Why Accounting Outsourcing Matters for Growing Businesses

Accounting outsourcing is the practice of contracting financial tasks like bookkeeping, payroll, and tax preparation to an external specialist team. It is a strategic move that helps businesses reduce costs, improve accuracy, and focus on core operations.

Quick Answer: What You Need to Know About Account Outsourcing

- Cost Savings: Save up to 40% compared to hiring full-time staff.

- Core Services: Bookkeeping, accounts payable/receivable, payroll, tax preparation, and financial reporting.

- Key Benefits: Access professional expertise, improve accuracy (82% report better results), and free up time for strategic work.

- Who Benefits Most: Small to mid-sized businesses ($3-$15M) struggling with turnover, lacking financial leadership, or experiencing rapid growth.

- Technology Edge: Cloud-based platforms provide real-time visibility and automation.

- Security: Reputable providers offer rigorous data protection and compliance controls.

If you are spending too much time on your books or your board is demanding reports you cannot produce, you are not alone. The accounting outsourcing market is projected to hit $115.5 billion by 2030. Many business owners want to build something meaningful, not wrestle with QuickBooks.

Over 60% of businesses cite a lack of skilled personnel as a primary reason for outsourcing. Amid talent shortages and complex regulations, the in-house model is challenging for many SMBs. This guide shows you how to outsource your books without losing control, covering the benefits, services, and how to choose the right partner.

