Why Financial Leadership Matters More Than Ever for Growing Businesses

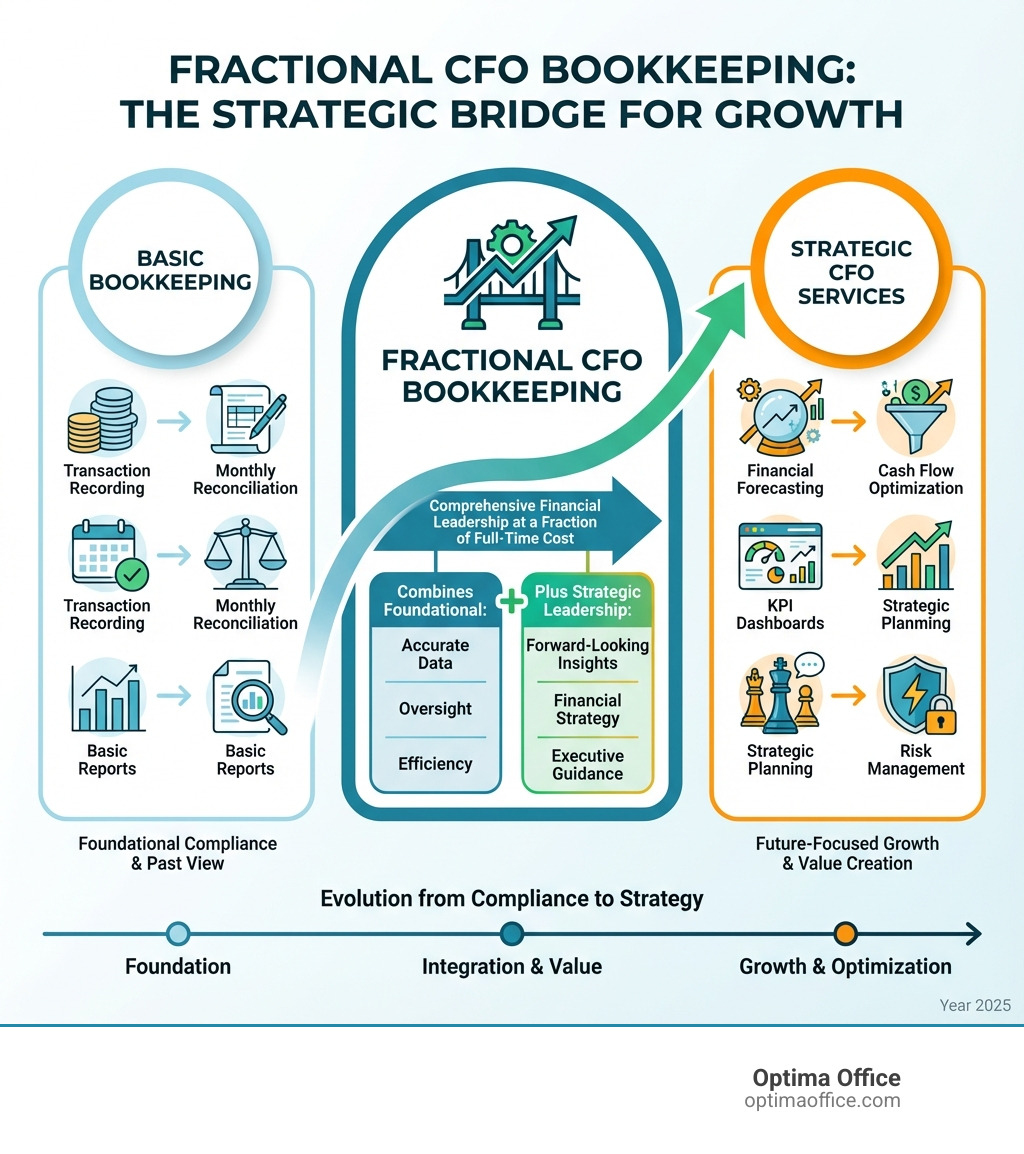

Fractional CFO bookkeeping combines strategic financial leadership with foundational accounting oversight, giving small and mid-sized businesses access to executive-level expertise without the cost of a full-time hire. Unlike traditional bookkeeping that simply records transactions, this integrated approach uses your financial data to drive business decisions, optimize cash flow, and plan for sustainable growth.

