Navigating the Complex Landscape of California HR Compliance

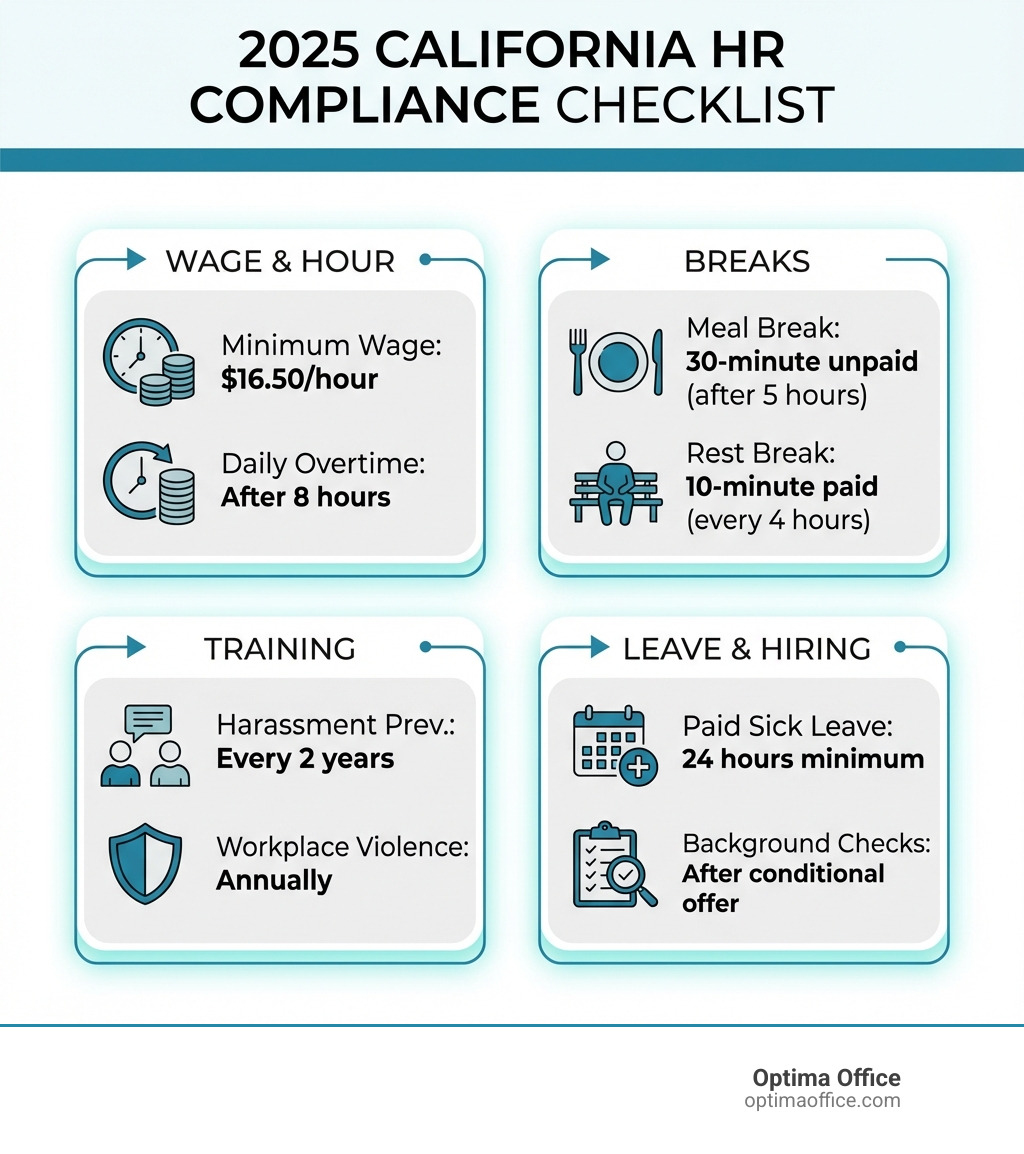

A california hr compliance checklist is essential for employers to steer the state’s complex labor laws, which often exceed federal requirements. At its core, the checklist must cover:

- Anti-discrimination policies covering California’s expanded protected classes (including hair texture, intersectional characteristics)

- Wage and hour compliance including $16.50/hour minimum wage (2025), daily overtime after 8 hours, mandatory meal/rest breaks