The Core Benefits: More Than Just Cost Savings

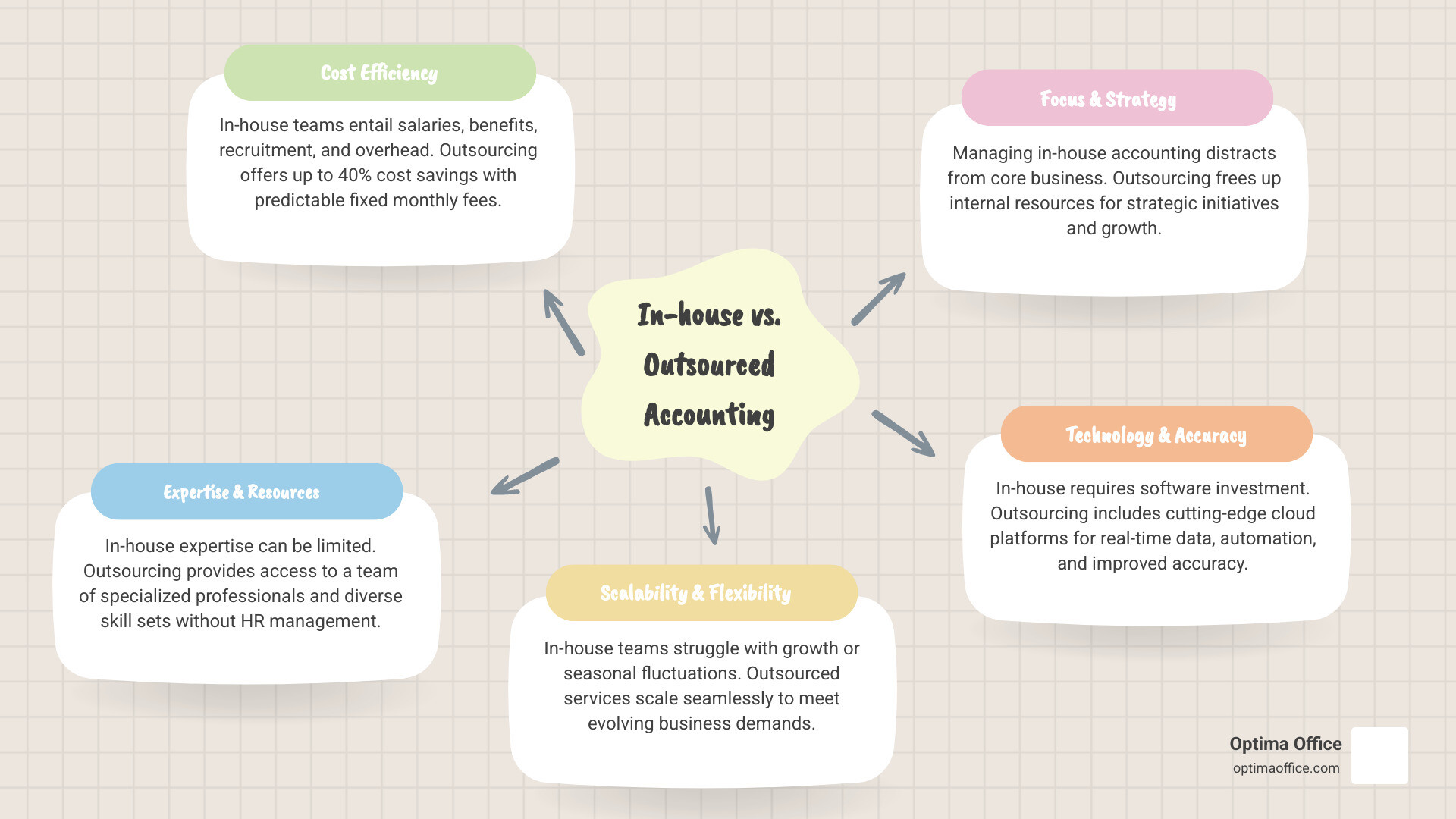

When we talk about accounting outsourcing, many immediately think of cost savings. While that is a significant perk, it is only the beginning. The strategic advantages extend far beyond the balance sheet, helping businesses in San Diego and Southern California thrive.

Businesses that outsource their accounting functions can see cost savings of up to 40%. This often comes from avoiding expenses tied to full-time employees, such as salaries, benefits, and recruitment. We also see improved accuracy, with 82% of businesses that outsource their accounting reporting better results, giving leaders more reliable financial data for decision-making.

Increased efficiency is another major win. With specialized teams and streamlined processes, tasks are completed faster and with fewer errors. Outsourcing allows clients to focus on their core competencies. Around 70% of businesses report an increased focus on strategic initiatives after outsourcing their accounting, freeing internal resources for what truly drives the business forward.

Access to specialized skills is crucial in today’s complex financial landscape. Outsourcing brings a team of experts to your corner, providing knowledge across various accounting domains that might be too expensive or difficult to hire for internally. This also helps in overcoming talent shortages, a challenge more than 60% of businesses face.

Reduce Costs and Improve Efficiency

Hiring an in-house accounting team is expensive, even for a small or mid-sized company in San Diego. Beyond base salary, there are employer payroll taxes, workers’ compensation insurance, medical benefits, retirement plans, vacation and sick days, and the time and expense involved in recruitment.

Accounting outsourcing sidesteps many of these expenses. By converting a high-overhead cost into a predictable, fixed monthly fee, businesses gain financial stability. This reduction in overhead allows access to the benefits of a complete finance department without the full price tag.

Beyond cost savings, outsourcing improves efficiency. Specialized teams are built for streamlined workflows and process automation, replacing manual, spreadsheet-driven tasks with cloud-based solutions. This leads to faster turnaround times for reports, more accurate data, and less time spent chasing down information.

Outsourcing also offers scalability. Your accounting needs fluctuate with seasonal demands, growth spurts, or unexpected challenges. With an outsourced team, you can scale services up or down as required, ensuring you have the right level of support without committing to permanent staff.

Focus on Your Core Business

Most business owners would rather strategize for growth than reconcile bank statements. Time-consuming financial tasks can easily pull owners and key personnel away from their primary responsibilities.

By delegating day-to-day bookkeeping, accounts payable, and payroll to an external team, businesses can reallocate internal resources toward mission-critical activities. Sales teams can spend more time on client acquisition, product teams can focus on innovation, and leadership can devote hours to strategic planning.

Research supports this shift: about 70% of businesses report an increased focus on strategic initiatives after outsourcing. When you are not bogged down by administrative burdens, you have the bandwidth for higher-level decision-making that drives enterprise growth.

A Spectrum of Services: What to Outsource

One of the strengths of accounting outsourcing is its versatility. It is not a one-size-fits-all solution, but a flexible framework that can be custom to your business needs. Whether you are a startup or an established company, there is a wide range of services available.

You can pick and choose the specific services that make the most sense for your company, creating a customized mix of support. Services are designed to be scalable, adjusting as your business grows or its needs evolve.

Common outsourced accounting services include:

- Bookkeeping: Daily transaction recording, general ledger maintenance, chart of accounts setup.

- Accounts Payable (AP): Invoice processing, expense allocation, vendor management, payment approvals, timely payments.

- Accounts Receivable (AR): Customer invoicing, payment tracking, aging schedules, collections, cash forecasting.

- Bank Reconciliation: Matching bank statements with internal records to ensure accuracy.

- Payroll Processing: Calculating and processing employee paychecks, managing deductions, handling payroll tax filings.

