Why Businesses Are Turning to Outsourced CFO Services

Outsourced CFO services provide access to experienced financial experts for strategic insights without the cost of a full-time executive. These professionals deliver the financial leadership and planning that drives growth at a fraction of the cost of an internal hire.

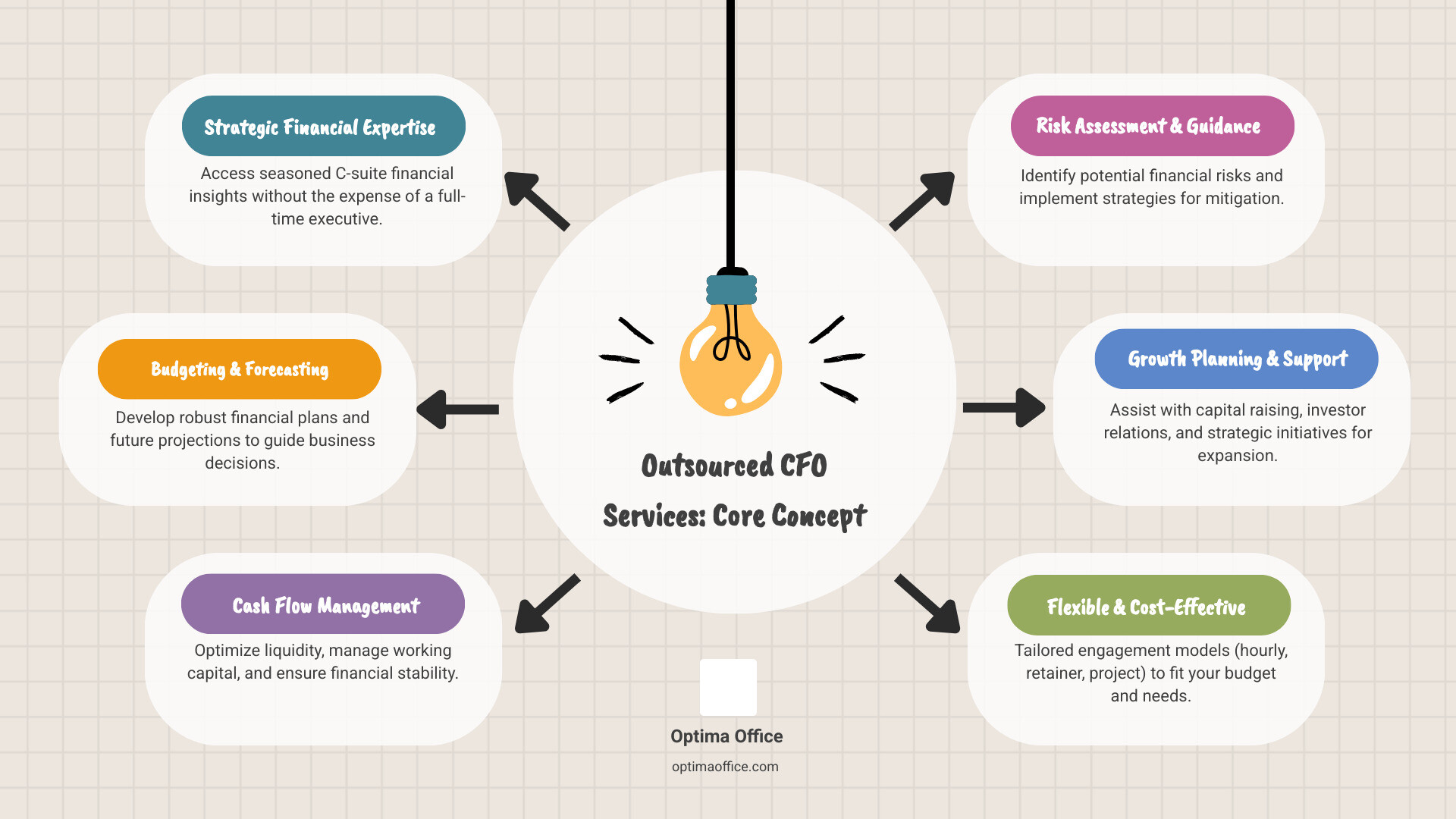

What are outsourced CFO services?