- Required training including harassment prevention (biennial) and workplace violence prevention (annual)

- Leave policies covering CFRA, paid sick leave, and Paid Family Leave

- Hiring practices including pay scale disclosures, Fair Chance Act compliance, and proper background checks

- Updated employee handbooks with current policies and required workplace posters

- PAGA risk mitigation through proper wage and hour practices and documentation

California has created what one law firm describes as a significantly different employment landscape from federal law. The state forbids workplace discrimination for employers with 5 or more employees, while federal Title VII applies only to employers with 15 or more. California mandates paid family leave, requires daily overtime for hours worked beyond 8 in a day, and sets its minimum wage more than twice the federal rate.

These differences matter. Army contractors paid $1.1 million to settle unpaid rest break claims. McDonald’s settled overtime violations for $26 million. A discount grocer paid $2 million over minimum wage issues.

For small businesses in Southern California, staying compliant isn’t just about avoiding lawsuits; it’s about protecting your organization during growth, especially when facing HR challenges like leadership turnover or outdated systems.

California lawmakers continue crafting new requirements each year. In 2025 alone, significant changes take effect around intersectional discrimination, whistleblower protections, independent contractor classifications, and PAGA reform. The Private Attorneys General Act remains a particular concern—employees can sue on behalf of the state for labor code violations, often triggered by inadequate training on wage and hour laws.

Avoid costly California HR violations—get a free HR Compliance Audit to identify gaps before they become lawsuits. Get Your Free HR Compliance Audit →

Why California is Different

California’s reputation for employee-friendly laws is well-earned. The state sets a higher bar than federal regulations, creating a complex web of rules for employers in San Diego and Southern California.

Let’s look at some key distinctions:

- Broader Anti-Discrimination Protections: While federal law (Title VII) applies to employers with 15 or more employees, California’s Fair Employment and Housing Act (FEHA) extends its anti-discrimination protections to employers with just 5 or more employees. This means many smaller businesses are subject to comprehensive anti-discrimination laws. Furthermore, California protects a longer list of classes, including age, gender identity/expression, marital status, medical condition, military/veteran status, and even hair texture and styles (the CROWN Act). This includes prohibitions against discrimination based on a combination of two or more protected characteristics, known as intersectional discrimination.

- Higher Minimum Wage: California’s minimum wage consistently surpasses the federal rate of $7.25 per hour. For 2025, the state minimum wage is scheduled to increase to $16.50 per hour. Many cities and counties also have their own ordinances that mandate even higher local minimum wages.

- Daily Overtime Rules: Unlike federal law, which primarily focuses on weekly overtime, California mandates “daily overtime.” This means employers must pay 1.5 times the regular rate for all hours worked over 8 in a workday, as well as for hours worked over 40 in a workweek, and double time for hours over 12 in a day or over 8 hours on the seventh consecutive workday.

- Mandatory Meal and Rest Breaks: Federal law does not require meal or rest breaks, though it does mandate compensation for short rest breaks. California, however, strictly requires employers to provide non-exempt employees with a paid 10-minute rest break for every 4 hours worked (or major fraction thereof). Additionally, a 30-minute unpaid meal break must be provided if an employee works more than 5 hours a day, and a second 30-minute meal break if they work more than 10 hours.

- Generous Family and Sick Leave Policies: California boasts its own paid family and medical leave requirements, offering up to 8 weeks of paid leave for specific family care reasons, a benefit not federally required for private employers. Beyond that, employers with 5 or more employees must provide up to 12 weeks of job-protected, unpaid leave to care for a family member. All employers in California must provide at least 24 hours (or 3 days) of paid sick leave to eligible workers, with some local ordinances requiring even more.

- Private Attorneys General Act (PAGA): This unique California law allows employees to sue employers on behalf of the state for Labor Code violations. PAGA claims can be incredibly costly and are often triggered by seemingly minor infractions, such as inadequate training on wage and hour laws or improper break policies.

The Cost of Non-Compliance

Ignoring California’s HR laws is a high-stakes gamble that can lead to severe financial penalties, reputational damage, and operational disruption. The costs of non-compliance can be astronomical.

- PAGA Lawsuits: PAGA is a major concern. A single wage and hour violation can escalate into a class-action-like claim, resulting in six- or seven-figure settlements. Even technical violations can trigger substantial penalties.