- Tax Preparation & Planning: Preparing and filing tax returns, identifying tax-saving opportunities, ensuring compliance with tax laws.

- Financial Reporting: Generating monthly, quarterly, and annual financial statements (P&L, Balance Sheet, Cash Flow).

- Budgeting & Forecasting: Developing financial plans, predicting future performance, variance analysis.

- Cash Flow Management: Optimizing cash inflows and outflows to maintain liquidity.

- Virtual CFO/Controller Services: High-level strategic financial planning, risk management, financial leadership.

- Audit Support: Preparing audit-ready documentation and assisting with audit inquiries.

- Compliance Reporting: Ensuring adherence to industry-specific regulations and statutory requirements.

Foundational Bookkeeping and Compliance

At the heart of any sound financial operation lies meticulous bookkeeping and solid compliance. These foundational tasks are crucial but time-consuming and prone to error if not handled by experienced professionals.

An outsourced team can ensure that daily transactions are accurately recorded, the general ledger is maintained, and bank accounts are regularly reconciled. This attention to detail is vital for clear financial visibility and informed decisions. Managing supplier invoices (Accounts Payable) and tracking customer payments (Accounts Receivable) can also be handled externally to improve cash flow.

Payroll processing demands precision and adherence to ever-changing labor laws and tax regulations. Errors can lead to compliance issues, penalties, and employee dissatisfaction. Outsourced accountants handle everything from calculating wages and deductions to generating payslips and filing necessary payroll tax forms. Tax preparation requires similar expertise to ensure accuracy and identify all eligible deductions and credits.

By entrusting these foundational tasks to specialists, you are making sure that financial records are accurate, up-to-date, and compliant, forming a base for continued growth. To learn more about how Optima Office can support your business with these services, please visit: Find out more about our outsourced accounting services.

Strategic Financial Oversight

Foundational services keep your financial engine running, but strategic financial oversight steers your business toward long-term goals. Many small and mid-sized companies cannot justify a full-time CFO or Controller, yet they need high-level financial guidance to scale.

Outsourced management accounting turns raw financial data into actionable insights. This includes financial reporting such as profit and loss statements, balance sheets, and cash flow statements that help explain business performance. Budgeting and forecasting support realistic financial plans and future cash flow projections.

Cash flow management helps optimize your cash position so you have the liquidity needed for operations and investments. Virtual CFO services provide strategic financial planning, risk management, and support for key stakeholders on a fractional basis, giving you experienced financial leadership without the full-time salary commitment.

The Blueprint for Successful Account Outsourcing

Choosing to outsource your accounting is a significant decision, and doing it well requires a thoughtful approach. It is not just about handing off tasks; it is about creating a strategic partnership that aligns with your business goals.

When you evaluate providers in San Diego and Southern California, it is important to look beyond the surface and assess a potential partner’s expertise, technology, security protocols, and scalability. This selection process is your first line of defense in risk mitigation and helps ensure you choose a provider that can operate as an extension of your team.

Consider this table when evaluating potential accounting outsourcing partners:

| Key Factor | Description | What to Look For |

|---|---|---|

| Expertise & Specialization | The provider’s knowledge of your industry and specific accounting needs. | Certifications (CPA, etc.), industry-specific experience, client testimonials, and case studies. |

| Technology & Software | The tools and platforms they use to manage your finances. | Proficiency in modern cloud accounting software, secure data-sharing platforms, and automation capabilities. |

| Communication & Reporting | How they will communicate with you and provide financial insights. | A dedicated point of contact, regular meeting schedules, clear and customizable reporting, and proactive communication. |

| Security & Compliance | How they protect your sensitive financial data. | Robust data encryption, secure servers, documented disaster recovery plans, and adherence to relevant regulations. |

| Scalability & Flexibility | Their ability to adapt as your business grows or changes. | Tiered service packages, ability to add or remove services, and a track record of supporting growing businesses. |

| Pricing & Contracts | The cost structure and terms of the agreement. | Transparent, all-inclusive pricing (avoiding hidden fees), clear contract terms, and a straightforward cancellation policy. |

Introduction

Accounting outsourcing is the practice of contracting your financial tasks like bookkeeping, payroll, tax preparation, and financial reporting to an external specialist team instead of managing them in-house. It helps businesses reduce costs, improve accuracy, and focus on what they do best.

Quick Answer: What You Need to Know About Account Outsourcing

- Cost Savings: Businesses can save up to 40% compared to hiring full-time staff.