- On-demand access to C-suite financial expertise

- Strategic financial planning and analysis

- Cash flow management and forecasting

- Risk assessment and business guidance

- Capital raising and investor relations support

- Flexible engagement models (hourly, retainer, or project-based)

For small and mid-sized businesses, this model is a solution. Strategic financial guidance is crucial for growth, but a full-time CFO can cost up to a million dollars annually, which is prohibitive for most companies with revenue below $50 million.

The reality for growing businesses is stark: Your bookkeeper handles the past, but who’s planning your financial future? You face pressure for analytics you can’t provide and spend too much time on financial insights instead of running your business.

Outsourced CFOs bridge this gap. They analyze your financial data to reduce costs and increase revenue, create robust accounting systems, and provide the strategic oversight that transforms how you make decisions.

As one industry expert puts it: “Business is about people. Your success story is our success story.” That’s exactly what outsourced CFO services deliver – a true partnership focused on your growth.

What is an Outsourced CFO and What Do They Do?

Think of an outsourced CFO as your business’s financial quarterbacka seasoned professional who calls the plays without sitting on your full-time payroll. Unlike a traditional in-house CFO, an outsourced CFO provides executive-level expertise on a flexible basis, whether part-time, project-based, or as needed.

While your bookkeeper records what happened yesterday and your controller ensures those numbers are accurate, an outsourced CFO turns that financial data into your roadmap for tomorrow. They are the strategic partner who helps you understand not just where your money went, but where it should go next.

For background on the traditional CFO role, see Chief financial officer.

This shift from historical reporting to forward-looking strategy can be transformative. To better understand how these financial roles work together, check out our guide on The Role of Bookkeepers, Controllers, and CFOs.

Core Strategic & Financial Services

Our outsourced CFO services go beyond basic number-crunching to provide comprehensive financial leadership designed to accelerate growth.

Financial planning and analysis (FP&A) is our backbone. We analyze performance data to spot trends and opportunities. This informs our budgeting and forecasting, where we build realistic financial roadmaps to guide your decisions.

Cash flow management is often our most immediately valuable service. We analyze cash patterns, identify potential shortfalls, and optimize working capital to prevent cash crunches.

Our profit improvement strategies boost revenue and trim unnecessary costs. Through margin analysis and cost structure reviews, we uncover hidden profit leaks.

KPI monitoring focuses you on the metrics that matter. We create dashboards for real-time insights. This pairs with our financial modeling, where we build scenarios to evaluate investments, expansions, or strategic pivots.

Risk assessment and management protects your business. We identify financial vulnerabilities and implement strategies to address them. This includes establishing robust internal controls for accuracy, efficiency, and compliance.

Specialized Support for Business Growth

Beyond core financial management, our outsourced CFOs provide specialized expertise crucial for scaling your business.

Capital raising and fundraising is a key specialization. With experience in over $50 billion in transactions, our team prepares investor materials, manages cap tables, and positions companies for funding from VCs, private equity, and other sources.

M&A due diligence is essential for acquisitions or sales. We evaluate financial health, identify risks, and ensure smooth integration to protect your interests.

Investor relations keeps partners informed with timely reporting, positioning you for growth. This extends to exit strategy planning, where we help maximize valuation for a sale, ownership transition, or retirement.

System implementation addresses infrastructure needs. We help select and implement scalable ERP systems. Our contract negotiation experience ensures you get favorable terms.

For a complete overview of how these services work together, visit our Chief Financial Officer Services page to see how we customize our approach to your specific needs.

