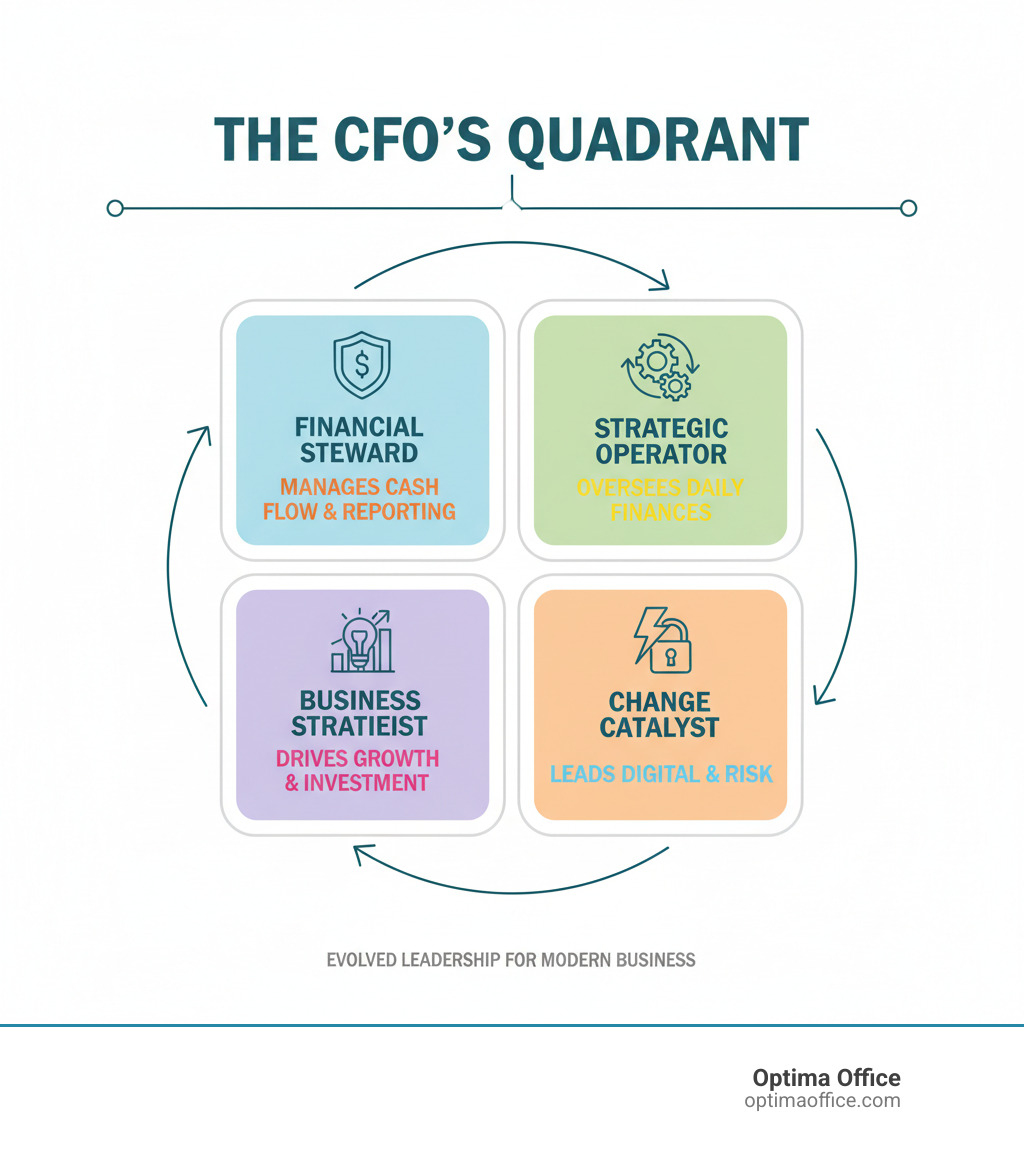

A CFO (Chief Financial Officer) is the highest-ranking financial executive in a company, responsible for managing all financial operations and serving as a strategic partner to the CEO. However, this C-suite position has evolved far beyond traditional accounting to become a critical driver of business growth and risk management.