- Core Services: Bookkeeping, accounts payable/receivable, payroll, tax preparation, financial reporting.

- Key Benefits: Access to professional expertise, improved accuracy (82% report better results), and more time for strategic work.

- Who Benefits Most: Small to mid-sized businesses ($3-$15M) dealing with turnover, lacking financial leadership, or experiencing rapid growth.

- Technology Edge: Cloud-based platforms provide real-time visibility and automation.

- Security: Reputable providers offer strong data protection and compliance controls.

If you are spending too much time managing your books, your controller just left, or your board is demanding financial reports you cannot easily produce, you are not alone. The accounting outsourcing market is projected to grow from $54.2 billion in 2022 to $115.5 billion by 2030, and there is a clear reason.

Most business owners did not start their companies to wrestle with QuickBooks or chase down unpaid invoices. They started to build something meaningful. Outsourcing the finance function can transform the accounting system, improve reporting, and save hours each month.

Over 60% of businesses cite a lack of skilled personnel as a primary reason for considering outsourcing. Between talent shortages, wage pressures, and increasingly complex regulations, the traditional in-house accounting model is breaking down for many small and mid-sized companies.

This guide explains the real benefits beyond cost savings, what services you can outsource, how to choose the right provider, and how to keep your financial data secure, so you can outsource your books without losing control of your business.

The Core Benefits: More Than Just Cost Savings

Many businesses turn to accounting outsourcing for cost savings, often up to 40%. The true value, however, lies in the strategic advantages that support growth and resilience.

Reduce Costs and Improve Efficiency

Hiring an in-house accounting team is expensive. Beyond salary, you have payroll taxes, benefits, recruitment costs, and overhead. Accounting outsourcing converts many of these costs into a predictable monthly fee, often saving businesses up to 40% compared to full-time staff.

This model also increases efficiency. Specialized teams use streamlined workflows and cloud technology to automate manual tasks. The result is faster, more accurate financial reporting, with books that are up-to-date and audit-ready. Outsourcing offers scalability as well, allowing you to adjust services based on business needs during growth or slower periods.

Focus on Your Core Business

Business owners should focus on strategy and growth, not daily reconciliations. Outsourcing day-to-day financial tasks frees up time and mental energy for higher-value work. Around 70% of businesses report a better ability to focus on core operations after outsourcing.

By delegating bookkeeping, payroll, and accounts payable, your team can concentrate on innovation, customer acquisition, and strategic planning. With an outsourced team, you also gain access to specialized skills, from controllers to CFOs, without the cost of hiring them full-time.

A Spectrum of Services: What to Outsource

One of the strengths of accounting outsourcing is its versatility. It is not a one-size-fits-all solution, but a flexible framework that can be customized to your unique business needs, from startups needing basic bookkeeping to established enterprises requiring high-level financial strategy.

You can pick and choose the specific services that make the most sense for your company, creating a scalable package that grows with you.

Common outsourced accounting services include:

- Bookkeeping: Daily transaction recording, general ledger maintenance.

- Accounts Payable (AP): Invoice processing, vendor payments.

- Accounts Receivable (AR): Customer invoicing, collections, cash forecasting.

- Bank Reconciliation: Matching bank statements with internal records.

- Payroll Processing: Employee payments, deductions, and tax filings.

- Tax Preparation & Planning: Preparing and filing tax returns and identifying tax-saving opportunities.

- Financial Reporting: Generating P&L, Balance Sheet, and Cash Flow statements.

- Budgeting & Forecasting: Developing financial plans and predicting future performance.

- Cash Flow Management: Optimizing cash inflows and outflows.

- Virtual CFO/Controller Services: Strategic financial planning and risk management.

- Audit Support: Preparing documentation and assisting with audits.

- Compliance Reporting: Ensuring adherence to industry regulations.

Foundational Bookkeeping and Compliance

Meticulous bookkeeping and compliance are at the heart of any sound financial operation. These tasks are crucial but can be time-consuming and error-prone without experienced professionals.

An outsourced team ensures that daily transactions are accurately recorded, the general ledger is maintained, and bank accounts are reconciled. This provides clear financial visibility and supports informed decisions. Handling supplier invoices (Accounts Payable) and tracking customer payments (Accounts Receivable) externally can also help improve cash flow.

Payroll processing and tax preparation demand precision and adherence to changing regulations. Errors can result in penalties and compliance issues. External specialists manage wages, deductions, payroll tax forms, and tax filings so you remain compliant and can optimize your tax position.

