Why Financial Control is Non-Negotiable for Property Managers

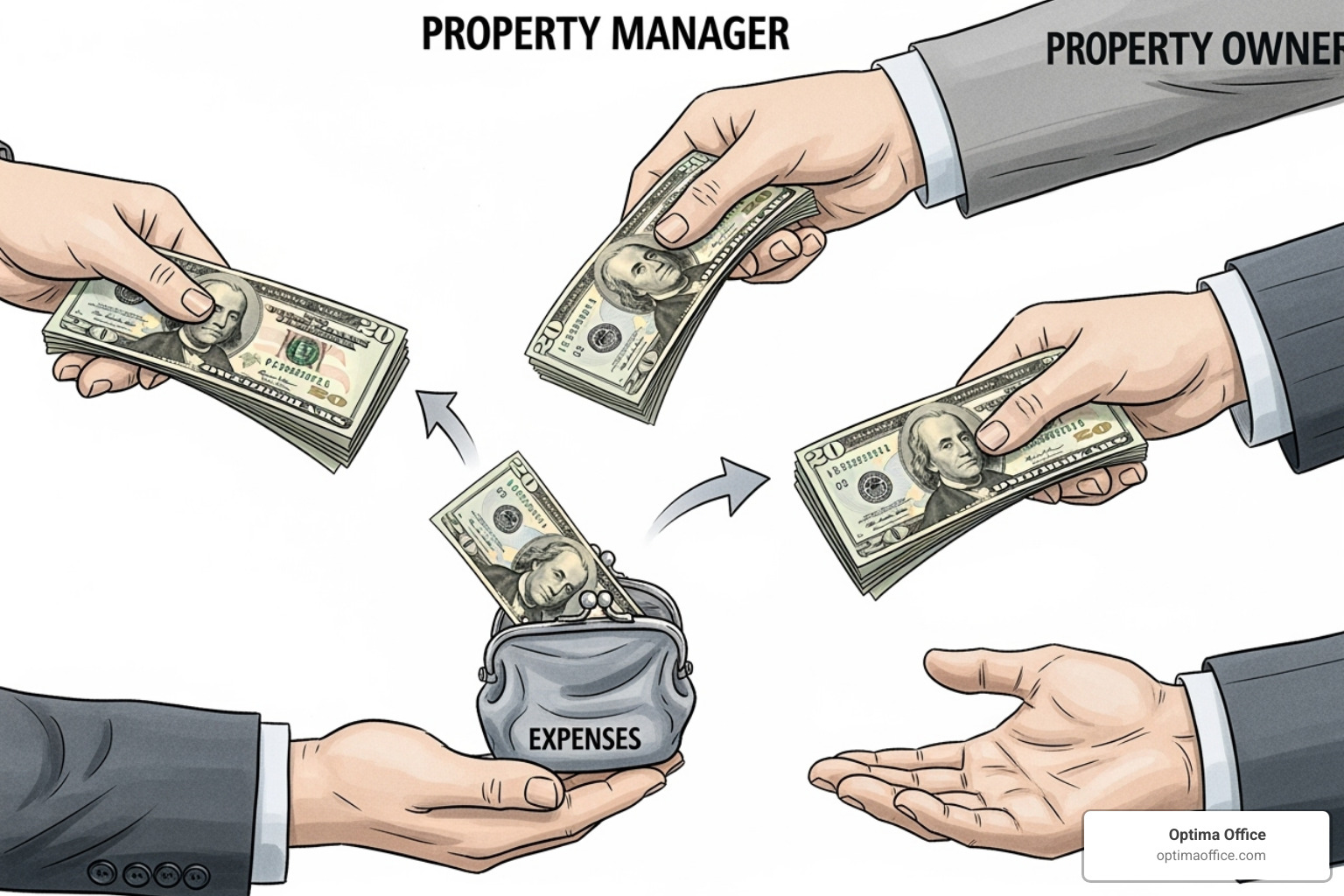

Real estate property management accounting is the specialized practice of tracking all income and expenses for rental properties. It involves everything from rent collection and maintenance costs to handling security deposits, ensuring tax compliance, and generating detailed financial reports for property owners.

The property management industry is growing fast. 91% of property management companies plan to expand their portfolios this year, but many face rising operational costs. In this environment, strong financial control is what separates thriving managers from those stuck in reactive mode.

Without proper accounting, you risk missing tax deadlines, mismanaging security deposits, and losing owner trust. Effective accounting provides the financial visibility needed for data-driven decisions on rent pricing, expense control, and investment opportunities. It improves cash flow, ensures compliance, and builds the credibility essential for sustainable growth.

The Fundamentals of Property Management Accounting

Real estate property management accounting is the financial backbone of your operation. Unlike regular business accounting, it involves juggling multiple revenue streams, handling other people’s money (like security deposits), and navigating unique real estate regulations. This specialized approach is crucial for financial transparency, regulatory compliance, and confident decision-making.

Key Concepts and Terminology

- Double-Entry Bookkeeping: Every transaction affects at least two accounts, creating a self-checking system that is usually recommended for accuracy.

