Reclaim Your Time and Boost Your Bottom Line

Understanding how outsourcing bookkeeping saves time and cost is crucial for business owners juggling multiple responsibilities while trying to grow their companies. Here’s the quick answer:

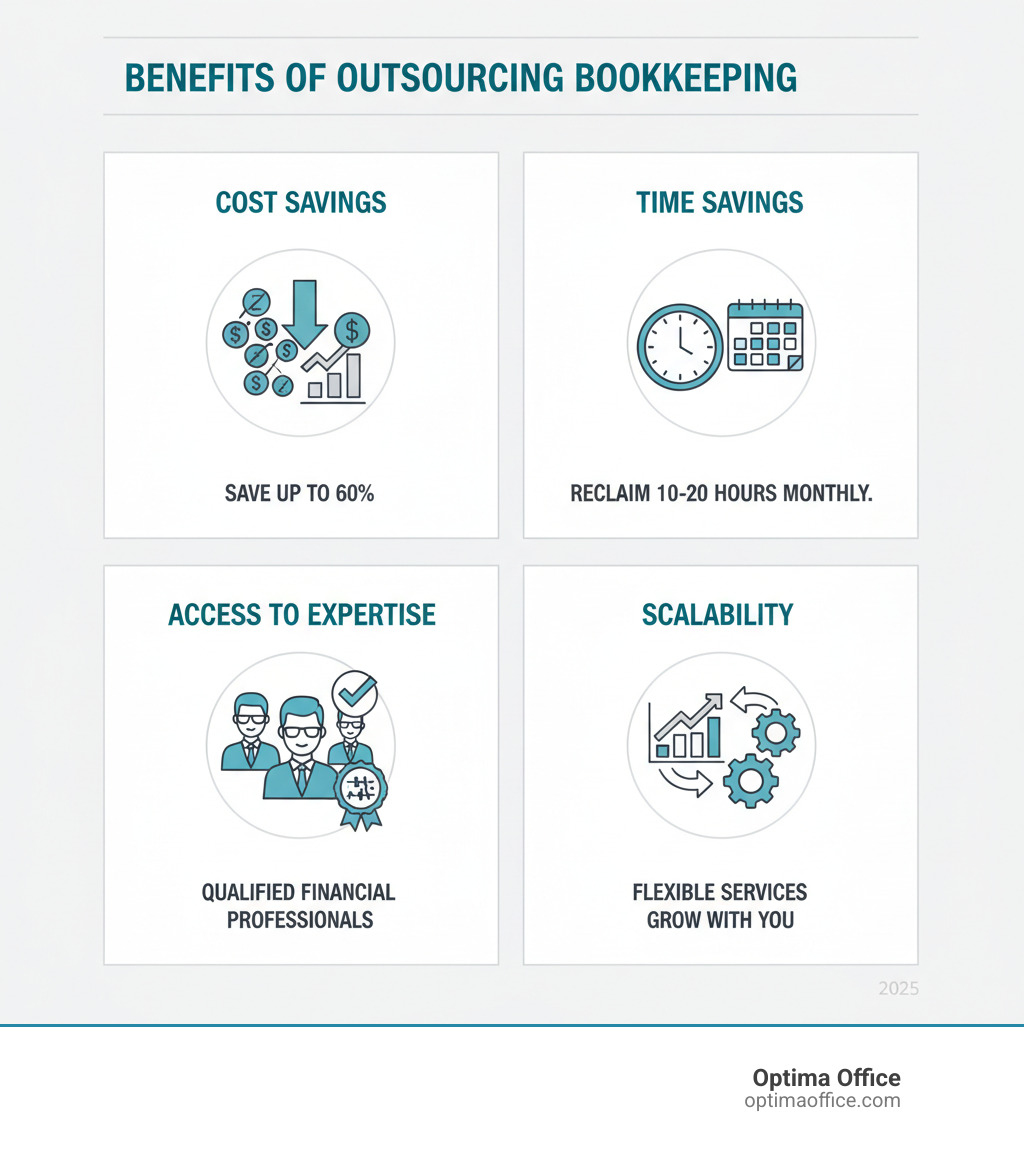

Time Savings:

- Eliminates 10-20 hours monthly spent on financial tasks

- No hiring, training, or managing bookkeeping staff

- Frees up time for core business activities like sales and customer service

Cost Savings:

- Save 40% to 60% compared to hiring in-house staff

- Avoid salaries ($35,000-$55,000 annually), benefits, and overhead costs

- Pay only for services needed with predictable monthly expenses

Additional Benefits:

- Access to expert financial professionals and advanced software

- Improved accuracy and compliance with tax regulations

- Scalable services that grow with your business

If you’re a business owner in San Diego or Southern California, you know the challenge all too well. You started your company to serve customers and build something meaningful, not to spend countless hours reconciling bank statements or chasing down receipts. Yet here you are, staying late to manage books that never seem to balance quite right.

The financial management burden hits especially hard when you’ve outgrown your current bookkeeper, experienced unexpected staff turnover, or simply recognize that your team lacks the accounting leadership needed to provide timely business insights. Many business owners spend around 18 hours per month managing payroll alone – time that could be invested in strategic planning, customer acquisition, or product development.

Discover where your bookkeeping costs are hidden with a free Financial GAP Assessment before you outsource. Get Your Free Financial GAP Assessment →

The “time is money” principle becomes painfully real when you’re the one sacrificing both. Outsourcing bookkeeping offers a strategic solution that addresses both challenges simultaneously, changing a necessary burden into a competitive advantage.

The Hidden Drain: Uncovering the True Cost of an In-House Bookkeeper

When you think about hiring a bookkeeper, you probably focus on the salary first. That makes sense – it’s the biggest number staring back at you from job postings. But here’s what many business owners don’t realize: that salary is just the beginning of a much larger financial commitment.

The real question isn’t whether you can afford to pay a bookkeeper’s salary. It’s whether you can afford all the hidden costs that come with having an employee – costs that can easily double or triple your initial budget. Understanding how outsourcing bookkeeping saves time and cost starts with recognizing just how expensive that “affordable” in-house option really is.

The Visible Costs of Hiring

Let’s start with what you can see coming. The average salary for a bookkeeper ranges between $35,000 and $55,000 per year. For a mid-level professional in San Diego, you’re looking at around $46,000 annually – which feels manageable when you’re drowning in financial paperwork.

But then reality hits. That base salary is just your starting point.

Benefits packages add another 20-30% to your labor costs immediately. Health insurance, dental coverage, retirement contributions, and paid time off aren’t optional extras – they’re expectations. Suddenly, your $46,000 bookkeeper is costing you closer to $60,000.

Don’t forget about payroll taxes either. You’ll pay Social Security, Medicare, unemployment insurance, and workers’ compensation. That’s another 10-15% on top of everything else.

Then there are the recruitment and onboarding expenses. Job postings, background checks, interviews, and the time you spend managing the hiring process all add up. Once you’ve found someone, you’ll invest weeks training them on your systems, processes, and company culture. And here’s the kicker – every time that person leaves, you get to do it all over again.

The Hidden Costs You Don’t See

Now we get to the sneaky stuff – the expenses that quietly drain your resources while you’re focused on the obvious ones.

Your new bookkeeper needs a place to work. That means office space, which comes with rent, utilities, insurance, and maintenance costs. In San Diego, allocating even a modest workspace can cost $100-300 per month. Over a year, that’s $1,200-3,600 just for the space.

They’ll also need equipment and software licenses. A computer, monitor, desk, chair, printer – plus subscriptions to QuickBooks, Excel, and other specialized tools. Budget another $1,000-3,000 annually, and remember that technology needs regular updates and replacements.