By entrusting these foundational tasks to experts, you gain peace of mind and a solid base for growth. To learn more about how Optima Office can support your business, visit: Find out more about our outsourced accounting services.

Strategic Financial Oversight

While foundational services keep your financial engine running, strategic financial oversight moves your business toward its long-term goals. Many small and mid-sized companies cannot justify a full-time CFO or Controller but still need senior-level guidance.

Outsourced management accounting turns financial data into actionable insights with detailed reporting such as profit and loss statements, balance sheets, and cash flow statements. Budgeting and forecasting support realistic financial plans and help predict future cash needs.

For businesses seeking integrated leadership, virtual CFO services provide strategic financial planning, risk management, and support for owners and stakeholders. This gives you access to experienced financial executives on a fractional basis.

The Blueprint for Successful Account Outsourcing

Choosing to outsource your accounting is a significant decision, and doing it successfully requires a thoughtful approach. It is not just about handing off tasks; it is about building a strategic partnership that supports your goals.

When you work with an accounting outsourcing provider in San Diego or Southern California, vet them carefully. Assess expertise, technology, security protocols, and scalability. This helps reduce risk and ensures the provider can operate as an extension of your team.

Consider this table when evaluating potential accounting outsourcing partners:

| Key Factor | Description | What to Look For |

|---|---|---|

| Expertise & Specialization | The provider’s knowledge of your industry and specific accounting needs. | Certifications (CPA, etc.), industry-specific experience, client testimonials, and case studies. |

| Technology & Software | The tools and platforms they use to manage your finances. | Proficiency in modern cloud accounting software, secure data-sharing platforms, and automation capabilities. |

| Communication & Reporting | How they will communicate with you and provide financial insights. | A dedicated point of contact, regular meeting schedules, clear and customizable reporting, and proactive communication. |

| Security & Compliance | How they protect your sensitive financial data. | Robust data encryption, secure servers, documented disaster recovery plans, and adherence to relevant regulations. |

| Scalability & Flexibility | Their ability to adapt as your business grows or changes. | Tiered service packages, ability to add or remove services, and a track record of supporting growing businesses. |

| Pricing & Contracts | The cost structure and terms of the agreement. | Transparent, all-inclusive pricing (avoiding hidden fees), clear contract terms, and a straightforward cancellation policy. |

The Blueprint for Successful Account Outsourcing

Choosing to outsource your accounting is a significant decision. Success depends on due diligence, clear expectations, and the right partner.

When assessing accounting outsourcing providers, focus on factors such as expertise, technology, communication, and security. You want a team that understands your industry, uses modern cloud tools, and takes data protection seriously.

| Key Factor | Description | What to Look For |

|---|---|---|

| Expertise | The technical proficiency and industry-specific knowledge of the outsourced team. | Relevant certifications, experience with similar businesses, and strong client references. |

The Future is Here: Technology and Trends in Outsourced Accounting

The accounting outsourcing market is evolving quickly, driven by technology. Valued at $54.2 billion in 2022, it is projected to reach $115.5 billion by 2030. This growth is supported by cloud accounting software and a projected 65% increase in AI and automation in the next few years.

The Role of Technology and Automation

Modern accounting outsourcing relies heavily on technology. Cloud platforms like QuickBooks and Xero have changed financial management, offering real-time insights from anywhere.

Automation reduces manual data entry and helps minimize errors. AI tools support tasks like transaction coding, anomaly detection, and predictive analytics. Clients gain access to a modern tech stack without having to build it themselves.

Navigating Regulations and Future Trends

Staying compliant with changing tax laws and regulations, especially in complex environments like California, is challenging. Accounting outsourcing gives you access to professionals who monitor regulatory updates and help you avoid penalties.

The future of outsourcing will feature deeper use of AI, better integrations between systems, and more real-time collaboration. As the market grows, businesses that leverage these tools can expect more efficient processes and clearer financial insight.

Conclusion

Accounting outsourcing is more than a cost-cutting measure; it is a strategic move for growth. From saving up to 40% to gaining the freedom to focus on your core business, outsourcing provides access to specialized expertise in an increasingly complex financial landscape.

For small and mid-sized businesses in San Diego and Southern California, talent shortages and rising costs make the traditional in-house model difficult. With Optima Office, you get the benefits of a complete finance and HR department for a fraction of the cost of hiring internally. Our outsourced controllers, CFOs, and accountants bring the right expertise and can be deployed quickly.

Outsourcing your accounting allows you to maximize profits, minimize risk, and support long-term growth without losing visibility or control.