Why Bookkeeping for Businesses is Your Foundation for Success

Bookkeeping for businesses is the systematic recording of all financial transactions—from sales and expenses to payments and receipts. It’s the backbone that keeps your company’s financial story accurate and ready for decision-making.

Quick Answer: Essential Bookkeeping Components

- Daily Tasks: Record all income and expenses as they happen.

- Monthly Tasks: Reconcile bank accounts and review financial statements.

- Key Records: Invoices, receipts, bank statements, and payroll records.

- Main Methods: Single-entry (simple) or double-entry (comprehensive).

- Financial Reports: Income statement, balance sheet, and cash flow statement.

- U.S. Requirements: Keep records for 3-7 years, manage sales tax, and file quarterly/annually.

The numbers tell a sobering story. About 60% of business owners say accounting trips them up, leading to costly errors. Without proper bookkeeping, cash flow problems cause roughly 20% of U.S. small businesses to fail in their first year.

But proper bookkeeping isn’t just about avoiding disaster. It’s about building a financial foundation that helps you:

- Make informed decisions based on real data, not guesswork.

- Stay tax compliant and avoid steep penalties.

- Track cash flow effectively (a worry for 33% of business owners).

- Save time—modern software can automate 75% of bookkeeping tasks.

Whether you’re a growing professional services firm in San Diego or a non-profit managing multiple funding sources, your bookkeeping system must match your business’s complexity.

This guide will walk you through everything from choosing the right bookkeeping method to understanding when to bring in professional help. We’ll cover common mistakes that cost businesses thousands and practical steps to build a system that helps you grow.

The Foundations of Bookkeeping: Methods and Records

Think of your business as a house and bookkeeping for businesses as its foundation. Without a solid foundation, the structure will eventually crumble. The same is true for your business finances.

Every dollar that flows in and out of your business tells a story. If you don’t capture these stories systematically, you’re running your business blindfolded. This is where proper bookkeeping methods and meticulous record-keeping come in.

The backbone of good bookkeeping is your financial records: invoices, receipts for every business expense, and bank statements. These aren’t just pieces of paper; they are the official proof of your business activities.

Here’s something many business owners overlook: the IRS requires you to keep records for at least three years after the tax year they relate to, and sometimes longer. When you’re facing questions about a transaction from years ago, you’ll be grateful you kept everything organized.

Choosing Your Bookkeeping Method

You have two main paths for recording transactions. Picking the right one can be the difference between clarity and confusion.

Single-entry bookkeeping is like a simple diary of your money. You record income when it comes in and expenses when they go out. It’s straightforward and works well for freelancers or very small businesses with simple finances.