- Class-Action Litigation: Beyond PAGA, California is prone to traditional class-action lawsuits concerning wage and hour violations, discrimination, and other labor code breaches. These cases can drag on for years, incurring massive legal fees and large payouts. For instance, a discount grocer settled a class action lawsuit for $2 million over minimum wage and overtime violations. Army contractors agreed to pay $1.1 million to settle claims for unpaid rest breaks. And a large fast-food company paid $26 million to settle claims of violating California’s overtime pay rules. These aren’t isolated incidents; they’re cautionary tales for employers who don’t prioritize compliance.

- Reputational Damage: Lawsuits and regulatory fines often become public knowledge, leading to negative press and a tarnished employer brand. This can make it difficult to attract and retain top talent, especially in competitive markets like Southern California.

- Regulatory Fines: State agencies like the Division of Labor Standards Enforcement (DLSE) and the Department of Fair Employment and Housing (DFEH) have the authority to levy significant fines for violations, adding another layer of financial burden.

For businesses in San Diego and Southern California, adhering to a thorough california hr compliance checklist is a strategic imperative to protect your bottom line and ensure business longevity.

Key 2025 California HR Law Updates

As we move into 2025, California is introducing significant employment law changes. Employers in Southern California must stay informed and update their california hr compliance checklist to incorporate these new requirements.

Wage, Hour, and Salary Changes for 2025

- 2025 Minimum Wage Increase: Effective January 1, 2025, California’s statewide minimum wage is scheduled to increase to $16.50 per hour. This is a significant jump from previous years and will impact payroll across many industries.

- 2025 Exempt Employee Salary Threshold: For employees to qualify as exempt from overtime under the executive, administrative, or professional exemptions, their minimum annual salary will rise to $68,640 per year (or $5,720 per month) in 2025. This threshold is tied to twice the state minimum wage for full-time employment.

- Local Minimum Wage Ordinances: Many cities and counties within California, including some in Southern California, have their own minimum wage rates that may be higher than the state minimum. Employers must always pay the highest applicable rate.

- Healthcare Worker Minimum Wage Tiers: Effective July 1, 2025, specific minimum wage tiers will apply to healthcare workers. Covered healthcare facilities must pay $24/hour for larger facilities/integrated systems and $21/hour for clinics/other facilities.

- Overtime-Exempt Computer Professional Pay Rates: The minimum annual salary for overtime-exempt computer professionals will also increase to $118,657.43 for 2025, with an hourly rate threshold of $56.97. Similarly, the hourly rate for physicians/surgeons for exemption purposes will be $103.75 in 2025.

Expanded Employee Protections and Rights

- Intersectional Discrimination (SB 1137): California’s Fair Employment and Housing Act (FEHA) now explicitly prohibits discrimination or harassment based on a combination of two or more protected characteristics. This means our anti-discrimination policies must address these nuanced forms of bias.

- Hairstyle Discrimination (CROWN Act): The CROWN Act has been further amended (AB 1815) to remove the word “historically” from the definition of race, broadening protection for any trait associated with race, including hair texture and protective hairstyles, regardless of historical context. Employers should review dress codes and grooming policies to ensure compliance.

- Driver’s License Requirement Restrictions (SB 1100): Employers are now restricted from requiring a driver’s license for a job unless driving is an essential function of the position and no alternative transportation would work comparably. This means we need to carefully evaluate job requirements.

- Whistleblower Posting Requirements (AB 2299): New requirements mean employers must display an updated whistleblower rights poster, and avoid policies that discourage reporting.

- “Captive Audience” Meeting Protections (SB 399): Employees cannot be penalized for refusing to attend mandatory employer-sponsored meetings on political or religious matters, including discussions about unionization. This impacts how we conduct certain internal communications.

- Workplace Violence Restraining Orders (WVROs) (SB 428): The law regarding Workplace Violence Restraining Orders has been amended to allow employers to seek a temporary restraining order (TRO) on behalf of employees who have suffered violence or a credible threat of violence, even if the employee is not physically present at the workplace.

Leave Policies and Benefits Updates

- Paid Family Leave (PFL) Benefit Increase (SB 951): Effective in 2025, CA PFL wage replacements will increase to 70%-90% of an employee’s average weekly earnings, depending on the employee’s income level. This provides more substantial support for employees taking PFL.