Here’s one that really stings: management overhead. Even the most independent bookkeeper needs supervision, questions answered, and guidance on company-specific issues. That’s your time – or your manager’s time – pulled away from growing the business. Time you can’t get back.

Paid time off and sick leave mean you’re paying for work that isn’t getting done. When your bookkeeper takes vacation or falls ill, you either handle the work yourself or fall behind on critical financial tasks. Neither option is great for your stress levels or cash flow.

Employee turnover costs can be devastating. The average cost of replacing an employee ranges from 50-200% of their annual salary. When you factor in lost productivity during the transition, recruitment expenses, and training time, a single departure can cost $20,000-40,000 or more.

Let’s put this all in perspective with real numbers:

| Cost Category | In-House Bookkeeper (Annual) | Outsourced Bookkeeping (Annual) | Your Savings |

|---|---|---|---|

| Salary/Service Fees | $46,144 | $2,400 – $30,000 | Up to $43,744 |

| Benefits (25%) | $11,536 | $0 | $11,536 |

| Payroll Taxes | $3,529 | $0 | $3,529 |

| Recruitment/Training | $3,000 – $7,000 | $0 | $3,000 – $7,000 |

| Office Space | $1,200 – $3,600 | $0 | $1,200 – $3,600 |

| Equipment/Software | $1,000 – $3,000 | $0 | $1,000 – $3,000 |

| Management Time | $2,000 – $5,000 | $0 | $2,000 – $5,000 |

| Total Annual Cost | $69,409 – $84,309 | $2,400 – $30,000 | $39,409 – $81,909 |

The math is pretty clear. Small businesses can save 40% to 60% on costs by outsourcing their bookkeeping instead of hiring internally. You’re not just cutting expenses – you’re eliminating the unpredictable costs and administrative headaches that come with managing employees.

The best part? You get professional expertise without any of the employment risks, space requirements, or management burden. That’s how outsourcing transforms a necessary expense into a strategic advantage for your business.

How Outsourcing Bookkeeping Saves Time and Cost for Your Business

Picture this: it’s 9 PM on a Tuesday, and while your competitors are still hunched over spreadsheets trying to reconcile last month’s expenses, you’re at home having dinner with your family. This isn’t a fantasy—it’s exactly how outsourcing bookkeeping saves time and cost for smart business owners who’ve finded the strategic advantage of letting experts handle their financial management.

We get it. As a business owner, you’re already wearing more hats than a Broadway costume department. The last thing you need is another time-consuming task eating into your day, especially one that doesn’t directly generate revenue. That’s where outsourcing transforms from a nice-to-have into a must-have business strategy.

How Outsourcing Bookkeeping Saves Time and Frees Up Your Schedule

The time savings start immediately, and they’re more dramatic than most business owners expect. Think about your last hiring experience—the weeks spent reviewing resumes, the hours of interviews, the background checks, and the inevitable anxiety about whether you made the right choice. Outsourcing eliminates the entire hiring process in one fell swoop.

But here’s where it gets really interesting. With outsourced bookkeeping, there’s no training required. None. Zero. While your competitors are spending months getting their new bookkeeper up to speed on their systems and preferences, you’re working with seasoned professionals who hit the ground running from day one.

Let’s talk about payroll for a moment—that monthly monster that seems to devour time like a hungry teenager raids the refrigerator. Small business owners spend around 18 hours per month managing payroll alone. That’s nearly half a work week! When you outsource, those 18 hours magically reappear in your schedule.

What could you accomplish with an extra 18 hours each month? Maybe finally implement that marketing campaign you’ve been putting off. Perhaps spend more time with your highest-value customers. Or— thought—actually take a weekend off without worrying about Monday’s financial tasks.

The reduced administrative burden extends beyond just payroll. Bank reconciliations, accounts payable, accounts receivable, expense tracking—all those tedious but necessary tasks that pull you away from what you do best disappear from your to-do list. This means you can focus on core business activities that actually move the needle: developing new products, nurturing client relationships, or strategizing your next growth phase.

