Why CFO, HR, Tax and Accounting Are Your Startup’s Secret Weapon

CFO, hr, tax and accounting for startups are the four pillars separating thriving companies from the 90% that fail. While poor cash flow management kills more startups than bad products, most founders focus on features instead of the financial foundation that keeps their company alive.

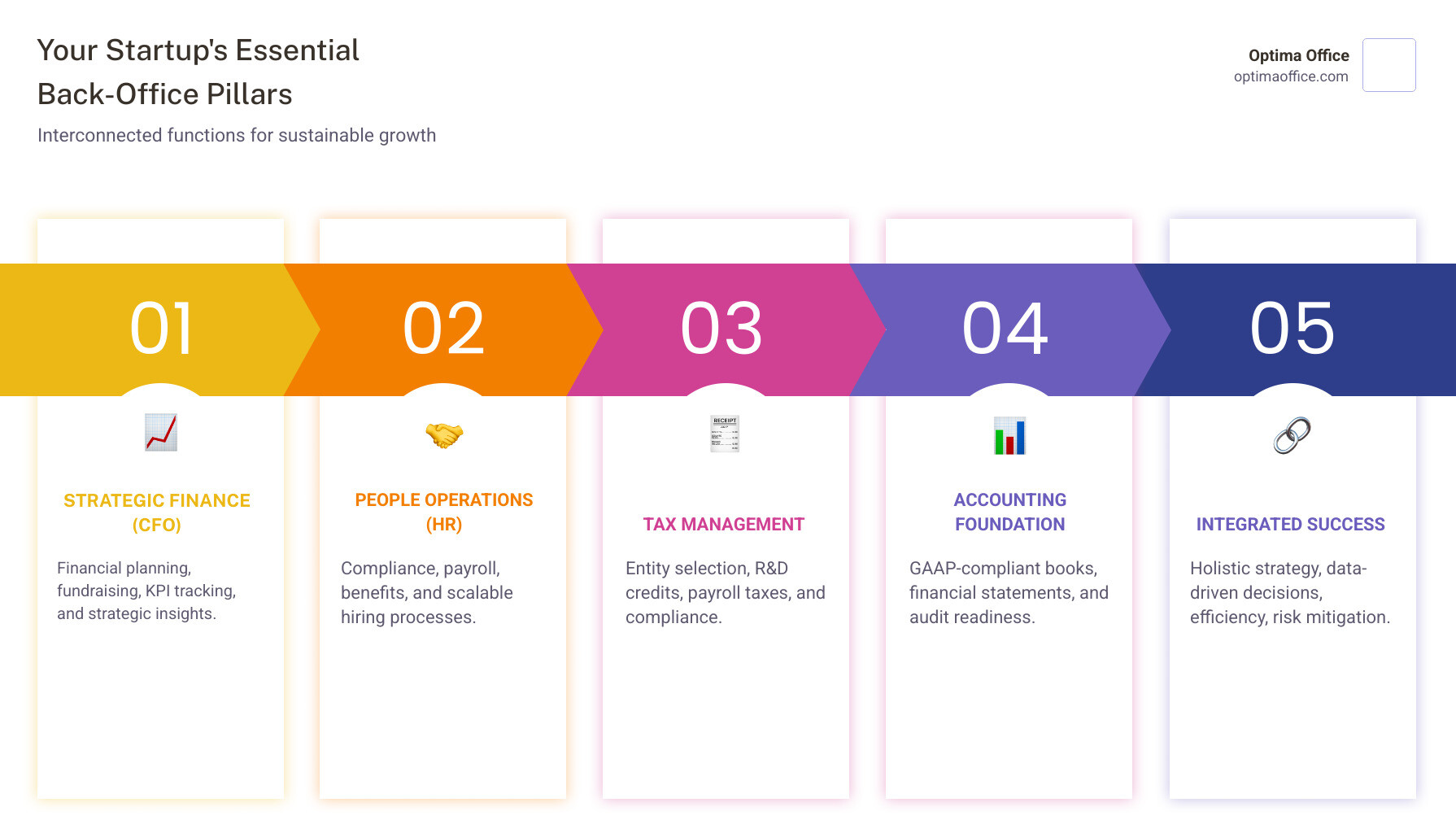

Essential Services for Startup Success:

- Strategic Finance (CFO) – Financial planning, fundraising support, and KPI tracking ($2,500-$15,000/month vs. $250,000+ for full-time)

- People Operations (HR) – Compliance, payroll, benefits, and scalable hiring processes

- Tax Management – Entity selection, R&D credits, payroll taxes, and compliance deadlines

- Accounting Foundation – GAAP-compliant books, financial statements, and audit readiness

Research shows startups with professional financial support are twice as likely to be acquired. Companies working with specialized firms have collectively raised over $20 billion and maintain significantly better financial health.

