Why Financial Expertise Shouldn’t Break Your Budget

Fractional accounting is a flexible, cost-effective solution where businesses hire experienced finance professionals—like CFOs, Controllers, or Accountants—on a part-time or project basis, paying only for the services they need without the overhead of full-time salaries and benefits.

Quick answer for searchers:

- What it is: Part-time or on-demand accounting services from senior finance professionals

- Who needs it: Startups, small businesses ($3-$15M revenue), and companies experiencing growth or transition

- Key benefits: Access C-level expertise at 60-80% lower cost than full-time hires

- Services included: Strategic planning, financial reporting, cash flow management, compliance, and day-to-day bookkeeping

- Typical cost: $2,500-$8,000/month vs. $459,027/year for a full-time CFO

Most small businesses can’t justify a full-time CFO at nearly half a million dollars per year, yet they desperately need strategic financial guidance. This creates a painful gap where owners are stuck between unaffordable full-time hires and basic bookkeepers who lack strategic expertise. When a key finance person leaves, operations can grind to a halt.

Fractional accounting bridges this gap. It provides access to seasoned finance professionals who work with your business part-time, scaling their involvement as your needs change. You get the strategic thinking of a CFO, the operational excellence of a Controller, and the accurate record-keeping of skilled accountants—without the six-figure salaries and benefits packages.

In this guide, we’ll unpack how fractional accounting works, explore the roles these professionals fill, and help you determine if this model is right for your growing business.

What is Fractional Accounting and How Does It Work?

Fractional accounting brings experienced finance professionals into your business on a part-time or project basis. Instead of committing to full-time salaries, you get the exact expertise you need, when you need it. Its like having a financial expert on speed dialsomeone who integrates with your team and delivers strategic insights without the overhead of a traditional employee.

The model’s beauty is its flexibility. You might need deep strategic guidance during a funding round or consistent bookkeeping throughout the year. With fractional accounting, you can dial services up or down as your business evolves. This approach differs dramatically from traditional accounting, where you’re locked into fixed salaries regardless of actual needs. Fractional accounting flips this model, giving you a cost-effective alternative that adapts to your reality.

For businesses trying to understand which level of support makes sense, we’ve put together guidance on why you should consider hiring a Fractional CFO. You can also explore our broader outsourced accounting services to see the full range of possibilities.

Here’s how fractional accounting stacks up against traditional in-house accounting:

| Feature | Traditional In-house Accounting | Fractional Accounting |

|---|---|---|

| Cost | High fixed salaries, benefits, payroll taxes, office space | Flexible, pay-as-you-go, no benefits, reduced overhead |

| Flexibility | Low; difficult to scale up or down quickly | High; services can be scaled to match current business needs and budget |

| Expertise | Limited to the skills of specific hires; potential skill gaps | Access to a broad team of specialized experts (CFO, Controller, Staff Accountant) |

| Scalability | Slow and costly hiring/firing processes | Rapid deployment (often within 3-5 days); easy to adjust service levels |

| Commitment | Long-term employment commitment | Project-based or part-time engagement; no long-term employment obligations |

| Technology | Dependent on internal software and infrastructure | Leverages modern cloud-based tools and best practices; often brings advanced tech solutions |

| Strategic Input | Varies by employee’s role and experience | Strong emphasis on strategic guidance, financial planning, and decision-making, especially at higher fractional levels |

The Fractional Model vs. Traditional Accounting

Startups and growing companies need financial expertise but can’t afford a full finance department. Traditional in-house accounting comes with the crushing overhead of salaries, benefits, and other employee costs. And if you hire the wrong person, you’re stuck with a difficult termination and expensive recruitment process.

Basic outsourced bookkeeping handles transactions but lacks the strategic thinking needed for growth. Your business needs more than just a bookkeeper; it needs a financial partner who can guide decisions and help you avoid costly mistakes.

Fractional accounting bridges this gap. You get senior-level expertise without the senior-level commitment and strategic thinking without the six-figure salary. You can adjust your level of support as your business grows or as seasonal demands change.

How a Fractional Engagement Typically Works

When you partner with a fractional accounting provider like Optima Office, the process starts with a thorough findy period where we dig into your current financial situation, workflows, and challenges. Based on what we learn, we create a customized plan. We might recommend ten hours a month of CFO guidance plus twenty hours of controller support, or perhaps intensive project-based work to clean up historical financials.