Your team benefits too. When you’re not constantly juggling financial tasks, you can provide better leadership and support to your employees. The improved operational flow creates a ripple effect throughout your organization, boosting overall productivity and morale. For more insights on streamlining your business operations, check out The Guide to Business Administration Efficiency.

How Outsourcing Bookkeeping Saves Cost and Improves Your Cash Flow

Now for the numbers that’ll make your accountant smile (and your bank account even happier). The financial benefits of outsourcing bookkeeping aren’t just significant—they’re changeal for most small and mid-sized businesses.

The pay-for-service model is beautifully simple: you pay for exactly what you need, when you need it. No more paying full-time salaries during slow periods. No more benefits packages that cost as much as a luxury car payment. No more worrying about vacation coverage or sick days derailing your financial operations.

Here’s a number that might surprise you: small businesses can save 40% to 60% on costs when they outsource their accounting functions compared to hiring in-house staff. That’s not just pocket change—that’s money you can reinvest in growing your business, upgrading your equipment, or building up your cash reserves for opportunities.

The savings extend beyond labor costs. Outsourcing avoids software investment entirely. No more expensive QuickBooks licenses, no more annual software renewals, no more IT headaches when systems need updates. Your outsourced provider handles all the technology infrastructure, often giving you access to more sophisticated tools than you could afford on your own.

Perhaps most importantly, professional bookkeeping services reduce the risk of costly errors. A missed tax deadline, an incorrectly categorized expense, or a simple data entry mistake can cost thousands in penalties and fees. Professional bookkeepers catch these issues before they become expensive problems.

The predictable monthly expense of outsourced bookkeeping makes budgeting refreshingly straightforward. Instead of worrying about unexpected costs—overtime during busy seasons, recruitment fees when someone quits, or training expenses for new hires—you have one clear, consistent line item in your budget. This predictability improves your cash flow planning and gives you the financial clarity every business owner craves.

When you add it all up, outsourcing bookkeeping isn’t just about saving money—it’s about creating a more efficient, profitable, and manageable business model that scales with your success.

Beyond the Basics: Strategic Advantages of Outsourced Bookkeeping

When we talk about how outsourcing bookkeeping saves time and cost, we’re really just scratching the surface. The true power of outsourcing goes far beyond basic cost-cutting measures. It’s a strategic move that can completely transform how your business operates, giving you access to expertise and flexibility that would otherwise be out of reach.

Think about it this way: you didn’t start your business to become an accounting expert. You started it to serve customers, solve problems, and build something meaningful. Outsourcing lets you get back to that core mission while ensuring your financial foundation is rock-solid.

Gain Instant Access to a Full-Spectrum Finance Team

Here’s where things get really exciting. When you outsource your bookkeeping, you’re not just hiring one person to crunch numbers. You’re gaining access to an entire team of experts with specialized knowledge across different areas of finance.

Imagine having a bookkeeper who handles your day-to-day transactions, a controller who provides strategic oversight, and CFO-level support for major financial decisions – all working together on your behalf. That’s exactly what happens with quality outsourced services. At Optima Office, we believe in providing a highly-customized mix of outsourced controllers, CFOs, accountants, and HR professionals, bringing the right expertise and personality fit to solve problems quickly.

This depth of expertise translates into improved accuracy across all your financial operations. Professional firms have established processes and multiple layers of review that catch errors before they become problems. They understand the nuances of payroll regulations, tax compliance, and financial reporting in ways that even the most dedicated single bookkeeper might miss.

The fraud risk mitigation benefit is something many business owners don’t consider until it’s too late. Reputable outsourced firms have robust internal controls and security protocols. When multiple professionals are reviewing your books and following established procedures, it becomes much harder for financial irregularities to slip through unnoticed.

Perhaps most importantly, you’ll get better financial reporting for decision-making. Instead of basic transaction records, you’ll receive detailed insights about profitability, cash flow trends, and financial health. This expert analysis helps you make informed decisions about investments, expansion, and risk management.