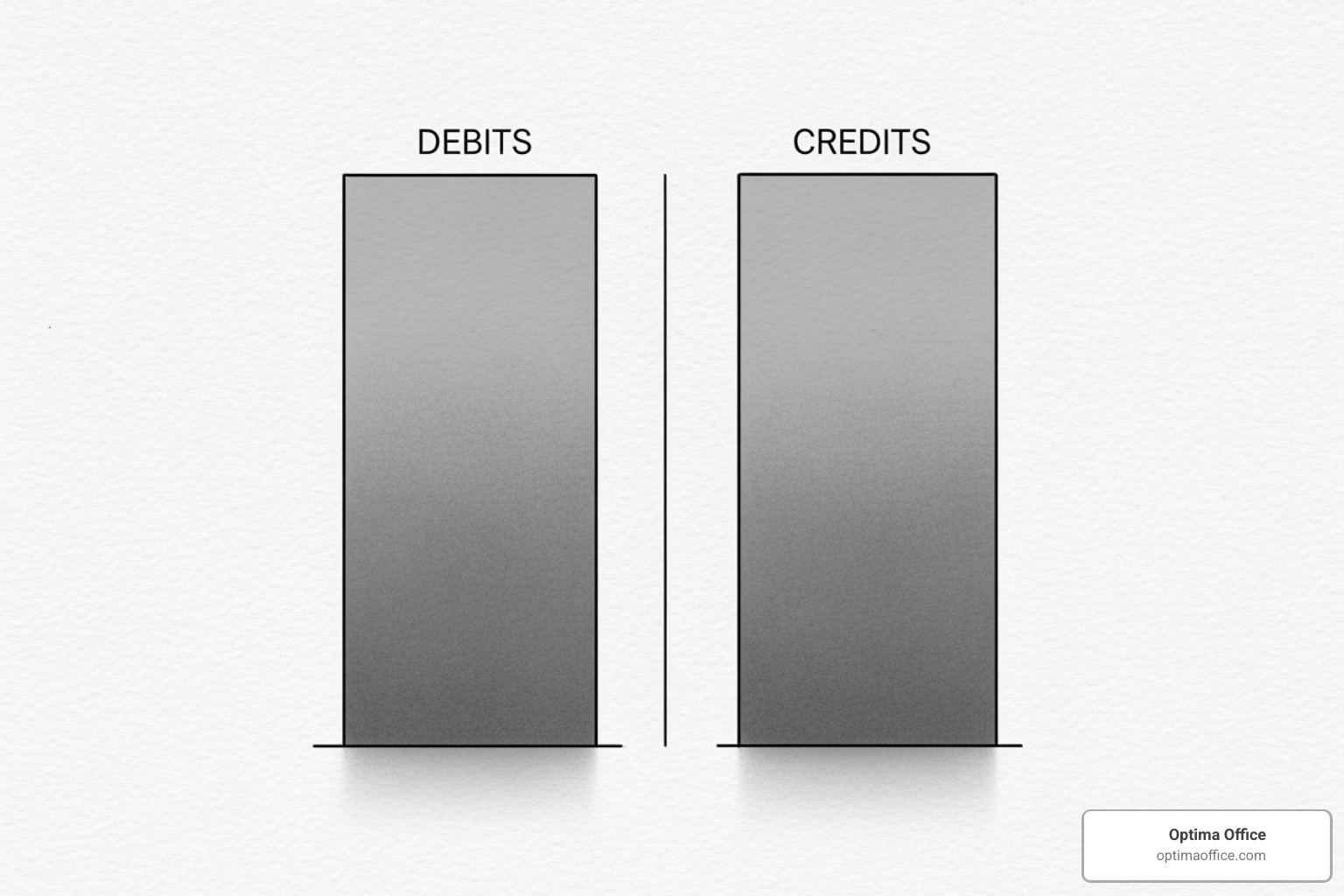

Double-entry bookkeeping is the standard for most businesses. Every transaction is recorded twice—as a debit and a credit—creating a self-checking system that ensures your books always balance. For example, buying a $2,000 computer means your equipment asset account increases (a debit) and your cash account decreases (a credit). If your business is incorporated or follows Generally Accepted Accounting Principles (GAAP), double-entry is essential for the accuracy that banks, investors, and the IRS expect.

Cash vs. Accrual Accounting

The next choice is when to record transactions.

Cash accounting is simple: you record income when money hits your bank account and expenses when you pay them. If you invoice a client in December but get paid in January, the income is recorded in January.

Accrual accounting provides a more complete financial picture. You record income when you earn it and expenses when you incur them, regardless of when cash changes hands. This method follows the matching principle, pairing revenues with the expenses that generated them in the same period. Accrual accounting offers a clearer view of your long-term performance, which is why most growing businesses use it to make smart decisions.