- Employer PTO Usage Rules for PFL (AB 2123): Employers can no longer require employees to use their vacation or PTO before receiving CA Paid Family Leave benefits. While employers can offer employees the option to supplement PFL with PTO, it cannot be a mandatory requirement.

- Expanded Protections for Crime Victims (AB 2499): Protections for crime victims are being expanded, requiring larger employers (25+ employees) to provide extended leave for victims of certain violent acts. We must ensure our leave policies and notices reflect these new rights.

- Infertility Coverage in Health Insurance (SB 729): New requirements will mandate health insurance plans to cover infertility treatment, including fertility preservation. Employers sponsoring health plans should verify their plans are compliant.

Other Significant 2025 Changes

- PAGA Reforms (June 2024): While technically effective for claims filed on or after June 19, 2024, the Private Attorneys General Act (PAGA) will undergo significant changes that impact how claims are handled and potentially offer employers more opportunities to “cure” violations before facing penalties.

- CalSavers Registration Deadline (Dec 31, 2025): If you have one or more employees and do not offer your own retirement plan, you must register for CalSavers by December 31, 2025. This state-sponsored retirement savings program is becoming mandatory for even the smallest employers.

- Sunset of Independent Contractor Exemptions: Starting January 1, 2025, several independent contractor exemptions will end, including those for newspaper distributors, carriers, certain manicurists, and construction trucking subcontractors. We’ll need to carefully review any such classifications.

- California Consumer Privacy Act (CCPA) Updates: The CCPA sees a broader definition of “sensitive personal information” to include “neural data” (SB 1223) and a clarification of “personal information” (AB 1008). Additionally, successor businesses are now required to honor consumer opt-out rights from the acquired entity (AB 1824).

- Digital Replica Usage in Employment Agreements (AB 2602): New laws restrict the usage of digital replicas (e.g., AI-generated likenesses) in employment agreements, requiring specific consent.

Your Essential California HR Compliance Checklist for 2025

A robust california hr compliance checklist is critical for any business in San Diego or Southern California. Here are the essential components for your 2025 checklist:

Hiring and Onboarding

The hiring process is a critical first step for compliance and must be handled correctly.

- Essential New Hire Notices and Forms: California law requires employers to provide numerous notices and pamphlets to new hires. This includes the New Hire Notice (Labor Code 2810.5), pamphlets on paid sick leave, DFEH notices, and more. A comprehensive California New-Hire Notices Checklist can help ensure you don’t miss anything.

- Job Descriptions (Annual Review): Accurate and up-to-date job descriptions are foundational. They clarify duties, aid in proper classification (exempt vs. non-exempt), support reasonable accommodation requests, and provide a basis for performance management. We recommend reviewing and updating them annually.

- Pay Scale in Job Postings: For many positions, California law requires employers to include a reasonable pay scale in job postings. Ensure your recruitment advertisements comply.

- Fair Chance Act (Background Checks): Under the Fair Chance Act, criminal background checks can only be conducted after a conditional offer of employment. If a conviction surfaces, you must conduct an individualized assessment and allow the applicant to provide additional information before making a final decision.

- Pre-employment Drug Screening (Cannabis Metabolites): California employers cannot discriminate against applicants for off-duty cannabis use. Drug screenings must be adjusted to avoid testing for non-psychoactive cannabis metabolites.

- I-9 Verification: Always ensure timely and accurate completion of Form I-9 for all new hires, verifying their identity and eligibility to work in the U.S.

Wage, Hour, and Breaks

This area is a frequent source of litigation, making adherence crucial.

- Employee Classification (Exempt vs. Non-Exempt): Misclassifying employees can lead to significant wage and hour penalties. We must ensure employees meet the strict duties and salary tests for exempt status.

- Timekeeping Records: Maintain accurate records of all hours worked by non-exempt employees, including start and end times, and meal and rest periods.

- Daily and Weekly Overtime Calculation: Correctly calculate and pay daily overtime (over 8 hours in a workday, over 40 in a workweek, and double time as applicable).

- Meal Break Rules (30-min Unpaid): Provide a timely, uninterrupted 30-minute unpaid meal break for non-exempt employees working more than 5 hours. A second meal break is required for shifts over 10 hours.

- Rest Break Rules (10-min Paid): Ensure non-exempt employees receive a paid 10-minute rest break for every 4 hours worked or major fraction thereof.