The engagement is built on flexible hours, so you only pay for what you use. Our team works remotely using cloud-based technology, integrating seamlessly with your operations. We leverage modern tools and incorporate AI into your accounting practice where it makes sense, bringing efficiency and accuracy. Some clients need project-based work, while others want ongoing as-needed support. At Optima Office, we pride ourselves on rapid deployment, typically getting your team in place within three to five daysno lengthy recruitment, just experienced professionals ready to make an immediate impact.

The Core Benefits for Startups and Growing Companies

Startups and growing companies no longer have to choose between financial excellence and staying lean. When you’re juggling product development and customer acquisition, you need serious financial help but can’t afford a full-time CFO or Controller. Fractional accounting is the transformative solution, giving you access to sophisticated expertise without the high cost.

It allows you to operate like a much larger company—with strategic financial planning and expert guidance—while maintaining the agility that keeps startups competitive. The demand for fractional accounting is exploding, particularly among companies navigating rapid growth, capital raises, or mergers. Our clients tell us that fractional accounting gives them peace of mind, allowing them to focus on what they do best while knowing their finances are in expert hands. Learn more about the advantages a Fractional CFO can bring to your business.

Significant Cost Savings

The numbers show where the fractional model truly delivers. The average Chief Financial Officer in the U.S. earns approximately $459,027 per year, while a solid accountant costs around $79,880 annually. These figures don’t include the additional 25-40% for benefits, payroll taxes, and recruitment.

Now consider fractional accounting. You can access high-level CFO expertise for $2,500 to $8,000 per month—roughly 60-80% less than a full-time hire. You get the same strategic acumen but only pay for the hours you need. You avoid hidden costs like recruitment, benefits, and training, and those savings flow directly back into your business to fuel growth. For a detailed comparison, check out Fractional CFO vs. Traditional CFO.

Access to a Full Suite of Expertise

One person can’t do everything. A bookkeeper isn’t equipped to build financial models for a Series A pitch, and an accountant may not have experience with complex cash flow strategies for rapid expansion.

With fractional accounting, you gain access to an entire team of specialized professionals. Your fractional CFO provides strategic guidance, your fractional Controller ensures operational excellence, and your fractional accountant handles daily transactions. This collaborative approach bridges the talent gaps that plague many growing businesses.

You get high-level strategic guidance for critical decisions, operational efficiency from streamlined processes, and robust compliance and risk management. Our professionals bring battle-tested solutions from their experience with hundreds of companies, helping you avoid expensive mistakes. Understanding why businesses need accounting and finance consulting services highlights how this combination of breadth and depth makes the difference.

Building Your On-Demand Finance Department: Roles and Responsibilities

Imagine having a full, expert finance team custom to your business’s needswithout the massive cost of hiring internally. That’s what an Optima Office fractional accounting team provides. We structure our teams to offer comprehensive support, covering every role from staff accountant to CFO, ensuring you get the right blend of expertise and personality to solve problems quickly.

Each role brings unique skills and clear responsibilities, ensuring all your financial bases are covered with a plan designed to meet your goals. Want to understand how these different roles fit together? Dive deeper into the specific functions of Bookkeepers, Controllers, and CFOs.