Key CFO Responsibilities:

- Financial Strategy – Developing long-term financial plans and investment strategies

- Risk Management – Identifying and mitigating financial risks across the organization

- Reporting & Compliance – Ensuring accurate financial reporting and regulatory compliance

- Stakeholder Relations – Managing relationships with investors, banks, and board members

- Strategic Planning – Collaborating with leadership on major business decisions

Presently, the modern CFO role has transformed dramatically. According to recent research, smart companies now view the CFO position as more of an investment than an expense. Today’s CFOs are increasingly involved in areas like cybersecurity, technology adoption, and even ESG (environmental, social, and governance) initiatives.

When it comes to small and mid-sized businesses, the need for experienced financial leadership is greater than ever. With 54% of CFOs working 50+ hours per week and average salaries ranging from $130,000 to $456,739 depending on company size, many growing businesses are turning to fractional CFO services to access this expertise without the full-time cost.

Get CFO-level expertise without the $400K+ salary. Get Your Free Fractional CFO Guide →

When it comes to the CFO’s influence, it extends throughout the organization – from guiding daily cash flow decisions to shaping multi-year strategic plans. As one industry expert noted, the most-valued CFOs are visionaries who work closely with top leadership and aren’t shy about recommending strategic moves.

What is a Chief Financial Officer (CFO)?

Generally, a Chief Financial Officer is the financial captain of a company’s ship. And, they’re not just managing money—they’re charting the course for the entire organization’s financial future. A CFO serves as the top financial executive, making critical decisions that impact everything from daily operations to long-term growth strategies.

Unlike a traditional accountant who focuses on recording what happened, a CFO is always looking ahead. They’re asking questions like: Where should we invest next year? What risks are we facing? How can we grow while staying financially healthy? This forward-thinking approach makes them an essential strategic partner to the CEO and other executives.

The CFO role sits at the heart of company leadership. They translate complex financial data into clear insights that drive business decisions. Whether it’s evaluating a potential acquisition, planning for expansion, or navigating economic uncertainty, the CFO provides the financial wisdom that keeps companies on track.

The Primary Responsibilities of a CFO

A CFO’s day involves wearing many different hats. They’re part strategist, part risk manager, and part financial detective—all rolled into one critical role.

Financial planning and analysis forms the backbone of what modern CFOs do. They create budgets that actually work, forecast future performance, and build financial models that help companies make smart decisions. It’s like being a weather forecaster, but for business—predicting financial storms and sunny days ahead.

Financial reporting and compliance might sound boring, but it’s absolutely vital. CFOs ensure that financial statements are accurate and meet strict regulatory standards. The Sarbanes-Oxley Act requires public companies to maintain rigorous internal controls, and CFOs are on the front lines of this compliance effort. Getting this wrong can mean serious legal trouble, so attention to detail is crucial.

Risk management keeps CFOs up at night—in a good way. They’re constantly scanning the horizon for potential financial threats, from market volatility to cybersecurity risks. However, smart CFOs don’t just identify these risks; they build strategies to protect the company when challenges arise.

When it comes to capital structure and investment strategy, CFOs make decisions that shape the company’s future. Should they take on debt to fund growth? Is now the right time to raise equity? These choices can make or break a business, which is why having experienced financial leadership matters so much.

Data analysis has become increasingly important as businesses generate more information than ever before. Today’s CFOs use advanced analytics to uncover insights that weren’t visible before and turn spreadsheets into strategic advantages.

Finally, strategic decision-making ties everything together. CFOs don’t just crunch numbers—they interpret what those numbers mean for the business and recommend actions that drive growth and profitability.