What most founders miss is that these aren’t separate functions. Your CFO strategy affects HR costs, your accounting impacts your tax burden, and your HR policies create financial risks. They work together as an integrated system.

The smartest founders treat their back-office as a competitive advantage. They know that saving up to 80% versus hiring a full-time finance team isn’t just about cost—it’s about accessing expertise they couldn’t afford otherwise.

Building Your Financial Foundation: Core Accounting and Tax Needs

Imagine securing funding only to realize your “accounting system” is a mess of spreadsheets and receipts. This scenario is all too common. Building solid accounting and tax foundations isn’t glamorous, but it’s what separates successful startups from cautionary tales. It’s the GPS for your business—without it, you’re driving blind.

Proper bookkeeping and financial statements are your secret weapon for making smart decisions and proving your worth to investors. With GAAP compliance and the right accounting software from day one, you gain real-time visibility into your cash flow and avoid scrambling during due diligence.

Many founders stumble over business structure decisions, potentially leaving thousands on the table. The R&D tax credit alone can save some startups up to $500,000 annually, even if they aren’t profitable. For those incorporated in Delaware, managing the Delaware Franchise Tax is crucial to avoid penalties. This is why cfo, hr, tax and accounting for startups must work as an integrated system.

Our Outsourced Accounting services and Tax Planning for Startups can get your financial house in order, while our Year-End Financial Checklist for Your Business keeps you prepared.

Essential Accounting and Bookkeeping Processes

Let’s cover the nuts and bolts. While cash accounting seems simple, accrual accounting tells the real story of your business health by matching revenues with the expenses that generated them. For example, if you land a contract in December but get paid in January, accrual accounting correctly shows you earned that revenue in December. Investors prefer this clarity.

Your chart of accounts is your financial filing system; setting it up correctly from the start prevents chaos later. The month-end close process is where we reconcile accounts, catch errors, and prepare your financial reporting. Consistent closing means you’re always audit ready, eliminating panic when investors or auditors come knocking. Your business needs strategic insight, not just data entry. Learn more about Why Your Business Needs More Than Just a Bookkeeper.

Key Tax Considerations and Compliance for Startups

Startup tax planning is about making smart, long-term decisions. Your entity selection (C-Corp, S-Corp, LLC) shapes how you raise money and pay taxes. Restructuring later is expensive.

Once you hire, payroll taxes (federal, Social Security, Medicare, state) become a reality. The IRS is strict about deadlines, and penalties can eat into your cash runway. Similarly, sales tax obligations can be complex, especially for e-commerce startups selling across multiple states.

State and local tax (SALT) obligations are a maze, particularly with remote employees. Knowing the landscape helps you decide where to locate and hire. Staying on top of tax deadlines and avoiding compliance errors protects your cash and reputation. Since tax and HR are intertwined, staying informed on updates like New HR Rules and Regulations is crucial. With the right guidance, tax planning can become a competitive advantage.

Strategic Leadership: The Fractional CFO and Critical KPIs

As your startup grows, financial decisions become more complex. Many founders need CFO-level expertise but can’t justify the cost of a full-time hire. This is where a fractional CFO bridges the gap.

A fractional CFO is a part-time financial strategist who becomes an active part of your leadership team. While a full-time CFO costs $250,000 to $400,000 annually, a fractional CFO delivers the same strategic value for $2,500 to $15,000 per month—a saving of up to 80%. This isn’t just about cost; it’s about gaining a fresh perspective from an expert who has worked with multiple companies, spotting problems before they become expensive mistakes. They also provide the financial credibility investors look for.

For a deeper dive, see our Fractional CFO Guide and 3 Reasons Your Small Business Needs a CFO.

When to Hire a Fractional CFO

The right time is when financial complexity outgrows your capabilities. Key triggers include:

- Growth complexity: Your spreadsheet tracking is breaking down, and you’re making decisions on gut feel instead of data.