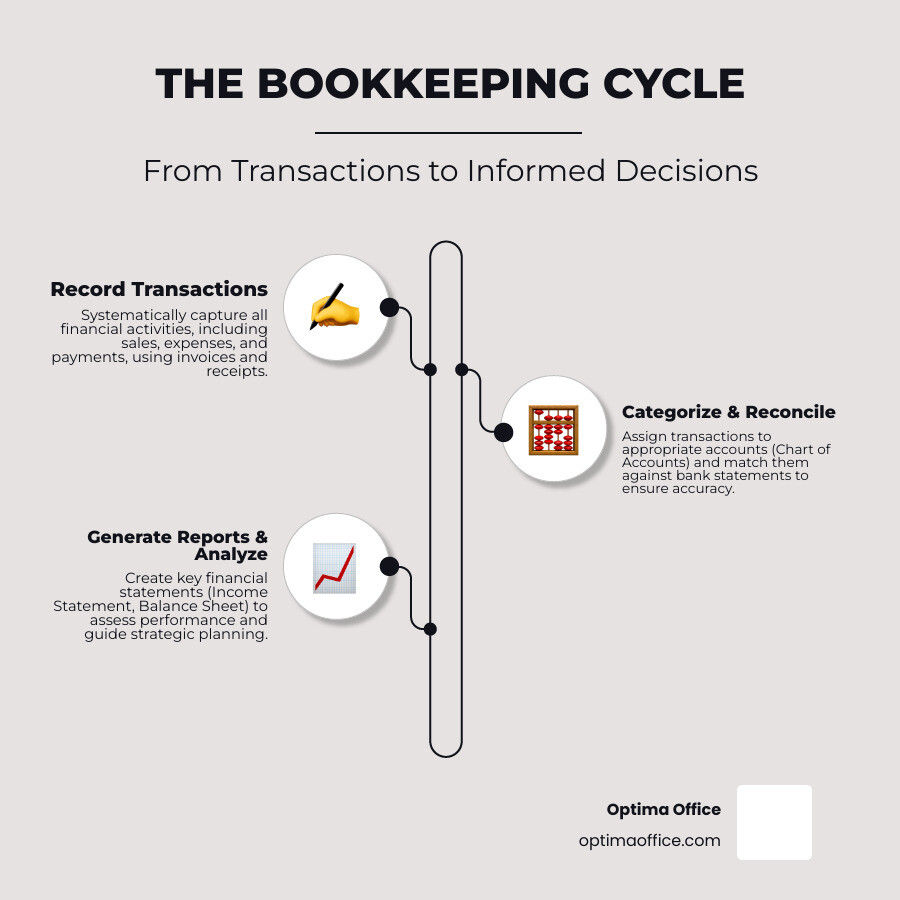

The Core Bookkeeping Process: From Transactions to Reports

With your methods chosen, it’s time to establish the daily rhythm of bookkeeping for businesses. This systematic process turns raw financial data into powerful insights about your business performance. A predictable routine gives you confidence that you always know where your business stands financially.

Step 1: Categorize Your Financial Transactions

Every dollar needs a home. Without proper categorization, your financial records are a mess. Your Chart of Accounts is the financial filing system that sorts every transaction into logical categories like assets, liabilities, equity, revenue, and expenses.

For example, office supplies go into “Office Expenses,” and a paid invoice lands in “Sales Revenue.” This consistency makes your financial reports meaningful, helping you spot spending patterns, identify tax-deductible expenses, and understand which parts of your business are most profitable.

Step 2: Reconcile Your Business Accounts

Account reconciliation is your monthly financial fact-check. You compare your bookkeeping records against your bank and credit card statements to ensure they match perfectly.

This process is a safety net that catches honest mistakes (like entering $250 instead of $25) and helps with fraud detection. Spotting unauthorized charges early can save you from major headaches. Many business owners skip this step, but it’s a crucial monthly health check that prevents small errors from becoming big problems.

Step 3: Prepare Key Financial Statements

Once your accounts are reconciled, you can generate the three reports that tell your complete business story. These are your business dashboard, not just paperwork for your accountant.

- The Income Statement (or Profit & Loss) shows your profitability over a period by subtracting expenses from revenue to find your net profit or loss.

-

The Balance Sheet is a snapshot of your financial position at a specific moment, showing what you own (assets), what you owe (liabilities), and your net worth (equity).

