff (Bookkeeper + Controller) you need.

What is the difference between QuickBooks Online and Desktop?

QuickBooks Online (QBO) is cloud-based, meaning you can access it anywhere with an internet connection. It’s built for collaboration and integrates easily with other cloud apps. QuickBooks Desktop is installed on a specific computer (or server). While Desktop often has deeper features for complex inventory or job costing, most San Diego small businesses are moving to QBO for its flexibility and ease of remote support.

How do I switch my San Diego business to paperless accounting?

The transition to paperless is easier than you think! Start by connecting your bank and credit card feeds to QuickBooks. Next, implement a digital document management system (like the receipt capture mentioned above). Finally, encourage your vendors to send digital invoices. By following a smart guide to accounting services, you can eliminate 90% of your physical paperwork in just a few months.

Choosing the Right Partner for Your San Diego Business

At Optima Office, we know that San Diego businesses move fast. You don’t have time for a three-month onboarding process. Our USP is rapid team deployment—we can typically have a fractional team in place within 3 to 5 days.

Our proprietary five-point system ensures that the bookkeeper or controller we send you isn’t just a “numbers person,” but a perfect personality fit for your office culture. We provide a unique blend of fractional CFO, controller, bookkeeping, and even HR advisory services. This integrated approach ensures that your “people” strategy and your “money” strategy are always in sync.

If you’re ready to stop “doing the books” and start using them to grow your empire, we’re here to help. Explore our San Diego bookkeeping services today and let’s get your finances on the right track.