- Chart of Accounts (COA): An organized list of all your financial accounts (e.g., rent income, maintenance expenses), used to categorize transactions for easier reporting.

- General Ledger (G/L): The master record of all transactions, showing the complete history of each account.

- Trust Accounting: The practice of holding funds that don’t belong to you (like security deposits) in separate, dedicated accounts as required by law in most states.

- Assets, Liabilities, and Equity: Assets are what you own (cash, property), liabilities are what you owe (vendor bills, security deposits), and equity is the net worth of your business.

- Revenue and Expenses: Revenue is income from rent and fees, while expenses are costs like repairs and utilities.

- Accounts Payable/Receivable: Accounts payable tracks money you owe to vendors, while accounts receivable tracks money owed to you by tenants.

Cash vs. Accrual Accounting: What’s Right for You?

Choosing the right accounting method is a key decision.

Cash basis accounting is simple: you record income when cash is received and expenses when cash is paid. It provides a clear view of your cash on hand but can be misleading about true profitability.

Accrual basis accounting is more complex but offers a more accurate financial picture. It records income when it’s earned and expenses when they are incurred, regardless of when money changes hands. This method is better for growing businesses that need a true understanding of long-term profitability.

| Feature | Cash Basis Accounting | Accrual Basis Accounting |

|---|---|---|

| Basis of Recognition | Records income when cash is received; expenses when cash is paid | Records income when earned; expenses when incurred, regardless of cash movement |

| Complexity | Simpler, straightforward | More complex, requires tracking receivables and payables |

| Financial Picture | Shows actual cash on hand; can be misleading about true profitability | Provides a clearer picture of long-term financial health and obligations |

| Best For | Small businesses, sole proprietors, simple property portfolios | Growing businesses, multiple properties, those needing a more accurate view of profitability |

While cash basis is appealing for its simplicity, accrual basis gives property owners a more realistic view of their investment’s performance, which builds trust and credibility.

Setting Up and Running Your Accounting System

A solid accounting system is the foundation of a smooth property management business. As your portfolio grows, you need more than basic bookkeeping; you need a financial infrastructure that supports strategic decisions. That’s why your business needs more than just a bookkeeper.

The Property Management Accounting Cycle

The accounting cycle is a recurring step-by-step process that keeps your finances in order.

- Record charges: Log monthly rent, late fees, and other tenant charges.

- Process payments: Record payments as they arrive to keep accounts receivable current.

- Pay vendors and owners: Manage invoices for services and ensure owners receive distributions promptly.

- Reconcile accounts: Reconcile your bank accounts monthly to catch errors and ensure accuracy.

- Generate reports: Turn financial data into actionable insights with P&L statements, cash flow reports, and owner statements.

Best Practices for a Rock-Solid Setup

- Use separate bank accounts: Maintain a dedicated operating account for business expenses and separate trust accounts for security deposits.

- Structure your chart of accounts: A well-organized COA makes generating meaningful reports effortless.

- Reconcile monthly: Don’t skip monthly bank reconciliations. This process catches errors, helps detect fraud, and ensures your records match reality.

- Standardize processes: Create clear guidelines for invoicing, rent collection, and reporting to reduce errors and improve efficiency.

- Conduct regular financial reviews: Analyze your reports to spot trends and make proactive decisions. For more ideas, see these accounting tips you can prepare to implement year-round.

Essential Features of Accounting Tools and Services

The right tools and services streamline operations. Look for features like automated rent collection, comprehensive expense tracking, and tenant portals to reduce manual work. Robust owner reporting builds trust, while automated bank reconciliation saves hours and reduces errors. Modern technology, including AI, can further automate routine tasks, freeing your team for strategic work. Learn how to incorporate AI into your accounting practice.

Note: For comprehensive solutions that integrate these features with expert oversight, consider working with a professional accounting firm like Optima Office. We offer custom services for property management businesses, ensuring you have the right financial infrastructure to support your growth without the overhead of hiring full-time staff.

Leveraging Financial Data for Growth and Efficiency

Your financial reports are a compass for your business, guiding you toward smarter decisions and stronger growth. This is where real estate property management accounting becomes a powerful strategic tool. Understanding The Role of Bookkeepers, Controllers and CFOs shows how financial expertise turns data into actionable insights.

Key Financial Reports Every Property Manager Needs

These core reports are your business intelligence system.

- Profit & Loss (P&L) Statement: Your performance scorecard, showing profit or loss over a period. Monthly reviews help you spot trends and catch problems early.

- Balance Sheet: A snapshot of your financial health, showing assets, liabilities, and equity. It reveals if you’re building equity and have enough cash reserves. For more, see Balance Sheets 101.

- Cash Flow Statement: Tracks the actual cash moving in and out of your business, which is crucial for managing working capital.

- Owner Statements: Customized reports for clients that detail income, expenses, and distributions, building trust and transparency.

- Rent Roll: An operational list of all tenants, rent amounts, and lease dates. It helps predict income and track occupancy.