The Key Benefits of Outsourced CFO Services

When you’re running a growing business, every dollar counts. That’s why outsourced CFO services are a smart choice for companies that need high-level financial expertise without breaking the bank.

Cost-effectiveness is the biggest win. Hiring a full-time, experienced CFO can cost up to a million dollars annually when factoring in salary, benefits, and bonuses, as noted in many executive compensation surveys. This is prohibitive for most businesses with revenue under $50 million. With outsourced CFO services, you get Fortune 500-level expertise at a fraction of that cost, paying only for what you need. It’s Executive Expertise Without the Executive Price Tag.

Strategic insights are invaluable. An outsourced CFO brings an unbiased, objective perspective, free from office politics. This fresh view helps spot opportunities and risks you might miss. They use their deep knowledge to influence outcomes and find cost-effective routes to your goals.

Flexibility is a game-changer. As your business evolves, so should your financial support. outsourced CFO services scale with you. Whether you need intensive support during fundraising or less guidance during a quiet period, the model adapts. This scalability ensures you have the right expertise without a rigid fixed cost.

By delegating complex financial tasks to an outsourced CFO, you can focus on your core business. Instead of wrestling with financial reports, you can concentrate on innovation and customer service. This focus transforms your leadership team’s effectiveness. Learn more about executive roles in our article on How a COO Can Be Integral to Successful Businesses.

The team advantage is a key benefit. With a firm like ours, you access the collective knowledge of an entire team, not just one person. This provides broader industry insights and comprehensive support a single hire can’t match. Our team’s decades of accounting and business management experience across many industries brings a wealth of knowledge to your business.

The bottom line? Outsourced CFO services give you professional-grade financial leadership without the professional-grade price tag, and that’s a combination that’s hard to beat.

Is It Time to Hire an Outsourced CFO?

Many business owners find themselves at a financial crossroads. Your company has grown beyond what your bookkeeper can handle, but you’re not ready for a full-time CFO’s hefty salary. This is often the perfect moment to consider outsourced CFO services.

The warning signs are often clear. If your business is experiencing rapid growth, you may face growing financial complexity. Cash flow is harder to predict, costs can spiral, and you need a robust financial infrastructure to keep pace. Without it, growth can become overwhelming.

Preparing for fundraising is another trigger. Seeking seed funding, Series A, or private equity requires intense financial preparation. You need polished investor decks, solid financial models, and an expert who speaks the language of VCs.

Are you lacking financial visibility? Constantly asking “Where did the money go?” or being surprised by cash shortages is a red flag. If your finance function only provides basic statements without strategic insights, you’re flying blind.

Complex compliance challenges can also push businesses toward outsourced expertise. Navigating intricate tax laws or industry regulations isn’t something to learn through trial and error, as the cost of mistakes can be devastating.

For businesses considering mergers, acquisitions, or exit strategies, an outsourced CFO is invaluable. These transactions require specialized knowledge of due diligence, valuation, and deal structure.

If any of these scenarios sound familiar, explore our guide on Telltale Signs Your Business Needs a Fractional CFO.

The versatility of outsourced CFO services applies across business stages. Startups gain crucial financial expertise on a tight budget. Scale-ups build mature finance departments to support expansion. Established SMEs optimize operations and strategize for long-term growth. As our article on 3 Reasons Your Small Business Needs a CFO explores, businesses of all sizes need strategic financial leadership.

Industries That Benefit Most from Outsourced CFO Services

While any industry can benefit, certain sectors find outsourced CFO services particularly valuable. Our team has experience across the economy, from startups to Fortune 500 corporations.

- Technology and SaaS companies face rapid growth, complex revenue recognition, and constant fundraising. Our CFOs guide tech founders from seed rounds to major exits.

- Manufacturing businesses have unique challenges in production costs, inventory, and supply chain finance. Our CFOs use specialized knowledge to streamline budgets and improve project sizing.