Collaboration with the C-Suite

The best chief financial officers are team players who work seamlessly with other executives. They understand that financial success requires collaboration across the entire leadership team.

As a strategic partner to the CEO, the CFO serves as a trusted advisor on all major decisions. This partnership is critical—while the CEO focuses on vision and leadership, the CFO ensures that vision is financially viable and sustainable.

Operational support for the COO involves translating operational efficiency into financial results. When operations teams want to streamline processes or invest in new technology, the CFO evaluates the financial impact and helps make informed decisions.

Board of directors reporting requires CFOs to communicate complex financial information clearly and confidently. Board members rely on the CFO to provide honest assessments of the company’s financial health and future prospects.

Investor relations can make or break a company’s ability to raise capital. Experienced CFOs know how to turn stakeholders into allies by building trust through transparent communication and consistent performance.

Cross-departmental guidance ensures that financial considerations are woven into every business function. Whether it’s helping marketing measure campaign ROI or working with HR on compensation planning, the CFO’s influence extends throughout the organization.

For many growing businesses, accessing this level of financial expertise through a full-time hire isn’t realistic. That’s why fractional CFO services have become increasingly popular—they provide the strategic guidance of an experienced CFO without the full-time cost commitment.

The Evolving Role of the Modern CFO

The CFO role has undergone a remarkable change. Gone are the days when the CFO was solely confined to financial reporting and compliance. Today, we are strategic architects, navigating complex economic landscapes and technological advancements.

From Number Cruncher to Strategic Partner

Traditionally, the CFO was often seen as the “financial gatekeeper” or the “number cruncher,” primarily focused on historical data, accuracy, and regulatory adherence. While these aspects remain crucial, the modern CFO has shifted dramatically to become a “business leader” and a forward-looking strategist. This shift from number cruncher to business leader is well-documented.

We now leverage data-driven insights to challenge existing strategies, identify new opportunities, and drive growth. This involves a deep understanding of the entire business, not just its financial mechanics. Modern CFOs are expected to be visionaries, proactively shaping the company’s future. Indeed, many now argue why CFOs need to be Chief Future Officers. We are at the forefront of technology adoption, using new tools to automate routine tasks and free up time for higher-value strategic work.

Top Challenges in Today’s Business Landscape

The modern CFO faces a dynamic and often unpredictable environment. Here are some of the key challenges we steer:

- Data Governance: With vast amounts of data available, ensuring its accuracy, consistency, and security across the organization is a significant undertaking. We must champion data use and ensure reliable insights are generated from high-quality data.

- Adopting AI and Emerging Technologies: Artificial intelligence (AI) and machine learning offer immense potential for efficiency and insights, but integrating these technologies effectively, identifying the right use cases, and ensuring a positive ROI can be complex. AI is ready to evolve the CFO role significantly, but it also presents a learning curve and implementation challenges.

- Talent Acquisition and Upskilling: Finding and retaining skilled finance professionals, especially those with technological proficiency, is a constant struggle. We need to systematically upskill our teams to handle new technologies and strategic demands.

- Cybersecurity Risks: As financial operations become more digital, the threat of cyberattacks looms larger. We are increasingly involved in assessing and mitigating cybersecurity risks to protect sensitive financial data.

- Regulatory Changes: The regulatory landscape is constantly shifting, requiring vigilance and adaptability to ensure continuous compliance.

- Balancing Growth and Cost Efficiency: Striking the right balance between investing in growth initiatives and maintaining stringent cost controls is a perpetual challenge, especially in uncertain economic times. We must make judicious decisions about where and when to spend the company’s money to speed up ROI and select the least risky options.

- Juggling Growing Responsibilities: The expansion of the CFO role means we are juggling more responsibilities than ever before, from traditional finance to new areas like ESG reporting and digital change. This often leads to long work weeks, with 54% of CFOs reporting working 50 hours or more per week.