-

The Cash Flow Statement tracks the movement of cash. It’s a vital early warning system, as even profitable businesses can fail if they run out of cash.

Together, these reports provide complete visibility into your business performance, helping you make informed decisions and stay prepared for tax season.

A Practical Guide to Bookkeeping for U.S. Businesses

In the U.S., bookkeeping for businesses means staying aligned with IRS regulations. Once you know the rhythm of monthly, quarterly, and annual tasks, it becomes second nature, keeping your business compliant and thriving.

Think of your bookkeeping as a financial health routine. Consistent hygiene prevents bigger problems, and the IRS has specific deadlines that can be costly if missed.

Monthly Bookkeeping Tasks

Your monthly routine is a financial check-up that keeps things running smoothly.

- Reconcile your accounts: Compare your books to bank and credit card statements. It’s easier to identify a mysterious charge now than six months later.

- Process payroll: This involves calculating and withholding federal and state taxes, plus Social Security and Medicare (FICA). These funds must be remitted on time to avoid steep penalties.

- Review financial statements: Your Income Statement, Balance Sheet, and Cash Flow Statement tell a story. Are expenses creeping up? Is a new marketing campaign paying off? These reviews help you spot trends before they become problems.

- Chase overdue invoices: Cash flow is your business’s lifeblood. A gentle reminder on unpaid invoices can make all the difference.

Quarterly Bookkeeping Tasks

Every three months brings key compliance tasks.

- Manage sales tax: If you sell goods or certain services, you’ll need to calculate, collect, and remit sales tax to the proper state and local authorities. Rates and rules vary significantly by location.

- Pay estimated taxes: If you expect to owe more than $1,000 in tax for the year, the IRS requires you to pay estimated taxes quarterly. This applies to most small businesses that aren’t C-corporations.

- Update budgets and forecasts: Review your financial plan quarterly to stay ahead of the game. Planning for seasonal slowdowns or large purchases helps you avoid cash flow surprises.

Annual Bookkeeping Tasks for Your Business

Year-end is when all your hard work pays off.

- Close the books: Finalize all transactions for the year and make year-end adjustments, like recording depreciation on assets.

- File your tax return: The main event. Corporations typically file Form 1120, while sole proprietors and freelancers use Schedule C with their Form 1040. Deadlines vary by business structure.

- Issue tax forms: Send W-2s to employees and 1099-NECs to independent contractors by January 31st.

- Review deductible expenses: Detailed records make it easy to review your deductible business expenses and ensure you’re maximizing your tax savings.

- Back up your records: With the IRS requiring you to keep records for several years, a secure backup (cloud and offline) is essential protection against data loss.

Avoiding Pitfalls and Knowing When to Get Help

Even with the best intentions, bookkeeping for businesses can be a challenge. About 60% of business owners admit that financial management trips them up, leading to costly errors. The good news is that most bookkeeping disasters are avoidable once you know what to watch for and when to call for help.

Common Bookkeeping Mistakes for Small Businesses

These seemingly innocent shortcuts can snowball into major headaches.

- Mixing personal and business funds: Using your business card for personal items creates a reconciliation nightmare and can trigger an IRS audit. The fix is simple: open a separate business bank account and use it for business transactions only.

- Messy record-keeping: A shoebox full of receipts is a recipe for disaster. One contractor we know faced an IRS audit and, after organizing his records, found an extra $13,200 in deductions he had missed.

- Procrastination: That “slow day” for catching up on data entry never comes. Regular transaction logging is a sanity saver.

- Ignoring small expenses: Those small coffee runs and office supply purchases add up. An e-commerce owner we worked with was missing out on significant tax savings from poor sales tax tracking. Proper tracking now saves her over $1,200 quarterly.

- Not backing up your records: A computer crash could wipe out months of work. Cloud and offline backups are essential.

Bookkeeping vs. Accounting: What’s the Difference?

Many people use the terms interchangeably, but they are different.