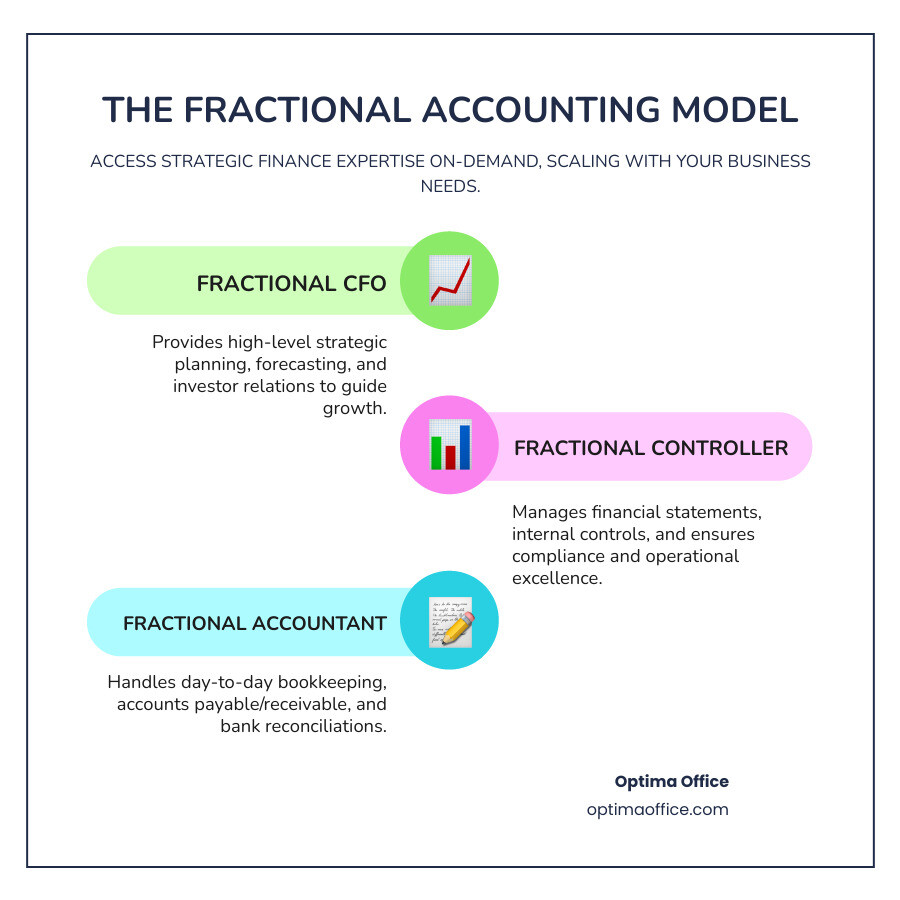

The Fractional CFO: Your Strategic Partner

The Fractional CFO is your strategic partner for growth, focusing on the big picture to help you meet long-term objectives. Key responsibilities include developing financial strategies, creating forecasts and budgets, optimizing cash flow, and managing investor relations. They provide crucial support for capital raises, including due diligence, and perform risk assessments to protect your assets. These insights are vital for accelerating growth and maximizing profits. Learn more about what a Fractional Executive CFO can do for your startup.

The Fractional Controller: The Operational Powerhouse

While the CFO sets the strategic direction, the Fractional Controller is the operational powerhouse ensuring your financial engine runs smoothly. They streamline accounting operations, prepare timely and accurate financial statements, and develop internal controls to safeguard assets. They also manage audit preparation, ensure data accuracy, and handle compliance with all accounting standards and tax laws. Our Fractional Controllers provide the rock-solid financial foundation your CFO needs for strategic planning. We’re so confident in their impact, we even offer a complimentary Controller Consultation Offer to help you explore your needs.

The Fractional Accountant and Bookkeeper: The Foundation of Your Finances

Every successful financial strategy needs a strong foundation, which is where your Fractional Accountant and Bookkeeper come in. These professionals handle day-to-day financial transactions with precision, ensuring your books are always accurate and organized. Their duties include recording daily transactions, managing accounts payable/receivable, performing bank reconciliations, and maintaining the general ledger. They provide the reliable data that your Controller and CFO depend on for strategic insights. If you’re looking to strengthen this essential foundation, learn why your business needs fractional bookkeeping services.

Is Fractional Accounting the Right Fit for Your Business?

Deciding if fractional accounting is right for you requires reflecting on where your business is and where it’s headed. For many small and mid-sized companies, this model offers the perfect balance of flexibility and strategic value.

Are you spending weekends trying to understand financial reports? Are investors asking questions you can’t confidently answer? These are signs that fractional accounting makes sense. Consider these indicators:

- Rapid growth: When revenue climbs but your financial infrastructure can’t keep up, a fractional team can step in quickly—often within 3-5 days—to build the foundation your growth demands.

- Budget constraints: You need strategic guidance, but a full-time CFO’s salary isn’t realistic. The fractional model gives you C-level expertise for a fraction of the cost.

- Specialized projects: Preparing for a capital raise, acquisition due diligence, or a new system implementation are perfect project-based needs for fractional support.

- Talent shortage: Good finance candidates are scarce and expensive. Fractional accounting bypasses recruitment headaches, giving you immediate access to experienced professionals.