How to Become a CFO: Skills, Salary, and Career Path

The path to becoming a CFO is both challenging and rewarding. It’s a journey that requires dedication, continuous learning, and strategic career moves. If you’re wondering how to reach this pinnacle of financial leadership, you’re looking at years of building expertise and proving your value as a strategic business partner.

Essential Qualifications and Career Path

Most CFOs didn’t wake up one day and land the job. The typical journey spans 10-15 years of progressive experience, with each step building the skills and credibility needed for executive leadership.

Education forms the foundation. You’ll need at least a bachelor’s degree in finance, accounting, or business administration. But if you’re serious about reaching the C-suite, consider an MBA with a finance concentration or a Master of Science in Finance. Regardless, these advanced degrees open doors and demonstrate your commitment to mastering the strategic side of finance.

Professional certifications separate the serious candidates from the rest. The CPA (Certified Public Accountant) certification is gold standard for financial credibility. If you’re more investment-focused, the CFA (Chartered Financial Analyst) designation carries tremendous weight. A CMA (Certified Management Accountant) is another respected path, especially for those interested in management accounting and strategic planning.

Experience is where theory meets reality. Most CFOs start in entry-level roles like staff accountant or financial analyst. The path to becoming a financial manager typically progresses through controller positions, then to finance director or VP of Finance roles. Each step teaches different aspects of financial leadership – from technical accounting skills to strategic planning and team management.

The timeline matters. Expect to spend at least 5 years in senior leadership roles before being considered for a CFO position. This isn’t just about checking boxes – you need time to develop the strategic thinking and leadership presence that boards and CEOs demand from their financial leaders.

Essential Skills and Average Salary

When it comes to being a successful CFO, other skills are required more than just being good with numbers. You’re leading teams, influencing strategy, and communicating with everyone from employees to investors.

Leadership skills are non-negotiable. As head of the finance department, you’ll inspire and guide teams while making tough decisions under pressure. You need to build trust and create a culture where your team can do their best work.

Strategic thinking sets great CFOs apart from good ones. You must see beyond the current quarter to anticipate trends, identify opportunities, and develop long-term financial strategies that drive business growth. This means understanding not just the numbers, but the story they tell about your company’s future.

Communication skills can make or break your success. You’ll present to boards, explain complex financial concepts to non-finance executives, and build relationships with investors and lenders. The ability to translate financial data into compelling business insights is crucial.

Analytical ability remains at the core of what you do. Deep expertise in financial modeling, data analysis, and quantitative methods helps you interpret complex information and make sound recommendations that shape company direction.

Business acumen connects your financial expertise to real-world results. Understanding your industry, market dynamics, and competitive landscape allows you to provide relevant guidance that drives meaningful business outcomes.

Compensation reflects the responsibility and expertise required. The median salary of a CFO in the United States was $397,887 a year as of May 2025, though recent data shows U.S. CFO pay averaging $456,739 in early 2025.

Company size significantly impacts compensation. Smaller companies might offer $130,000 to $200,000, while large public companies often provide much higher packages including bonuses and stock options. Location matters too – a CFO in Canada earns an average of $160,000 per year, while major U.S. markets command premium salaries.

Your experience and track record ultimately determine your earning potential. CFOs with proven success in driving growth and managing risk often command salaries well over $267,803 per year, plus significant performance-based compensation.

For many growing businesses, the need for CFO-level expertise is real, but the cost of a full-time executive isn’t feasible. That’s where fractional CFO services provide an attractive alternative – giving companies access to experienced financial leadership without the full-time expense.

A Day in the Life: CFO Types, Duties, and Tools

What does a CFO do all day? The role is a dynamic blend of strategic thinking, team leadership, and problem-solving, extending far beyond board meetings and number-crunching.

Typical Duties and Work Environment

There’s no “typical” day for a CFO. Although many work 50+ hours a week, this type of role offers more flexibility than ever. While primarily office-based, remote and hybrid work are becoming the norm.