Key differences at a glance:

- Traditional Bookkeeping: Records transactions, reconciles accounts, prepares basic financial statements

- Fractional CFO Bookkeeping: All of the above plus strategic planning, forecasting, KPI tracking, cash flow optimization, and executive-level financial guidance

- Cost: Fraction of a full-time CFO salary (typically 60-80% less)

- Flexibility: Services scale with your business needs

- Value: Transforms financial data into actionable business intelligence

Many small business owners find themselves stuck in what one industry expert calls the “messy middle” of growth. You’ve outgrown basic bookkeeping, but hiring a full-time CFO feels financially out of reach. Your controller or accountant left unexpectedly. Your board is demanding analytics you can’t produce. Or you’re drowning in financial tasks when you should be focusing on running your business.

This is where fractional CFO bookkeeping becomes a game-changer. It’s not just about keeping your books clean—though that’s the foundation. It’s about having someone who understands both the numbers and the strategy behind them, ensuring your financial data is accurate while also using it to drive better business decisions.

As one research source noted, “Fractional CFOs don’t just help you file your taxes and prepare basic financial statements. A fractional CFO helps you with data-driven decision-making, based on forward-looking financial reporting.” This approach transforms your accounting function from a backward-looking compliance task into a forward-looking strategic asset.

Ready for strategic financial leadership without the executive salary? Download our free Fractional CFO Guide now. Get Your Free Fractional CFO Guide →

The Modern Financial Team: Understanding the Key Players

In the complex world of business, understanding the distinct roles within your financial team is crucial. From daily transaction recording to high-level strategic planning, each position plays a vital part in your company’s success. For small and mid-sized companies, we know that building out a full in-house finance department can be a significant—and often unaffordable—undertaking. This is where the flexibility of part-time executives and remote work models shines, especially through the lens of fractional CFO bookkeeping.

What is a Fractional CFO?

Imagine having a seasoned financial expert on your team, providing strategic insights and leadership, but only for the hours you truly need. That’s precisely what a fractional CFO offers. Operating on a part-time, contractual basis, a fractional CFO is a highly experienced financial professional who steps into the role of Chief Financial Officer without the commitment and costs associated with a full-time executive.

Unlike traditional bookkeepers who focus on past transactions, a fractional CFO is a strategic partner, deeply involved in forward-looking analysis and data-driven decision-making. They don’t just report the numbers; they interpret them to guide your business toward its goals. As we’ve seen, “Fractional CFOs provide the job functions of a Chief Financial Officer but on a part-time basis,” offering top-tier financial leadership at a fraction of the cost. They work with multiple clients, bringing a wealth of diverse experience to the table. To dive deeper into this role, explore our Fractional CFO Guide.

Bookkeeper vs. Controller vs. CFO

It’s easy to confuse these roles, but each has a distinct purpose and level of strategic involvement. Understanding the differences is key to building an effective financial team, whether in-house or outsourced.

| Role | Primary Responsibilities | Focus (Past, Present, Future) | Strategic Involvement | Typical Cost (Full-time) |

|---|---|---|---|---|

| Bookkeeper | Records transactions, reconciles accounts, manages payroll, prepares basic financial statements. | Past | Low | Entry-level salary |

| Controller | Manages the accounting department, oversees financial reporting, ensures compliance, develops internal controls. | Present | Medium | Mid-level management |

| CFO | Drives financial strategy, forecasting, budgeting, risk management, M&A, capital raising, data-driven decision-making. | Future | High | Executive-level salary |

A bookkeeper, as the name suggests, keeps your books in order. They are the meticulous record-keepers, ensuring every transaction is accurately logged. A controller steps up to manage the overall accounting function, making sure financial statements are prepared correctly and internal processes are sound. But a CFO? A CFO interprets and analyzes that data, providing insight into what’s happened, what’s happening now, and what future issues may arise. They evaluate and advise on the future effects of your investment, financing, operational, and HR decisions. As we often say, your business needs more than just a bookkeeper for true strategic growth. Find out why in our article: Why Your Business Needs More Than Just a Bookkeeper.