- Preparing for funding rounds: Investors expect sophisticated financial modeling and clean historical records. A fractional CFO helps you tell a compelling financial story.

- Lack of strategic insight: You’re growing but aren’t sure if it’s profitable. You need help with pricing, customer acquisition costs, and scenario modeling.

- Inefficient processes: Manual data entry and disconnected systems are draining resources. A fractional CFO can implement better tools and processes.

If this sounds familiar, our article on Telltale Signs Your Business Needs a Fractional CFO can help.

Key Financial Metrics Every Founder Must Track

You can’t manage what you don’t measure. A fractional CFO helps you track the numbers that matter.

- Customer Acquisition Cost (CAC): How much you spend to win each new customer, including all sales and marketing expenses.

- Lifetime Value (LTV): The total revenue you expect from a customer. A healthy business has an LTV at least three times its CAC.

- Monthly Recurring Revenue (MRR): The lifeblood for subscription businesses, it shows growth trends and stability.

- Burn Rate & Cash Runway: Burn rate is how quickly you’re spending cash. Paired with your cash balance, it determines your runway—how long you can operate without new funding.

Understanding how these metrics interact is key. A fractional CFO helps build dashboards that turn this data into actionable insights. For practical strategies, explore our Cashflow Tips. These metrics are the foundation for all cfo, hr, tax and accounting for startups decisions.

The People Factor: Integrating HR into Your Startup’s Financial Health

Most founders don’t realize that HR decisions are financial decisions in disguise. Every hire, compensation package, and benefit offering directly impacts your cash flow. This is why smart startups treat CFO, HR, tax and accounting for startups as one integrated system.

When you hire your first employee, you add payroll taxes, workers’ compensation, and compliance requirements. A flawed compensation structure can burn cash too quickly, while poor equity planning can complicate future funding rounds. Strategic hiring isn’t just about finding talent—it’s about finding it at the right cost structure. This means understanding how compensation models, employee equity (ESOPs), and benefits administration affect your budget.

Our Human Resources services are designed with this financial reality in mind. See how this integration works in How Accounting and HR Professionals Can Help Grow Your Business.

HR Compliance and Building a Scalable Team

Compliance isn’t just about rules—it’s about protecting your cash flow from devastating penalties. A single misclassified employee can trigger back taxes and legal fees that derail your runway. Building a scalable team means getting the infrastructure right from day one.

- Employee handbooks provide legal protection and set clear expectations.

- Labor law compliance is critical, especially in states with frequently changing regulations like California.

- Onboarding processes must capture all necessary tax and legal information.

- Performance management systems create the documentation needed for difficult employment decisions.

Based in San Diego, we have deep expertise in Navigating California Employment with HR Support from Optima. Our HR Compliance services and guidance on The Importance of an Employee Handbook help you build a foundation for sustainable growth.

The Value of Integrated CFO, HR, Tax and Accounting for Startups

When finance and HR work as an integrated system, you gain a powerful advantage. Instead of operating in silos, your financial projections include realistic hiring costs, and your compensation plan aligns with your fundraising timeline. This leads to:

- Holistic strategy: Financial and HR planning are aligned.

- Data-driven decisions: People investments are tied to key financial metrics.

- Operational efficiency: Systems are connected, from payroll to accounting.

- Risk mitigation: Financial and compliance risks are managed proactively.

At Optima Office, this integration is how we operate. Our proprietary five-point system ensures the right fit, and we deploy a full team in just 3-5 days. We see the whole picture to help you maximize profits and minimize risk. Learn more in The Guide to Business Administration Efficiency.