To see if your situation matches, review these telltale signs your business needs a fractional CFO. Of course, this model isn’t for everyone. Very large enterprises or businesses in heavily regulated industries may require dedicated in-house teams.

How to Choose the Right Fractional Accounting Provider

Choosing the right provider is crucial, as they become a key financial partner. At Optima Office, we use a proprietary five-point system to ensure the perfect match. Key factors to consider include:

- Industry Experience: A provider who knows your sector can solve problems faster.

- Client Testimonials: Check references to understand their real-world performance and reliability.

- Communication Skills: They must translate complex financial data into clear, actionable advice.

- Technology Proficiency: Ensure they use modern, cloud-based tools like those we use to incorporate AI into your accounting practice.

- Scalability: The right partner can flex their services up or down as your business evolves.

- Cultural Fit: The team should mesh with your company’s values and working style.

Potential Drawbacks and How to Mitigate Them

Let’s be transparent about potential challenges and how to address them:

- Limited Availability: Since fractional professionals serve multiple clients, they aren’t always on-site. Mitigation: Establish clear expectations on response times and schedule regular check-ins. Our team-based approach ensures someone is always available.

- Communication Challenges: Nuance can be lost without face-to-face interaction. Mitigation: Use regular video calls and collaborative platforms to keep everyone aligned. Document all decisions and action items.

- Internal Team Integration: Existing staff may feel threatened. Mitigation: Clearly define roles from the start, emphasizing that the fractional team is there to support, not replace, internal staff. Foster collaboration and knowledge sharing.

- Increasing Costs: Your needs may expand over time. Mitigation: Conduct regular reviews of your service agreement. A good provider will be transparent about costs and help you optimize your plan for maximum value.

Frequently Asked Questions about Fractional Accounting

We get questions about fractional accounting every day. These are the ones that come up most often as business owners explore if this model is right for them.

How is fractional accounting different from basic outsourced bookkeeping?

This is a key distinction. Basic outsourced bookkeeping focuses on transactional tasks: data entry, reconciliations, and managing payables/receivables. It’s about recording what happened in the past.

Fractional accounting is a broader term that includes strategic leadership. A Fractional CFO or Controller uses financial data to provide forward-looking guidance, including planning, forecasting, and risk management. They help you decide what to do next, not just report on what you’ve done. If you’re wondering why your business needs more than just a bookkeeper, that article dives deeper into this distinction.

What size business benefits most from fractional accounting?

Fractional accounting is particularly transformative for startups, small to mid-sized businesses (typically with revenues between $3 million and $15 million), and companies in rapid growth or transition. These businesses need sophisticated financial expertise but often lack the budget for a full-time CFO. We also see great value for businesses with seasonal fluctuations, those navigating a capital raise, or organizations that need to fill a critical financial role immediately. The fractional model’s flexibility provides the right level of expertise, right when it’s needed.

Can a fractional team really replace a full-time finance department?

For many small and mid-sized companies, the answer is yes. Our customized mix of outsourced Controllers, CFOs, and Accountants can handle everything a traditional finance department would—often more efficiently and at a lower cost. A fractional accounting team provides all essential functions, from strategic planning and financial reporting to day-to-day bookkeeping. Because our professionals have worked across multiple industries, they often bring more diverse expertise than a single full-time hire.

As your company grows, the fractional model scales with you. If you eventually reach a size where full-time hires make sense, your fractional team can help build out that internal department and ensure a smooth transition. With our rapid deployment (typically within 3-5 days), you can fill a critical gap in your financial operations without delay.

Conclusion

You’ve found that fractional accounting is more than a cost-cutting tacticit’s a strategic investment in your future. It provides access to a full suite of financial experts, from strategic CFOs to detail-oriented accountants, without the overhead of full-time hires.

This model empowers startups and growing companies to make confident decisions, scale efficiently, and focus on what they do best. At Optima Office, we deliver this expertise through a customized, team-based approach. Our rapid deployment and focus on finding the right fit ensure you get the support you need to maximize profits and minimize risk.

The financial landscape is complex, but having a trusted partner who understands your business makes all the difference. That’s what we strive to be for every clientnot just a service provider, but a true partner in your growth journey.

Ready to open up your business’s full potential? Learn how a Fractional Controller can transform your financial operations and see how the right team can accelerate your growth.