How to Gain Insights and Optimize Performance

Use your reports to find opportunities for improvement.

- Look for trends: Compare monthly and yearly reports to spot rising costs or slowing rent collection before they become major problems.

- Find cost reductions: Analyze categorized expenses to identify outliers and negotiate better terms with vendors. Our guide on Accounting Cost Cutting Strategies offers practical tips.

- Manage timing: Stay on top of due dates for rent, bills, and lease renewals to keep cash flowing smoothly.

- Allocate resources effectively: Use data to decide where to invest time and money for the best returns.

Navigating Tax, Compliance, and Common Challenges in Real Estate Property Management Accounting

Property management involves complex tax and compliance requirements where mistakes can be costly. Being proactive about challenges is key, as shown by these Six Common Accounting Pitfalls in San Diego’s Small Business Scene. With the right systems, you can master your real estate property management accounting.

Key Tax Considerations for Your Properties

Proper records make tax season manageable.

- Reporting Rental Income: Most managers use Schedule E, Form 1040 for rental income.

- Deductible Expenses: Meticulous record-keeping pays off. Track repairs, management fees, property taxes, insurance, mortgage interest, and more. Learn more about deductible expenses from IRS Publication 527.

- Depreciation: This valuable non-cash deduction allows owners to recover the cost of a property over its useful life. You may need to file Form 4562.

- 1031 Exchanges: This strategy allows owners to defer capital gains taxes by reinvesting proceeds from a sale into a new property, but you must follow strict IRS timelines.

- Capital Gains: Understand the tax implications when a property sells for more than its adjusted basis to advise owners on sales timing.

Overcoming Common Challenges

- Managing multiple properties: Use a centralized accounting system to track each property’s finances while maintaining consolidated oversight.

- Tenant payment issues: Implement automated reminders, offer convenient online payment options, and enforce a clear late fee policy.

- Handling security deposits: Keep these funds in separate trust accounts and follow strict state regulations for handling and refunds.

- Maintaining compliance: Stay current on changing landlord-tenant laws, financial standards, and tax codes through ongoing education and professional relationships.

- Lack of standardized processes: Document clear procedures for all accounting tasks to improve efficiency and reduce errors as you grow.

Common Mistakes to Avoid

- Mixing personal and business funds: Always use separate bank accounts for business to maintain financial integrity and simplify tax prep.

- Neglecting bank reconciliation: Reconcile accounts monthly to catch errors, prevent fraud, and ensure your records are accurate.

- Incorrectly categorizing transactions: Use a well-defined chart of accounts to ensure your financial reports are accurate and support good decisions.

- Ignoring regular financial reviews: Use your reports to spot trends and catch problems early. A Year-End Financial Checklist for Your Business can help.

- Failing to track deductible expenses: Rigorously track all eligible expenses to avoid overpaying on taxes.

Frequently Asked Questions about Property Management Accounting

What is the difference between a bookkeeper, controller, and CFO in property management?

Each role provides a different level of financial expertise for your real estate property management accounting.

- A bookkeeper handles daily transactions like recording rent payments and entering expenses.

- A controller oversees the entire accounting cycle, prepares financial statements, and ensures compliance.

- A CFO provides high-level strategic guidance to drive growth, manage risk, and advise on major financial decisions. A fractional CFO offers this expertise without the cost of a full-time executive.

Each role is critical for building a complete financial leadership structure. You can learn more about the differences.

How does property management accounting impact business growth and success?

Effective accounting is an engine for growth. It provides the financial visibility needed for data-driven decisions on rent pricing, expense control, and investment opportunities. Good accounting improves cash flow, ensures regulatory compliance, and builds trust with property owners, all of which are essential for sustainable success.

What are the first steps to setting up a proper accounting system for a new property?

- Open a separate business bank account for the property to keep finances distinct.

- Choose an accounting method (cash or accrual). Accrual is often better for a more accurate long-term view.

- Establish a detailed Chart of Accounts to categorize all income and expenses for the property.

- Select a reliable system or service, like Optima Office, to track all financial activity, manage rent collection, and generate reports.

Conclusion: From Bookkeeping to Strategic Financial Leadership

Real estate property management accounting is more than balancing the books; it’s the foundation for your business’s success. In a market where most companies plan to expand but struggle with costs, financial control is the key differentiator.

Accurate financial data allows you to spot trends, identify opportunities, and make confident decisions. The ultimate goal is to move beyond simple record-keeping to strategic financial leadership—using your data to shape what happens next, maximize profits, and minimize risk.

As your portfolio grows, your financial needs become more complex. You need strategic guidance on cash flow, tax planning, and compliance. You need a partner who understands the unique challenges of property management.

At Optima Office, we provide a full suite of outsourced accounting and fractional CFO services designed for businesses like yours. Our proprietary five-point system ensures we match you with the right professionals, and our rapid team deployment (typically 3-5 days) means you get support quickly. This allows you to focus on what you do best: managing properties and growing your business, while we handle the financial infrastructure.

Ready to transform your property management accounting into a competitive advantage? Learn more about our specialized services for Real Estate and Property Management.