Fractional vs. Virtual vs. Interim CFO

While often used interchangeably, these terms can sometimes refer to subtle differences in engagement models:

- Fractional CFO: This is our core focus. A fractional CFO provides ongoing, part-time strategic financial leadership. The engagement is typically long-term, and the services can be delivered either remotely or, in some cases, with on-site presence. It’s about having executive expertise consistently, but not full-time.

- Virtual CFO: This term largely overlaps with fractional CFO, but often emphasizes the remote nature of the service delivery. A virtual CFO provides all their services entirely online, leveraging technology to manage your finances from afar. In practice, the terms are often used interchangeably, as many fractional CFOs work remotely.

- Interim CFO: An interim CFO is brought in for a specific, temporary period, often to fill a gap when a full-time CFO has left or is on leave, while the company searches for a permanent replacement. Their role is typically full-time but short-term, focusing on maintaining operations and stability during a transition.

For startups and growing businesses, understanding these distinctions helps you choose the right level of executive support. If you’re wondering what a fractional executive can do for your startup, we’ve got you covered: What Can a Fractional Executive Do For Your Startup?.

The Strategic Advantage of Integrated Fractional CFO Bookkeeping

For small and mid-sized enterprises (SMEs) in San Diego and Southern California, the strategic advantage of embracing fractional CFO bookkeeping is undeniable. It’s about gaining top-tier financial expertise that directly fuels your growth, without the usual executive-level overhead. This integrated approach ensures that your foundational financial data is not just accurate but also immediately actionable, driving smarter business decisions and fostering sustainable success.

Cost-Effectiveness: Top-Tier Expertise Without the Executive Salary

Let’s face it, hiring a full-time CFO is a luxury most SMEs simply can’t afford. A senior-level financial executive can cost a company upwards of a million dollars a year when you factor in salary, benefits, bonuses, and recruitment costs. For businesses with annual revenue below $50 million, this expense is often prohibitive. This is precisely why fractional CFO services are such a game-changer.

They offer the same level of expertise and high-level financial leadership, but at a fraction of the cost. We’re talking about accessing Fortune 500-level financial acumen without the executive salary. This cost-effective solution allows you to allocate your precious resources more effectively, maximizing your budget while gaining critical financial oversight. It’s “top-tier financial management without the expense of a full-time CFO or Controller.” The difference between a fractional CFO and a traditional CFO in terms of cost-effectiveness is stark, as detailed in our analysis: Fractional CFO vs. Traditional CFO.

Scalability for Every Growth Stage

One of the most compelling benefits of fractional CFO bookkeeping is its inherent scalability. As your business grows and evolves, so do your financial management needs. A fractional CFO can seamlessly adapt their services to match your changing requirements, ensuring you always have access to expert financial leadership precisely when you need it most.

For a startup, this might mean establishing foundational financial models and cash flow projections. As you enter a growth phase, the fractional CFO can help steer increasing financial complexity, manage multiple revenue streams, and prepare for funding rounds. For more mature businesses, their expertise can be leveraged for optimization, exit strategy planning, or even navigating mergers and acquisitions. Our model at Optima Office is designed for this flexibility, with rapid team deployment (typically 3-5 days) and a proprietary five-point system to ensure the right fit. This adaptable financial service ensures your business always has the right level of financial support, helping accounting and HR professionals alike contribute to growing your business: How Accounting and HR Professionals Can Help Grow Your Business.

The Power of Integrated Fractional CFO Bookkeeping

The true magic of fractional CFO bookkeeping lies in its integrated nature. It’s more than just having a bookkeeper and a CFO; it’s about having a unified approach where the strategic insights of a CFO are built directly upon the accurate and timely data provided by robust bookkeeping. This synergy eliminates information silos and ensures that every strategic decision is rooted in a clear, real-time financial picture.

Fractional CFOs provide data-driven, forward-looking financial reporting for decision-making, distinguishing them from traditional bookkeepers. They don’t just accept the numbers; they oversee the bookkeeping function to guarantee accuracy and then leverage that pristine data for strategic analysis. This proactive, partnership-driven approach means your financial data isn’t just a historical record; it’s a living tool for growth. Our fractional CFOs act as an extension of your team, focusing on strategic guidance, problem-solving, and driving enterprise growth rather than just number-crunching. They understand the unique challenges faced by entrepreneurs and combine financial expertise with innovative strategies, translating accurate bookkeeping into actionable business intelligence.