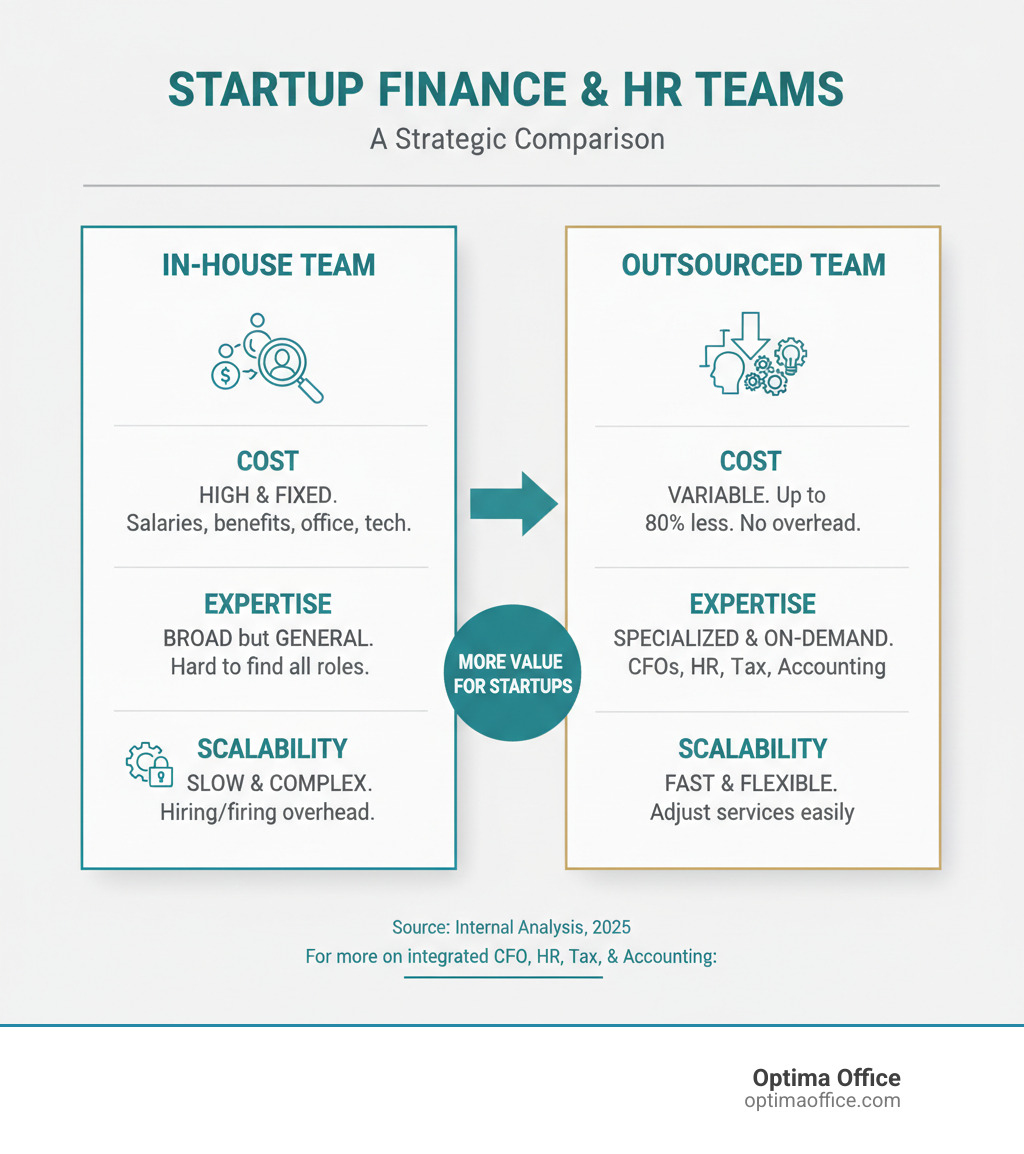

In-House vs. Outsourced: A Strategic Choice for CFO, HR, Tax and Accounting for Startups

Every founder must decide whether to build an in-house team or work with an outsourced provider. Building an in-house team for cfo, hr, tax and accounting for startups is expensive, involving salaries, recruitment costs, benefits, and training.

The math is compelling: outsourcing can save you up to 80% compared to hiring a full-time finance team. But the benefits go beyond cost. When you outsource, you access a team of specialists—controllers, CFOs, tax experts, and HR professionals—who have been through the startup journey dozens of times. You get senior-level expertise in areas like SaaS revenue recognition or complex equity compensation that a single hire rarely possesses.

Outsourcing also offers superior scalability. As your startup’s needs change, an outsourced provider adapts seamlessly, whether you need more CFO support during fundraising or expanded HR capabilities. This allows you to focus on what you do best: building your product and serving customers, rather than managing back-office functions.

For practical guidance, see How to Build an Efficient Back Office on a Startup Budget. For expert insights, see Helina Patience, CPA, CMA.