Mornings often start with C-suite meetings with the CEO, COO, and other executives to discuss performance and strategy. The CFO provides the key financial insights that shape major business decisions.

Team management is a significant part of the day. CFOs lead and mentor finance teams, including controllers and forecasting specialists, to develop the next generation of financial leaders.

Between meetings, CFOs dive into financial analysis, examining reports, tracking KPIs, and identifying trends. This work often leads to insights that can change a company’s direction.

Stakeholder communication connects the CFO to the outside world. They regularly engage with investors, banks, and partners, presenting financial results and future plans by translating complex data into clear narratives.

Furthermore, this type of role often demands networking and travel. For global companies, this can mean calls at odd hours to manage finances across time zones.

Different Types of CFO Roles

Not all CFO positions are created equal. The role varies dramatically depending on where a company stands in its journey, and each type brings its own unique challenges and rewards.

Startup CFOs are often the financial Swiss Army knives of their organizations. They’re focused on securing that crucial funding, managing tight budgets, and building financial processes from scratch. Many startup CFOs even accept stock options as part of their compensation, betting on the company’s future success. Knowing when startups should hire a CFO is crucial for early growth.

Growth CFOs work with mid-sized companies experiencing rapid expansion. Their focus shifts to scaling financial operations, securing additional capital for growth, and optimizing financial structures to support that exciting but challenging period of acceleration.

When companies hit rough waters, turnaround CFOs step in as financial lifeguards. They’re the ones stabilizing finances, implementing necessary budget cuts, managing debt restructuring, and sometimes even navigating bankruptcy proceedings to get companies back on solid ground.

Public company CFOs operate in a different league entirely. They’re managing complex operations for large, publicly traded corporations, dealing with investor relations, SEC filings, and regulatory compliance while handling vast sums of money.

For smaller businesses that need expert financial leadership without the full-time price tag, fractional CFOs provide part-time, high-level strategic guidance. This model allows companies to access top-tier talent while keeping costs manageable. Virtual CFOs offer similar services but work entirely remotely, using technology to manage financial operations from anywhere.

Common Technologies and Tools

Gone are the days when CFOs relied solely on spreadsheets and calculators. Today’s financial leaders are tech-savvy professionals who leverage cutting-edge tools to manage complex data and gain deeper insights.

Enterprise Resource Planning (ERP) systems like NetSuite serve as the backbone of modern financial operations. These integrated software suites manage everything from finance and human resources to manufacturing and supply chain, giving us a unified view of the entire business.

Financial Planning and Analysis (FP&A) software has revolutionized how we approach budgeting and forecasting. These tools allow us to create more accurate predictions and run multiple scenarios, helping us prepare for various future possibilities.

Business Intelligence (BI) tools are our crystal balls, collecting and visualizing massive amounts of data to help us spot trends, measure performance, and support critical decision-making. The insights these tools provide can be game-changing for strategic planning.

AI and machine learning are increasingly becoming part of our daily toolkit. We’re using these technologies for automated expense management, invoice matching, fraud detection, and predictive analytics. This automation frees us up to focus on the strategic work that truly moves the needle.

Cloud-based platforms have given us unprecedented flexibility and collaboration capabilities. Whether we’re working from the office, at home, or anywhere in between, we can access the tools and data we need to keep the business running smoothly.

The landscape of technology trends for finance leaders continues to evolve at breakneck speed. Staying current with these advancements isn’t just nice to have – it’s essential for any CFO who wants to drive efficiency and maintain a competitive edge in today’s business environment.

Frequently Asked Questions about the CFO Role

The financial world has many roles, which can be confusing. Let’s clarify the key differences and explain what makes a CFO unique.

Is a CFO the same as an accountant or controller?

Not quite, though these roles work together. Think of the financial team like a machine where each part has a specific job.

Accountants are detail-oriented professionals who record transactions, manage bills, and file taxes. They ensure the company’s financial history is accurate and complete.