Bookkeeping is the daily diary of your finances—recording transactions, categorizing them, and keeping everything organized.

Accounting is about making sense of that diary. Accountants analyze the data to create budgets, prepare forecasts, and provide strategic insights into your business’s future. Both are crucial: without good bookkeeping, accounting is unreliable.

When to Seek Professional Bookkeeping Support

You started your business to do what you love, not to become a bookkeeping expert. It’s time to get help when:

- You’re out of time: If you’re spending evenings and weekends on bookkeeping instead of growing your business, it’s time for a change.

- Your business is complex: Employees, inventory, or multi-state sales tax make DIY bookkeeping risky.

- You’re in a growth phase: Securing funding or expanding operations requires expert financial data and analysis.

- You fear an IRS audit: Audits are stressful and can result in significant penalties. Expert guidance is a smart investment.

- You need a financial strategy: To minimize taxes and plan for the future, you need professional expertise.

This is why Optima Office exists. We provide small and mid-sized companies with the financial and HR expertise they need without the cost of full-time staff. Our rapid team deployment within 3-5 days ensures you get the right expertise to solve problems quickly—so you can focus on growth.

Frequently Asked Questions about Bookkeeping for Businesses

Can I do my own bookkeeping as a small business?

Absolutely. Many owners of new or simple businesses handle their own bookkeeping for businesses using accounting software or even well-organized spreadsheets. Modern tools can automate about 75% of routine tasks, saving significant time.

However, be honest about your limits. About 60% of business owners admit that accounting challenges trip them up, leading to errors. If you’re spending more time on spreadsheets than growing your business, it’s likely costing you more than it’s saving. The tipping point often comes with growth—employees, inventory, and complex tax situations increase the risk of mistakes.

How does bookkeeping differ for freelancers vs. e-commerce?

Your business model shapes your bookkeeping needs.

For freelancers and consultants, the focus is on tracking billable hours, managing invoices, and capturing every deductible expense. The key is ensuring you claim all eligible deductions for things like home office use, software, and mileage when you file your Schedule C (Form 1040).

E-commerce businesses face greater complexity. You must manage inventory, calculate the Cost of Goods Sold (COGS), and handle sales tax compliance across different states. Your systems need to integrate with online platforms to track sales, refunds, and fees automatically, as real-time inventory data is crucial for managing cash flow.

What is the easiest way to start bookkeeping?

Building good habits from day one is the secret.

- Open a separate business bank account. This is the single most important step to avoid mixing personal and business finances.

- Choose your system early. While spreadsheets work for very simple businesses, accounting software is a better long-term choice as it automates work and reduces errors.

- Go digital with records. Scan and store all receipts and invoices digitally. This keeps you organized and helps meet the IRS’s record-keeping requirements without the paper clutter.

- Be consistent. Set aside time each week to log transactions and reconcile accounts. A little time weekly is far easier than a massive quarterly cleanup.

Conclusion

Your bookkeeping for businesses journey doesn’t have to be a solo adventure. Think of it as learning to tell your business’s financial story—one that reveals where you’ve been, where you are, and where you’re headed.

The statistics are clear: many business failures are linked to cash flow problems, and audit penalties can be severe. But these outcomes are preventable with the right systems.

When your books are accurate and up-to-date, you create a foundation for informed decision-making. You can spot opportunities, catch problems before they become crises, and invest with confidence.

Tax readiness becomes a routine task instead of a stressful scramble. Your IRS deadlines are just another part of your organized workflow. Most importantly, solid bookkeeping supports your growth planning, allowing you to make strategic decisions that move your business forward.

You didn’t start your business to become a bookkeeping expert. At Optima Office, we believe your energy should go toward what you do best. We handle the financial foundation that supports your vision.

Our team provides the expertise to solve problems quickly so you can focus on growth. Whether you need to clean up backlogged transactions or want strategic guidance for your next phase, we’re here to help translate your financial data into actionable insights.