Want to dive deeper into the different roles and how they can benefit your business? Check out our articles on Why Your Business Needs More Than Just a Bookkeeper, The Role of Bookkeepers, Controllers, and CFOs, and Bookkeeper vs. Controller: What’s the Difference?. If you’re considering executive-level financial guidance, our Fractional CFO services and insights on Telltale Signs Your Business Needs a Fractional CFO are invaluable resources.

Scale with Confidence and Ensure Tax Compliance

Growth is one of those wonderful problems to have, but it often brings unexpected complexity in financial management. This is where the flexibility for growth that outsourcing provides becomes invaluable. Whether you’re experiencing rapid expansion, dealing with seasonal fluctuations, or navigating economic uncertainty, outsourced services can adjust to meet your changing needs.

During busy seasons, you can seamlessly increase support without the headache of hiring temporary staff or overworking your current team. When things slow down, you can scale back services to optimize costs. It’s like having a financial department that grows and shrinks perfectly with your business needs.

The scalable services for seasonal businesses are particularly game-changing. If you run a retail business that explodes during the holidays or a landscaping company that’s busiest in summer, you know how challenging it can be to manage fluctuating financial workloads. Outsourced bookkeeping adapts to these patterns naturally.

But here’s where outsourcing really shines: tax compliance. Tax laws change constantly, and staying compliant can feel like a full-time job in itself. Professional bookkeeping firms employ tax experts who live and breathe these regulations. They ensure your business stays compliant and help you avoid costly penalties for missed deadlines or inaccurate filings.

This year-round compliance approach means your books are always tax-ready, not just when April rolls around. Your outsourced team tracks business deductions throughout the year, maintains proper documentation, and prepares for tax season continuously. No more last-minute scrambling or missed opportunities.

The avoidance of penalties and late fees alone can justify the cost of outsourcing. A single missed tax deadline or filing error can cost hundreds or thousands of dollars in penalties. Professional bookkeepers have systems in place to prevent these costly mistakes.

For comprehensive guidance on staying prepared throughout the year, check out our 2024-year-end accounting checklist. This resource helps ensure you’re always ready for tax season and compliance requirements.

When you combine expert knowledge, scalable services, and proactive compliance management, outsourcing becomes much more than a cost-saving measure. It becomes a strategic advantage that lets you focus on what you do best while ensuring your financial foundation supports sustainable growth.

Frequently Asked Questions about Outsourcing Bookkeeping

We understand that making the leap to outsourced bookkeeping brings up plenty of questions. After working with countless business owners, we’ve heard the same concerns time and again. Let’s tackle the most common ones to help you feel confident about this important decision.

What specific bookkeeping tasks can be outsourced?

Here’s the wonderful news: nearly every financial task that’s keeping you up at night can be expertly handled by an outsourced bookkeeping team. This flexibility is one of the key ways how outsourcing bookkeeping saves time and cost – you get exactly the services you need without paying for a full-time employee’s downtime.

Accounts payable and receivable management ensures your vendors get paid on time (avoiding those awkward phone calls) while systematically collecting payments from customers. This prevents damaged relationships, late fees, and the cash flow hiccups that can derail your operations. Bank and credit card reconciliation becomes a breeze when professionals carefully match your statements with internal records, catching discrepancies before they become bigger problems.

Payroll processing is where many business owners breathe their biggest sigh of relief. No more staying late calculating deductions or worrying about payroll tax deadlines – your team gets paid accurately and on time, every time. Financial statement preparation gives you those crucial reports like income statements and balance sheets that actually make sense, providing clear insights into your business’s health.

Tax compliance support means tracking business write-offs throughout the year and maintaining organized records that make tax season smooth rather than stressful. Finally, cash flow management helps you understand when money’s coming in and going out, so you can make informed decisions about everything from inventory purchases to expansion plans.

Is outsourcing my bookkeeping secure?