- Healthcare organizations steer complex regulations and reimbursement models.

- E-commerce companies manage high transaction volumes and inventory turnover.

- Non-profits require financial transparency and grant management.

- Professional services firms need project profitability analysis and retainer management.

Our track record includes helping a tech startup secure Series A funding and achieve 30% profitability growth. We’ve also partnered with manufacturing firms to find significant savings through improved inventory management and strategic pricing. In healthcare, we’ve helped clients streamline budgets and build trust with finance leaders.

Outsourced vs. In-House CFO: A Comparison

Choosing between an outsourced CFO and an in-house CFO is a major financial decision. While both provide strategic leadership, they offer different advantages.

- Cost: The difference is striking. A full-time CFO can cost up to a million dollars annually. Outsourced CFO services provide the same expertise at a fraction of the cost, as you pay only for what you need.

- Commitment: A traditional CFO is a significant fixed overhead. An outsourced CFO offers flexible engagement models (part-time, project-based, or retainer) that adapt to your needs.

- Scope of Experience: In-house CFOs can become isolated. Outsourced CFOs bring diverse industry exposure and a team’s collective knowledge, offering fresh perspectives.

- Objectivity: External CFOs provide unbiased perspectives, free from internal politics. They can offer candid advice that internal employees may find difficult to deliver.

- Onboarding Speed: Recruiting a full-time CFO can take months. Outsourced CFOs deploy rapidly for an immediate impact. At Optima Office, we can have a team in place within 3-5 days.

- Scalability: Outsourced support scales up or down with your business needs. A traditional CFO represents fixed capacity that is difficult to adjust.

For a deeper dive, check out our comparison of Fractional CFO vs. Traditional CFO. The flexibility and cost-effectiveness of outsourced CFO services make them an attractive option for businesses seeking strategic leadership without traditional executive overhead.

Choosing the Right Outsourced CFO Partner

Finding the perfect outsourced CFO partner isn’t just about checking boxes on a qualification list. It’s about finding a true financial ally who gets your business, shares your vision, and can seamlessly become part of your team’s success story.

Think of it this way: you’re not just hiring a service provider—you’re inviting a strategic partner into the inner workings of your company. This person will have access to your most sensitive financial data and will influence critical business decisions. Getting this choice right can be transformative for your business.

Crucial Considerations

When you’re evaluating potential outsourced CFO providers, three factors should top your priority list.

Experience matters—a lot. Look for professionals who bring substantial C-suite experience to the table. The best providers typically average 21 years or more of high-level financial leadership across companies of various sizes. At Optima Office, our CFOs have helped build, finance, and sell many companies throughout their careers, giving them the battle-tested wisdom your business needs.

Industry knowledge can be a game-changer. While financial principles are universal, every industry has its unique challenges, regulatory requirements, and growth patterns. A CFO who understands the nuances of your sector—whether it’s healthcare, manufacturing, or tech—can spot opportunities and risks that a generalist might miss.

Cultural fit is the secret ingredient that many businesses overlook. You’ll be working closely with your outsourced CFO, sharing sensitive information and making tough decisions together. The chemistry has to be right. We believe business is fundamentally about people, and a finance professional with the right mix of knowledge, skills, and experience should be personally matched with your company’s culture and communication style.

Vetting Process: Questions to Ask Potential Providers

The right questions can reveal everything you need to know about a potential partner. Start with their industry experience: “What is your experience working with businesses in my industry? Can you share anonymized examples of how you’ve helped similar companies?”

Dig into their service model: “What is your typical client engagement approach, and how flexible can you be with our unique needs?” This tells you whether they’re rigid in their approach or can adapt to your specific situation.

Don’t forget the practical details. Ask about their data security protocols, communication style, and reporting frequency. Find out what technological platforms they’re comfortable with and how they handle potential conflicts of interest when working with multiple clients.

Most importantly, ask about their onboarding process and request references. A provider who’s proud of their work will gladly share success stories and connect you with satisfied clients.