- Final Paycheck Requirements: California has strict rules for final paychecks, including specific timing for issuance (e.g., immediate for involuntarily terminated employees) and permissible deductions.

Employee Handbooks and Required Postings

Your employee handbook is a primary communication tool and a critical defense in legal disputes.

- Annual Handbook Review: We strongly recommend reviewing your employee handbook annually to incorporate new laws, update existing policies, and ensure it reflects current practices.

- At-Will Employment Statement: Clearly state your at-will employment policy, if applicable.

- EEO Policy: A robust Equal Employment Opportunity (EEO) policy is essential, covering all protected classes under state and federal law, including intersectional discrimination and hairstyle protections.

- Anti-Harassment and Anti-Retaliation Policies: Implement clear policies against harassment, discrimination, and retaliation, including a clear complaint and investigation procedure.

- Workplace Violence Prevention Plan: As of July 1, 2024, all California employers must have an effective Workplace Violence Prevention Plan in place, including annual training and record-keeping.

- Required Workplace Posters: Display all mandatory state and federal posters in a conspicuous location where employees can easily see them.

Mandatory Training and Performance Management

Training prevents violations, while effective performance management fosters a compliant workplace.

- Harassment Prevention Training: California mandates harassment prevention training every two years. Supervisors must receive 2 hours of training, while non-supervisory employees need 1 hour. Newly hired or promoted supervisors must complete this within six months.

- Workplace Violence Prevention Training: Annual training on your Workplace Violence Prevention Plan is now mandatory for all employees. Additional training is required whenever changes are made to the plan.

- Fair and Objective Performance Review Process: Conduct regular performance reviews (quarterly or bi-annually is a good practice). Ensure evaluations are based on consistent, objective standards to avoid claims of discrimination or retaliation.

- Documenting Performance Issues: Always document performance issues, corrective actions, and employee feedback. This creates a clear record and helps support employment decisions.

Best Practices for Ongoing HR Compliance

Maintaining compliance in California isn’t a one-time task; it’s an ongoing commitment. Here’s how we help businesses in Southern California adopt best practices for continuous HR compliance:

Building Your California HR Compliance Checklist

A dynamic checklist is your best friend in California.

- Auditing Current Practices: Regularly audit your HR practices against the latest state and federal laws. This helps identify potential gaps before they become costly problems.

- Identifying Gaps: Pinpoint areas where your policies or practices fall short of current requirements. Is your handbook missing the latest anti-discrimination language? Are your wage statements compliant?

- Assigning Responsibility for Updates: Designate specific individuals or teams to monitor legislative changes and update policies. For many small and mid-sized businesses, this is where a fractional HR expert from Optima Office can step in, offering the expertise of a full HR department without the full-time cost.

- Creating a Compliance Calendar: Develop a calendar that outlines key compliance deadlines: minimum wage changes, training due dates, handbook review dates, etc.

- Reviewing Job Descriptions and Handbooks Annually: As highlighted, these documents are living entities in California. Annual reviews are non-negotiable to align with new laws and current operational practices.

Managing Leaves of Absence

California’s leave laws are extensive and often run concurrently with federal FMLA. Proper management is essential.

- California Family Rights Act (CFRA): Understand employee eligibility and employer obligations for job-protected leave for family and medical reasons.

- Paid Sick Leave (State and Local): Track accrual, usage, and carryover of paid sick leave, ensuring compliance with both state law and any local ordinances in your operating area.

- Pregnancy Disability Leave (PDL): Provide up to four months of job-protected leave for employees disabled by pregnancy, childbirth, or related medical conditions.

- Kin Care: Understand the rules allowing employees to use half of their accrued sick leave to care for a family member.

- Bereavement Leave: Ensure policies align with state requirements for bereavement leave.

- Documenting Leave Requests: Carefully document all leave requests, approvals, denials, and communications to ensure compliance and avoid disputes.

Using a California HR Compliance Checklist to Mitigate Risk

A well-used california hr compliance checklist is your shield against potential legal battles.

- Ensuring Fairness and Consistency: By following clear policies and procedures outlined in your checklist, you ensure fair and consistent treatment of all employees, which is crucial in preventing discrimination and retaliation claims.

- Reducing PAGA Exposure: A significant portion of PAGA claims stem from wage and hour violations. By diligently following your checklist for proper classification, timekeeping, and break compliance, you drastically reduce your PAGA risk.