We get it – handing over your financial data feels vulnerable. But here’s what might surprise you: outsourcing often provides better security than keeping everything in-house. Professional firms stake their entire reputation on protecting client data, so they invest heavily in security measures that most small businesses simply can’t afford.

Data encryption protects your information both when it’s being transferred and when it’s stored. Secure cloud-based software like QuickBooks Online offers bank-level security that’s constantly updated and monitored. These platforms use multi-factor authentication, meaning even if someone had your password, they still couldn’t access your accounts.

Every team member signs non-disclosure agreements (NDAs) that legally bind them to protect your confidential information. Reputable firms undergo regular security audits and maintain strict compliance with industry standards. Perhaps most importantly, outsourcing actually reduces internal fraud risk by introducing professional oversight and segregation of duties – something that’s impossible when you have just one person handling all your books.

How does the onboarding process work with an outsourced provider?

The onboarding process should feel like welcoming a new team member who already knows exactly what they’re doing. At Optima Office, we’ve streamlined this to get your team operational within 3-5 days because we know you can’t afford lengthy disruptions.

We start with an initial consultation and needs assessment where we dive deep into your business, current processes, and specific challenges. This isn’t a generic questionnaire – it’s a real conversation about your goals and pain points. Next comes system integration, where we connect with your existing accounting software or help you transition to something more suitable for your needs.

Secure document transfer happens through protected portals or direct integration, so your historical data moves safely to our systems. We then introduce you to your dedicated team members and establish clear communication channels – whether that’s email, video calls, or secure messaging platforms.

Finally, we establish workflows and reporting schedules so you know exactly what to expect and when. You’ll never wonder about the status of your books or when reports will arrive. If you’re feeling hesitant about this transition, our insights on overcoming the stigma of outsourcing your accounting can help you understand why this move often feels much easier than business owners initially expect.

Conclusion: Make the Smart Move for Your Business’s Financial Health

In today’s competitive business world, smart decisions separate thriving companies from struggling ones. Throughout this guide, we’ve shown you exactly how outsourcing bookkeeping saves time and cost, changing what many see as a necessary burden into a powerful competitive advantage.

The numbers speak for themselves. You can save 40% to 60% compared to hiring in-house staff while reclaiming up to 18 hours per month currently lost to financial tasks. But the real magic happens when you consider what those savings represent: more time for strategic planning, better cash flow management, and the freedom to focus on what you do best.

Think about it this way – every hour you spend reconciling bank statements is an hour not spent with customers. Every dollar tied up in employee overhead is a dollar that could fuel your next growth initiative. When you outsource your bookkeeping, you’re not just cutting costs; you’re investing in your business’s future.

The strategic advantages go far beyond simple cost reduction. You gain instant access to a full-spectrum finance team – bookkeepers, controllers, and CFO-level expertise working together to strengthen your financial foundation. This professional support ensures better accuracy, improved compliance, and the kind of financial insights that help you make confident business decisions.

At Optima Office, we understand that small and mid-sized companies need a mixture of accounting and HR talent to run effectively, but hiring full-time staff at every level simply isn’t realistic. That’s why we’ve built our services around rapid team deployment (typically 3-5 days) and a highly-customized approach that brings together the right mix of controllers, CFOs, accountants, and HR professionals.

Ready to save 40-60% on bookkeeping costs? Start with a Financial GAP Assessment to see your optimization opportunities. Start Your Free Assessment →

Our mission goes beyond just providing exceptional services – we’re committed to building positive relationships that help our clients maximize profits, minimize risk, and drive real growth. When you partner with us, you’re not just outsourcing tasks; you’re gaining a dedicated team that understands your unique challenges and works alongside you to overcome them.

The choice is clear. You can continue spending valuable time on bookkeeping tasks that drain your energy and resources, or you can make the smart move that successful business owners are making every day. Stop letting financial management hold you back from achieving your bigger goals.

Take control of your finances by exploring outsourced accounting services.