Key Qualities to Look for in a Provider

The best outsourced CFO providers share several key characteristics that set them apart from the rest.

A proven track record speaks volumes. Look for firms that can showcase client testimonials, success stories, and quantifiable results. At Optima Office, we guarantee that each client is satisfied with our level of customer service—that’s how confident we are in our approach.

Team-based support beats going solo every time. While an individual freelancer might seem cost-effective, a firm offers something invaluable: access to a broader team’s collective knowledge, experience, and professional relationships. This means more comprehensive support, better continuity, and deeper expertise across different areas of finance.

Technology proficiency isn’t optional in today’s business environment. Your outsourced CFO should be comfortable with modern accounting systems, ERP solutions, and financial analytics tools. They should help you leverage technology for efficiency, not struggle to keep up with it.

Communication skills make all the difference. The best CFOs aren’t just number crunchers—they’re translators who can turn complex financial concepts into clear, actionable insights for your entire team. Look for providers who emphasize transparency in their reporting and communication. We ensure that we always deliver our services on-time without sacrificing quality in our work.

Understanding the Cost of Outsourced CFO Services

Let’s talk money—because understanding the investment is crucial to making the right decision.

Outsourced CFO providers typically use one of three pricing models. Retainer arrangements involve a fixed monthly fee for a predefined scope of services and availability—perfect for ongoing strategic oversight. Hourly rates work well for project-based tasks or when your needs fluctuate month to month. Project-based fees offer a fixed price for specific initiatives like M&A due diligence or fundraising support.

The actual cost can range from a few thousand to tens of thousands of dollars per month, depending on the scope of services, the CFO’s experience level, and your business’s complexity. Yes, that might sound like a lot—until you consider that a full-time CFO can cost up to a million dollars annually when you factor in salary, benefits, bonuses, and recruitment costs.

Here’s the real key: focus on return on investment, not just the price tag. An effective outsourced CFO can help you reduce costs, increase revenue, mitigate risks, and achieve growth objectives that far outweigh their fees. They add tremendous value for a fraction of the cost of a full-time hire.

For a deeper dive into maximizing this value, check out our comprehensive Fractional CFO Guide.

Frequently Asked Questions about Outsourced CFO Services

We know that considering outsourced CFO services brings up plenty of questions. After helping countless businesses steer these decisions, we’ve found there are a few key concerns that come up again and again. Let’s tackle the most important ones.

What’s the difference between an outsourced CFO and a controller?

This question comes up in almost every initial conversation we have with potential clients, and for good reason! While both roles are essential for your financial health, they operate in completely different spheres.

Your controller focuses on the technical side – making sure all your numbers are accurate, your books are balanced, and your financial reports are completed on time. They’re the detail-oriented professionals who ensure compliance and manage your accounting team. Think of them as the guardians of your financial accuracy, primarily concerned with what happened in your business.

An outsourced CFO, on the other hand, takes those numbers and transforms them into strategy. We’re looking forward, not backward. While your controller ensures your financial statements are correct, we use that data to help you plan for growth, manage cash flow, assess risks, and make strategic decisions that drive profitability.

The controller asks, “Are these numbers right?” The CFO asks, “What do these numbers tell us about where we should go next?”

Many of our clients benefit from having both roles covered through our integrated approach. We can provide controller services to ensure accuracy while delivering CFO-level strategic guidance to fuel growth. For more insight into how these roles work together, check out our article on Why Businesses Need Accounting and Finance Consulting Services.

How quickly can an outsourced CFO be integrated into my team?

Here’s where we get genuinely excited about what makes Optima Office different. While some providers might take weeks or even months to get started, we can deploy a complete team, including your CFO, in just 3-5 days.