- Defending Against Wrongful Termination Claims: Clear performance management, consistent disciplinary actions, and adherence to legal processes (all guided by your checklist) provide a strong defense against wrongful termination lawsuits.

- Proactive Risk Management: Instead of reacting to potential problems, a proactive approach using a checklist allows you to identify and rectify compliance issues before they escalate into costly legal challenges.

- Training Supervisors on Policies: Your supervisors are on the front lines. Training them thoroughly on all key HR policies—from wage and hour laws to anti-harassment protocols—is perhaps one of the most effective risk mitigation strategies. It empowers them to make compliant decisions and understand the nuances of California law.

Frequently Asked Questions about California HR Compliance

Here are some common questions we hear from employers in Southern California about HR compliance:

How does California’s minimum wage compare to the federal minimum wage?

California’s minimum wage is significantly higher than the federal minimum wage. As of January 1, 2025, the statewide minimum wage in California is scheduled to be $16.50 per hour. In contrast, the federal minimum wage has remained at $7.25 per hour since 2009.

It’s also crucial to remember that many cities and counties within Southern California may have their own local city and county ordinances that mandate an even higher minimum wage than the state rate. Employers must always pay the highest applicable minimum wage, whether it’s federal, state, or local. These rates are subject to annual adjustments, so staying informed is key.

What are the mandatory training requirements for California employers?

California has several mandatory training requirements designed to protect employees and foster a safe workplace:

- Sexual Harassment and Abusive Conduct Prevention: Employers with 5 or more employees must provide harassment prevention training every two years. Supervisors must receive 2 hours of training, and non-supervisory employees need 1 hour. Newly hired or promoted supervisors must complete this training within six months of their hire or promotion.

- Workplace Violence Prevention Plan Training: As of July 1, 2024, all California employers are required to have a Workplace Violence Prevention Plan and provide annual training to all employees on this plan. Additional training is necessary whenever the plan is updated.

- Supervisor Training on Wage/Hour Laws: While not explicitly mandated by law as a specific training course, training supervisors on wage and hour laws (e.g., proper break procedures, overtime calculation, timekeeping) is a critical best practice. It significantly reduces the risk of costly PAGA and class-action lawsuits, as many violations stem from supervisory errors.

- Industry-Specific Training: Certain industries may have additional mandatory training requirements (e.g., healthcare, construction) related to safety, patient care, or specific regulations.

How frequently should employee handbooks be reviewed in California?

Given the rapid pace of legislative changes in California, an annual review of your employee handbook is not just recommended, it’s essential for maintaining compliance. We like to think of it as an annual check-up for your company’s rules.

This annual review ensures that your handbook is updated for new legislation (like the 2025 changes discussed above), reflects any policy changes your organization has made, and remains aligned with current best practices. After reviewing and updating, communicate these policy changes communication to employees and obtain acknowledgment of receipt forms to confirm they have received and understood the updated handbook. This simple step can be a powerful defense if legal issues arise.

Protect your California business from PAGA claims and fines—start with a complimentary HR Compliance Audit today. Start Your Compliance Audit →

Conclusion: Stay Ahead of California’s Evolving HR Laws

Navigating the labyrinth of California’s HR compliance requirements can feel overwhelming, especially for small and mid-sized businesses in San Diego and Southern California. The state’s unique and changing laws demand a proactive compliance strategy, not just to avoid costly lawsuits and regulatory fines, but to foster a stable, equitable, and productive work environment.

A comprehensive california hr compliance checklist is more than just a list of tasks; it’s a strategic tool. It empowers you to understand your obligations, implement best practices, and anticipate changes, changing potential liabilities into opportunities for operational excellence.

This is where the value of expert guidance becomes invaluable. At Optima Office, we understand that small and mid-sized companies need a robust blend of HR talent to effectively run their operations, but often lack the funds to hire full-time staff at every level. Our fractional HR advisory services provide the expertise of a complete HR department for a fraction of the cost of hiring internally. We bring the right expertise and personality fit to solve problems quickly, so you can maximize profits, minimize risk, and drive enterprise growth.

Don’t let the complexity of California’s HR landscape hold your business back. Partner with experts who can help you stay ahead, ensuring your business is not just compliant, but thriving.

Learn more about our HR compliance services