Beyond the Books: High-Impact Services of a Fractional CFO

A fractional CFO brings much more to the table than just oversight of your bookkeeping. They are architects of financial strategy, navigators of cash flow, and interpreters of complex data. Their services extend far beyond basic accounting, directly impacting your business’s trajectory, profitability, and stability.

Strategic Financial Planning and Forecasting

One of the cornerstone services of a fractional CFO is their ability to craft and implement robust financial strategies. This includes:

- Budgeting: Developing detailed annual budgets that align with your business goals and provide a roadmap for spending and revenue.

- Financial Modeling: Creating sophisticated models to project future financial performance under various scenarios.

- Scenario Planning: Helping you anticipate potential challenges and opportunities by analyzing “what-if” situations, like the impact of new hires or product line adjustments.

- Long-term Vision: Assisting in the development of a three-year financial budget to plan future objectives, bringing future financial performance into the present for proactive decision-making.

A fractional CFO helps you develop and implement financial strategies that align with your business goals, providing expertise and viewpoint on financials for calculated decision-making. This strategic foresight is invaluable, especially when preparing for the year ahead. For more insights, refer to our Year-End Financial Checklist for Your Business and this authoritative guide on financial projections.

Optimizing Cash Flow and Driving Profitability

“Cash flow is the lifeblood of any business,” and poor cash flow management can quickly lead to financial distress. A fractional CFO is an expert in optimizing this crucial aspect of your operations:

- Cash Flow Management: Analyzing spending patterns, identifying inefficiencies, and creating strategies to improve liquidity. They provide a rolling 12-month, three-way forecast of profit and loss, cash flow, and balance sheet.

- Margin Analysis: Deep diving into your product or service margins to identify areas for improvement and increased profitability.

- Pricing Strategy: Advising on optimal pricing structures to maximize revenue and competitive advantage.

- Cost Reduction: Identifying opportunities to streamline expenses without compromising quality or operational efficiency.

By actively managing your cash flow, a fractional CFO can help your business achieve financial stability and growth. We offer numerous Cashflow Tips and insights on The Importance of Cutting Operational Costs.

Data-Driven Decision Making and KPI Tracking

In today’s business landscape, decisions based on gut feelings are a recipe for disaster. A fractional CFO empowers you with data-driven insights:

- Implementing Dashboards: Setting up customized financial dashboards that provide real-time insights into your business’s performance.

- Key Performance Indicators (KPIs): Identifying and tracking the most critical financial and non-financial metrics that drive your business, such as team growth or pricing changes.

- Turning Data into Insights: Changing raw financial data into clear, actionable recommendations that help you make smarter business decisions.

- Performance Measurement: Providing analysis and commentary on monthly or quarterly performance with an executive summary.

Fractional CFOs excel at helping you understand your numbers and use them to propel your business forward. Learn more about how accountants help business owners make smarter decisions: 6 Ways Accountants Help Business Owners Make Smarter Business Decisions.

Risk Management, Compliance, and Special Projects

Beyond the day-to-day, a fractional CFO is your shield and your guide through complex financial landscapes:

- Financial Compliance: Ensuring your business adheres to all relevant financial regulations and reporting standards.

- Internal Controls: Developing and implementing robust internal controls to safeguard assets and prevent fraud.

- Risk Mitigation: Proactively identifying and addressing financial risks, protecting your business from unforeseen challenges and complications.

- M&A Support: Assisting with due diligence, valuation, and post-transaction integration for mergers and acquisitions.

- Exit Strategy Planning: Helping craft financial roadmaps to maximize business value and ensure a smooth transition when you’re ready to sell or transition your business.

- Accessing Financial Networks: Leveraging a wealth of connections and resources, including banking relationships and investment networks, to support capital raising and funding initiatives.

Yes, a fractional CFO can absolutely assist with specific financial needs like mergers, acquisitions, or exit strategy planning, providing expert support from due diligence to post-transaction.