This rapid integration happens because we’ve refined our process over years of helping businesses. First, we conduct a thorough consultation to understand your specific needs and current financial situation. Then – and this is crucial – we use our proprietary five-point personality matching system to ensure we’re pairing you with someone who fits not just your technical needs, but your company culture.

The result? Your outsourced CFO doesn’t feel like an outsider looking in. They become part of your leadership team from day one, collaborating seamlessly with your existing staff and understanding your business goals immediately.

This speed means you start seeing results almost instantly. No lengthy recruitment processes, no months of onboarding – just immediate access to executive-level financial expertise when you need it most.

Are outsourced CFO services only for large companies?

This might be the biggest misconception we encounter, and we love busting this myth! Outsourced CFO services were actually designed specifically for small and mid-sized businesses that need strategic financial leadership but can’t justify the cost of a full-time executive.

Think about it: if you’re a large corporation with hundreds of millions in revenue, you can easily afford a full-time CFO making $500,000+ annually. But what if you’re a growing business with $5 million, $15 million, or even $40 million in revenue? You still need strategic financial guidance, but that full-time salary suddenly represents a huge chunk of your budget.

That’s exactly the gap we fill. Small businesses get the most value from outsourced CFO services because we provide Fortune 500-level expertise at a fraction of the cost. You get the same strategic thinking, financial modeling, and growth planning that big companies enjoy, but scaled appropriately for your business.

We’ve helped startups secure their first major funding rounds, guided family businesses through succession planning, and supported growing companies through acquisitions. Size doesn’t matter – strategic financial leadership does.

For more details on how smaller businesses specifically benefit, take a look at our guide on Fractional CFO Advantages. The truth is, if you’re focused on maximizing profits, minimizing risk, and driving growth, you’re exactly the type of business that thrives with outsourced CFO services.

Conclusion: Take the Next Step Towards Financial Clarity and Growth

Throughout this guide, we’ve explored how outsourced CFO services can transform your business trajectory. The evidence is clear: these services aren’t just about number-crunching or cost-cutting. They’re about gaining a strategic asset that drives growth, protects your interests, and opens doors you didn’t even know existed.

The recap speaks for itself. Outsourced CFOs provide executive-level expertise at a fraction of traditional costs. They bring objective insights free from internal politics. They scale with your needs, whether you’re a startup seeking your first funding round or an established company planning an exit strategy. Most importantly, they free you to focus on what you do best while ensuring your financial foundation is rock-solid.

Here’s the key takeaway: This isn’t about hiring a service provider. It’s about gaining a partner who’s invested in your success story. When you work with an outsourced CFO, you’re not just getting financial reports and budget forecasts. You’re getting someone who understands your vision, challenges your assumptions (in a good way), and helps you steer the complex financial landscape that every growing business faces.

At Optima Office, we’ve seen this partnership model work time and again. Our mission goes beyond providing exceptional accounting and HR services – we’re dedicated to building positive relationships that strengthen both our team and the communities we serve. We understand that small and mid-sized companies need a mixture of accounting and HR talent to run effectively, but hiring full-time staff at every level simply isn’t financially feasible for most businesses.

That’s where our approach makes all the difference. With Optima Office, you get the benefits of a complete finance and HR department for a fraction of internal hiring costs. Our highly-customized mix of outsourced controllers, CFOs, accountants, and HR professionals brings the right expertise and personality fit to solve problems quickly. The result? You maximize profits, minimize risk, and drive enterprise growth – all while maintaining the flexibility your business needs.

For businesses seeking that customized mix of financial and HR expertise, our integrated approach ensures you’re not just getting financial leadership in isolation. You’re getting a complete outsourced department custom to your specific needs, deployed rapidly, and matched to your company culture through our proprietary five-point system.

Ready to see how your business can benefit? The path to financial clarity and accelerated growth starts with understanding where you stand today. Get a free financial gap diagnosis to identify your needs and find how our outsourced CFO services can help you achieve the financial leadership your business deserves.

Your success story is waiting. Let’s write it together.