How Outsourced Services Adapt to Your Growth Stage

Your needs change as you grow, and a one-size-fits-all solution won’t work.

- Pre-seed stage: Focus on the basics: clean bookkeeping, proper business formation, and simple financial models to track your burn rate.

- Seed and Series A: The stakes get higher. Investors expect GAAP-compliant financials, detailed SaaS metrics, and sophisticated cash flow management. Fractional CFO support becomes critical.

- Growth stage: You’ll face audit preparation, complex technical accounting, and potential M&A due diligence. The margin for error shrinks.

An experienced outsourced provider brings institutional knowledge from seeing this movie before, helping you avoid costly lessons.

Avoiding Common Financial Pitfalls

Many startups fall into preventable traps. Here are the most common mistakes we see:

- Cash flow mismanagement: This silent killer trips up more startups than bad products. Professional cash flow management is essential for survival.

- Mispricing: Pricing too low prevents profitability, while pricing too high hinders market fit. Financial analysis helps find the sweet spot.

- KPI blindness: Making decisions on gut feel instead of data is dangerous. You must know your CAC, LTV, and burn rate.

- Tax and compliance errors: Missed payroll tax deadlines or misclassified employees can lead to devastating penalties and audits.

According to CB Insights’ analysis of startup failure reasons, financial mismanagement is a leading cause of death. These are all preventable problems with an experienced cfo, hr, tax and accounting for startups team.

Frequently Asked Questions about Startup Financial Management

We’ve helped countless startups steer their financial questions. Here are the answers to the most common ones.

How much does a fractional CFO cost for a startup?

A fractional CFO typically costs between $2,500 and $15,000 per month, depending on your needs. This is a fraction of a full-time CFO’s salary, which can easily exceed $250,000 annually plus overhead. While a fractional CFO may charge $200 to $300 per hour, the part-time engagement provides executive-level strategy without the full-time price tag. You pay for results and expertise when you need them most, freeing up capital and extending your runway.

What is the first financial hire a startup should make?

Your “first financial hire” doesn’t have to be an internal employee. The smartest first step is to outsource to a strategic partner. A startup needs expertise across bookkeeping, accounting, tax, and strategic finance, but rarely has the budget for full-time specialists in each area. Outsourcing gives you immediate access to a complete team.

With our integrated approach to cfo, hr, tax and accounting for startups, you get the right mix of expertise for your current stage. We can deploy an entire finance department in just 3-5 days—no lengthy hiring process, no training, just immediate support that scales with you.

How can I ensure my startup is ready for investor due diligence?

Due diligence is an opportunity to shine, not a source of stress. To be ready, you need:

- Clean financials: Up-to-date, accurate, and organized income statements, balance sheets, and cash flow statements that tell a clear story.

- GAAP compliance: Your financial statements must follow Generally Accepted Accounting Principles to demonstrate professionalism.

- A bulletproof cap table: A precise record of who owns what, including all equity grants, options, and convertible notes. Confusion here can kill deals.

- Realistic financial projections: Well-supported models for the next 3-5 years that show a clear path to profitability.

- Key metrics mastery: Know your CAC, LTV, MRR, and burn rate cold. Be ready to explain what the numbers mean for your strategy.

Expert fractional CFO support for fundraising is invaluable here. We help you craft a compelling financial narrative that gives investors the confidence to write a check.

Your Secret Weapon for Sustainable Growth

Building a successful startup requires more than a brilliant idea—it demands precise execution. The difference between the startups that thrive and the 90% that fail often comes down to having the right CFO, HR, tax and accounting for startups foundation from day one.

An integrated approach transforms these back-office functions into a competitive advantage. When your financial strategy, hiring, tax planning, and accounting work in unison, you build a powerful growth engine.

Working with Optima Office means gaining a strategic partner, not just a vendor. Our proprietary five-point system ensures the perfect fit, and we can deploy a complete finance and HR team in just 3-5 days. While your competitors wrestle with spreadsheets and compliance, you can focus on building your product and scaling your business.

This is the smartest investment in your startup’s future. We help you maximize profits, minimize risk, and drive enterprise growth, positioning you for the success that attracts investors and builds lasting value.

Ready to give your startup the foundation it deserves? Take the first step by getting a free Financial Gap Diagnosis and find what it will take to get you where you want to be.