How to Hire and Measure the ROI of Your Fractional CFO

Bringing on a fractional CFO is a strategic investment, and like any investment, it requires careful consideration and a clear understanding of the expected returns. For businesses in San Diego and Southern California, finding the right fractional CFO bookkeeping partner can profoundly impact your financial health and growth trajectory.

What to Look for in a Fractional CFO Bookkeeping Partner

When searching for the ideal fractional CFO, we recommend focusing on several key qualities:

- Strategic Mindset: Look for someone who can move beyond basic numbers to see the bigger picture, offering a viewpoint on financials for calculated decision-making.

- Industry Experience: While not always mandatory, expertise in your specific industry can provide invaluable context and innovative strategies. Our fractional CFOs have diverse experience across many sectors.

- Communication Skills: Your CFO should be able to simplify complex financial information and explain it in clear, actionable terms, acting as a true partner.

- Tech Proficiency: Familiarity with accounting software like QuickBooks, Xero, NetSuite, and other ERP systems is crucial for streamlined operations.

- Cultural Fit: This is often overlooked but essential. You’ll be working closely with this individual or team, so a personality that aligns with your company culture will foster a more productive and enjoyable partnership.

At Optima Office, we pride ourselves on our proprietary five-point system, which ensures we find the absolute right expertise and personality fit for your business. We believe every business owner deserves financial clarity and access to strategic expertise.

Common Engagement Models

The flexibility of fractional CFO services means there are several engagement models to suit different business needs and budgets:

- Retainer (Subscription): This is a common model where you pay a fixed monthly fee for a set number of hours or a predefined scope of services. It offers predictability and continuous support.

- Project-based: For specific, time-limited financial initiatives like a valuation, due diligence for an acquisition, or setting up a new financial reporting system.

- Hybrid Models: A combination of retainer for ongoing services and project-based fees for specialized tasks.

- Flexible Contracts: Many providers, like us, offer adaptable contracts that allow you to scale services up or down as your business needs evolve, providing agility without long-term commitments.

This adaptability ensures you can use an outsourced CFO on a project basis or as a part-time resource, aligning perfectly with your specific needs.

Measuring Success and Calculating ROI

Measuring the return on investment (ROI) of a fractional CFO involves both quantitative and qualitative metrics:

- Quantitative Metrics:

- Profit Growth: Direct impact on your bottom line through improved strategies.

- Cost Savings: Reductions in operational expenses, tax liabilities, or the cost of a full-time CFO.

- Cash Flow Improvement: Improved liquidity, better debt management, and optimized working capital.

- Increased Efficiency: Streamlined financial processes and reduced time spent on financial administration.

- Successful Funding Rounds: Securing capital or better loan terms due to improved financial presentations.

- Qualitative Benefits:

- Reduced Stress: Business owners can focus on core operations, knowing their finances are in expert hands.

- Improved Decision-Making: Access to clear, data-driven insights leading to more confident choices.

- Strategic Direction: A clear financial roadmap for future growth and stability.

- Risk Mitigation: Protection against financial pitfalls and compliance issues.

While a full-time CFO can cost up to a million dollars a year, a fractional CFO provides expert services at a fraction of that cost, offering significant cost savings. The true ROI isn’t just about saving money; it’s about the value generated through strategic guidance, which can be seen in case studies like our own: Optima Office Case Study: Cutting Bad Clients Can Increase Profits.

Frequently Asked Questions about Fractional CFO Bookkeeping

We get a lot of questions about how fractional CFO bookkeeping works and whether it’s the right fit for various businesses. Here are some of the most common inquiries we receive:

At what business stage should I hire a fractional CFO?

A fractional CFO is most beneficial at several critical stages of business growth, particularly for SMEs:

- Rapid Growth: When your business is expanding quickly and financial complexity is increasing.

- Financial Complexity: If you’re dealing with multiple revenue streams, international operations, or complex regulatory requirements that overwhelm your current team.

- Seeking Funding: When preparing to raise capital from investors or secure loans, a fractional CFO can prepare robust financial projections and presentations.

- Preparing for Sale: If you’re contemplating an exit strategy, a fractional CFO can help maximize your business’s valuation and ensure a smooth transaction.