Controllers manage the accounting team and ensure financial reports are accurate and compliant. They act as quality control managers for the company’s finances, report to the CFO, and focus on smooth daily operations.

A CFO is a strategic visionary. They understand how necessary accounting is and their job is to use financial data to plan for the future. They ask questions like “Where should we invest next?” and “How can we grow while managing risk?”

The CFO is focused on your company’s financial future – maximizing profits, minimizing risk, and driving growth. We’re not just recording what happened; we’re helping shape what happens next.

Is the CEO higher than the CFO?

Yes, the CEO (Chief Executive Officer) is the highest-ranking executive and the ultimate decision-maker for the organization.

The CFO reports directly to the CEO, serving as a trusted advisor on financial matters. The CEO relies on the CFO’s insights and analysis for strategic decisions.

While the CFO has authority over financial strategy, the CEO has the final say on company direction. This partnership is built on trust, with the CFO providing financial expertise for the CEO’s ultimate decisions.

What is a fractional CFO?

A fractional CFO is an experienced financial executive who works with a company part-time, providing access to top-level expertise without the full-time cost.

If your growing business needs strategic financial guidance but isn’t ready for a full-time executive costing $200,000+ annually, a fractional CFO is the solution. You get the same expertise but only pay for the time you need.

Additionally, this model is flexible and cost-effective, offering strategic planning, risk management, and growth planning from a seasoned CFO for a fraction of the cost of a full-time hire.

At Optima Office, we’ve built our entire approach around this concept and can deploy a fractional CFO to your business within 3-5 days. Furthermore, our proprietary five-point system ensures we match you with someone who’s not just qualified, but also fits your company culture perfectly. You get the complete benefits of a finance department without the overhead of hiring internally, allowing you to maximize profits, minimize risk, and focus on growing your business.

In Summary: The Role of The CFO

When it comes to the modern CFO role, it has truly become the backbone of modern business success. What started as traditional number-crunching has blossomed into something much more exciting—a position where financial expertise meets strategic vision to drive real business change.

Furthermore, the modern CFO isn’t just balancing books; they’re balancing the future of entire organizations. They’re the ones turning raw data into actionable insights, helping CEOs steer uncertain markets, and ensuring companies don’t just survive but thrive. Whether it’s a startup founder seeking their first major funding round to established businesses planning international expansion, the CFO’s strategic guidance makes the difference between good intentions and great results.

The evolving responsibilities we’ve explored—from AI adoption to ESG reporting, from cybersecurity oversight to talent development—show just how dynamic this role has become. Modern CFOs are part financial wizard, part technology advocate, and part business strategist. They’re the ones who can look at a spreadsheet and see tomorrow’s opportunities.

For many growing businesses, this level of expertise often feels out of reach. However, the reality of hiring a full-time CFO represents a significant investment—often $200,000 to $400,000+ annually when you factor in salary, benefits, and overhead. That’s where the beauty of fractional CFO services really shines.

At Optima Office, we’ve seen how the right financial leadership can transform a business trajectory. Our approach to fractional CFO services means you get all the strategic insight, risk management, and growth planning expertise without the full-time price tag. Whether you need help preparing for an acquisition, optimizing cash flow, or building financial systems that scale, our team brings that high-level CFO thinking to your business in just 3-5 days.

The bottom line: Every business deserves access to world-class financial leadership. You shouldn’t have to choose between expert guidance and smart budgeting. With our integrated approach to finance and HR services, you’re getting a complete leadership team designed to maximize your profits, minimize your risks, and accelerate your growth.

Ready to see what strategic financial leadership could mean for your business? Get a free financial gap diagnosis and find how the right CFO partnership can open up your company’s full potential. Sometimes the best investment you can make is in the expertise that helps you make every other investment count.

Ready for expert financial leadership at a fraction of the cost?

Download our Fractional CFO Guide today.