- Lack of Leadership: If your business lacks dedicated financial leadership or your current finance team is overwhelmed.

If your business is ready to scale but unsure how to proceed, or if you’re experiencing growing pains in your financial management, it’s a telltale sign you need a fractional CFO. Explore more signs in our article: Telltale Signs Your Business Needs a Fractional CFO.

Can a fractional CFO replace my bookkeeper?

This is a common misconception! A fractional CFO typically does not replace your bookkeeper. Instead, they lift and improve the bookkeeping function. Here’s why:

- Role Distinction: Bookkeepers handle the day-to-day recording of financial transactions. A fractional CFO focuses on strategic oversight, analysis, and forward-looking planning. Think of it as the bookkeeper gathering the ingredients, and the fractional CFO being the head chef who creates the meal.

- Oversight vs. Execution: While a fractional CFO ensures the accuracy and integrity of your bookkeeping, they usually don’t perform the routine data entry themselves. Their role is to interpret the data produced by bookkeeping and transform it into actionable insights.

- Enhancing the Bookkeeping Function: A fractional CFO will often work closely with your existing bookkeeper (or help you find one if needed), implementing better processes, technology, and reporting structures to ensure the data is pristine and readily available for strategic analysis. They turn bookkeeping from a compliance task into a strategic asset.

A fractional CFO ensures your bookkeeping is accurate and provides the necessary data for strategic analysis and decision-making, rather than performing the basic accounting tasks themselves. For a clearer picture of these roles, check out: Bookkeeper vs. Controller: What’s the Difference?.

How much do fractional CFO services cost?

The cost of fractional CFO bookkeeping services can vary widely depending on several factors:

- Scope of Work: The more extensive the services required (e.g., full strategic planning, M&A support, daily cash flow management vs. quarterly reviews), the higher the cost.

- Business Size and Complexity: Larger, more complex businesses often require more hours and specialized expertise, influencing the overall fee.

- Engagement Model: As discussed, project-based work, hourly rates, or retainer models will have different pricing structures.

- Provider Experience: Highly experienced CFOs with a track record of success will typically command higher rates.

However, the key takeaway is that a fractional CFO offers an affordable solution by providing expert services at a fraction of the cost of a full-time CFO. While hiring a full-time CFO can be an expensive proposition, outsourcing allows companies to access CFO-level expertise without the long-term financial commitment. It’s about value over sheer cost – investing in strategic financial leadership that drives growth and profitability.

Transform your bookkeeping into strategic advantage—discover how with our comprehensive Fractional CFO Guide. Download the Guide Now →

Conclusion: Drive Sustainable Growth with Strategic Financial Leadership

In today’s dynamic business environment, particularly for growing companies across San Diego and Southern California, the integration of high-level financial strategy with meticulous accounting oversight is no longer a luxury—it’s a necessity. Fractional CFO bookkeeping offers a powerful solution, providing you with the strategic financial leadership typically reserved for large corporations, but at a cost and flexibility custom to your unique needs.

We’ve explored how a fractional CFO differs from traditional financial roles, offering forward-looking insights that transform your financial data into a roadmap for success. We’ve highlighted the immense benefits, from cost-effectiveness and scalability to improved strategic planning, optimized cash flow, and data-driven decision-making. By embracing this integrated approach, you gain a partner who not only keeps your books in impeccable order but also leverages that information to maximize profits, minimize risk, and drive enterprise growth.

At Optima Office, our mission is to provide exceptional accounting and HR services while building positive relationships. We understand that small and mid-sized companies need a mixture of accounting and HR talent to effectively run their operations, but often lack the funds to hire full-time staff at every level. That’s where we come in. With Optima Office, you get the benefits of a complete finance and HR department for a fraction of the cost of hiring internally. Our highly-customized mix of outsourced controllers, CFOs, accountants, and HR professionals bring the right expertise and personality fit to solve problems quickly—so you can focus on what you do best. We pride ourselves on rapid team deployment (typically 3-5 days) and our proprietary five-point system, ensuring the perfect fit for your business.

Don’t let financial complexities hold your business back. It’s time to empower your business with strategic financial leadership. Take the next step towards mastering your financial future and achieving sustainable growth.

Get a free Financial Gap Diagnosis